A bowing basement wall needs immediate repair. Learn how much it costs to repair a bowing basement wall and what factors can affect the final price tag.

A great home has a solid foundation, but here's what to do when that's in question

In most states, a home seller is required to disclose previous foundation repairs.

Foundation repairs are not necessarily a deal-breaker for buying a great home.

You may be able to take legal discourse if you close on a home with undisclosed foundation problems.

Always confirm inspection and warranty information for past foundation issues.

Are you asking yourself, “Should I buy a house with foundation repair”? Time, research, and documentation are your three greatest allies to finding undisclosed foundation problems. After all, there is nothing quite like realizing that the seller didn’t disclose a foundation problem after closing. Whether you’ve closed the sale or not, you may have more options than you think when you notice cracks in your foundation. Here's how to decide whether to buy a house with foundation repairs and how a local foundation repair team can help.

Whether or not you should buy a home that needs foundation repairs will depend on the severity of the repairs needed. Some repairs are doable and not too pricey, especially if your home insurance covers the foundation repairs. On the other hand, the cost of foundation repair can increase quickly if there are significant issues. Sometimes, you can come to an agreement with the seller and have them cover the foundation repair cost, but if not, you may want to reconsider.

Disclosure laws vary by state, but in most locations, a homeowner is required to disclose foundation issues in the past. Even if the homeowner had the issue repaired, this information is crucial to helping the buyer make the right financial choice and to build confidence in the honesty of the seller.

After all, foundation repairs can affect the value of the home. As the buyer, you may also need to know about related warranties on recent repairs should something go wrong in the near future.

Your foundation's condition can affect your home value. If you have any foundation issues, be sure to disclose them before making a sale. Hire a structural engineer to look at your foundation and share what they say with potential buyers.

We all make concessions and consider negotiations when buying something as large as a home. While former foundation problems are technically a negative, there are both upsides and downsides to going ahead with the sale.

Homeowners and potential buyers should always put all of their cards on the table during a sale. This honesty unlocks a few perks when going ahead with the purchase.

You may be able to negotiate the home's sale price.

Consider requesting flexibility in the structure of the sale, such as the size of the down payment.

You can move forward trusting that the homeowner likely provided all the details about the home up front.

You may be able to ask that the seller order a more in-depth home foundation inspection if you are concerned about specific problems.

Foundation repair warranties may still be valid, covering any upcoming problems.

However, it is not surprising that many buyers shy away from homes with previous foundation problems. Here are some downsides to moving forward and when to walk away from foundation problems.

There could be underlying issues that lead to foundation issues.

The warranty on recent repairs may be expired.

You did not have control over who was hired to attend to the foundation issues.

There still could be structural problems from the previously damaged foundation.

Your lender could deny your mortgage.

Let's say that you've begun to move ahead with the home purchase, and the current owner skirted around some foundation problems. Here are some options about where to go from here, especially if you've fallen in love with the property otherwise.

Home repair issues get incredibly more complex once a sale is complete. In fact, as the buyer, you might have little to no leverage once the deal is closed. If it’s not, call your realtor ASAP to let them know about the issues you’ve found.

A foundation repair inspector can give you a proper diagnosis of what’s going on and what needs to be fixed (and how). Identifying the type of foundation repair that’s needed is the first key to getting the situation resolved.

Each state has different rules for real estate when the seller doesn’t disclose a foundation problem and separate definitions for what constitutes an “as-is” sale. For example, in some states, the realtor (not the seller) could be liable if undisclosed defects were not reported in the listing or before the inspection. Make sure you read up on your state’s guidelines surrounding these issues.

Taking action right after you notice foundation damage is key. The longer you wait to address the problem, the easier it is for a court to rule in the seller’s favor, citing the fact that the damage (or even a common foundation settlement) took place after they sold you the house.

Check your home warranties and manufacturer’s warranties to see if they cover foundation repairs. (Reading up on the different types of foundation systems, as well as basement and foundation terms, can make it easier to understand warranty legalese.) These steps could be your saving grace financially and may negate the need to contact the seller.

It can be disheartening to discover foundation damage, especially if the home inspector you hired didn’t notice it during their walkthrough. But since they did miss it, now’s a good time to look for additional signs of foundation trouble, as well as any other serious issues they didn’t disclose.

Those issues may include the following:

Faulty electrical wiring

Roof problems

Plumbing issues

Environmental hazards

If any of these problems exist, they could help you mount a better case against the seller to receive compensation. Take pictures and videos and write down what you find. Having another inspector look at your home at this point could provide good evidence to prove your case.

It may sound cynical, but the best bargaining chip you have—assuming the sale is final and your warranties won’t cover repairs—is to find proof that your seller knew the problem existed and covered it up.

For example, painting over cracked bricks or horizontal cracks in your basement wall to disguise them could be used as proof that the seller purposefully withheld information from you.

Arguing won’t get you far when contacting the seller (or their realtor). Instead, calmly outline the situation, letting them know by citing facts and providing video or image proof that you’ve found undisclosed foundation damage and would like to resolve the issue.

Your top priority when reaching out should be to prevent the seller (or their realtor) from getting into defensive mode. As the saying goes, you catch more flies with honey than vinegar.

Mentally prepare yourself for a compromise. If you can get the seller to pay for even a portion of the foundation repair costs, you can consider that a win—especially if, from a legal standpoint, they aren’t obligated to help at all.

If you can’t reach a resolution and want to pursue further action, you should speak to an attorney. If the seller refuses to pay for the repairs, some out-of-court alternatives do exist. A lawyer can draft a demand letter outlining how much you’re asking for and what you plan to do if the terms aren’t met.

Or you might consider mediation, which puts you both in front of a neutral third party to help resolve the issue without a judge’s ruling.

If the undisclosed foundation damage is extensive, costly, or dangerous enough, it could make sense to file a lawsuit. Suing for breach of contract, failure to notify, negligence, and fraud are all possibilities in this situation.

Think long and hard before going down this route, though. Lawsuits are costly, to the point that you may spend more fighting your case than you would if you simply fixed the foundation issues. It might feel like the seller is getting away with something they shouldn’t be, but from a practical point of view, it could be the right thing to do.

As long as a licensed home inspector and structural engineer have given you the thumbs up, there is nothing technically unsafe about purchasing a home with previous foundation issues. You only need to worry about safety issues if the foundation issues are not fixed.

That being said, every home and every foundation problem is different. You should know that you are taking a risk that the problems could return or stem from unknown issues.

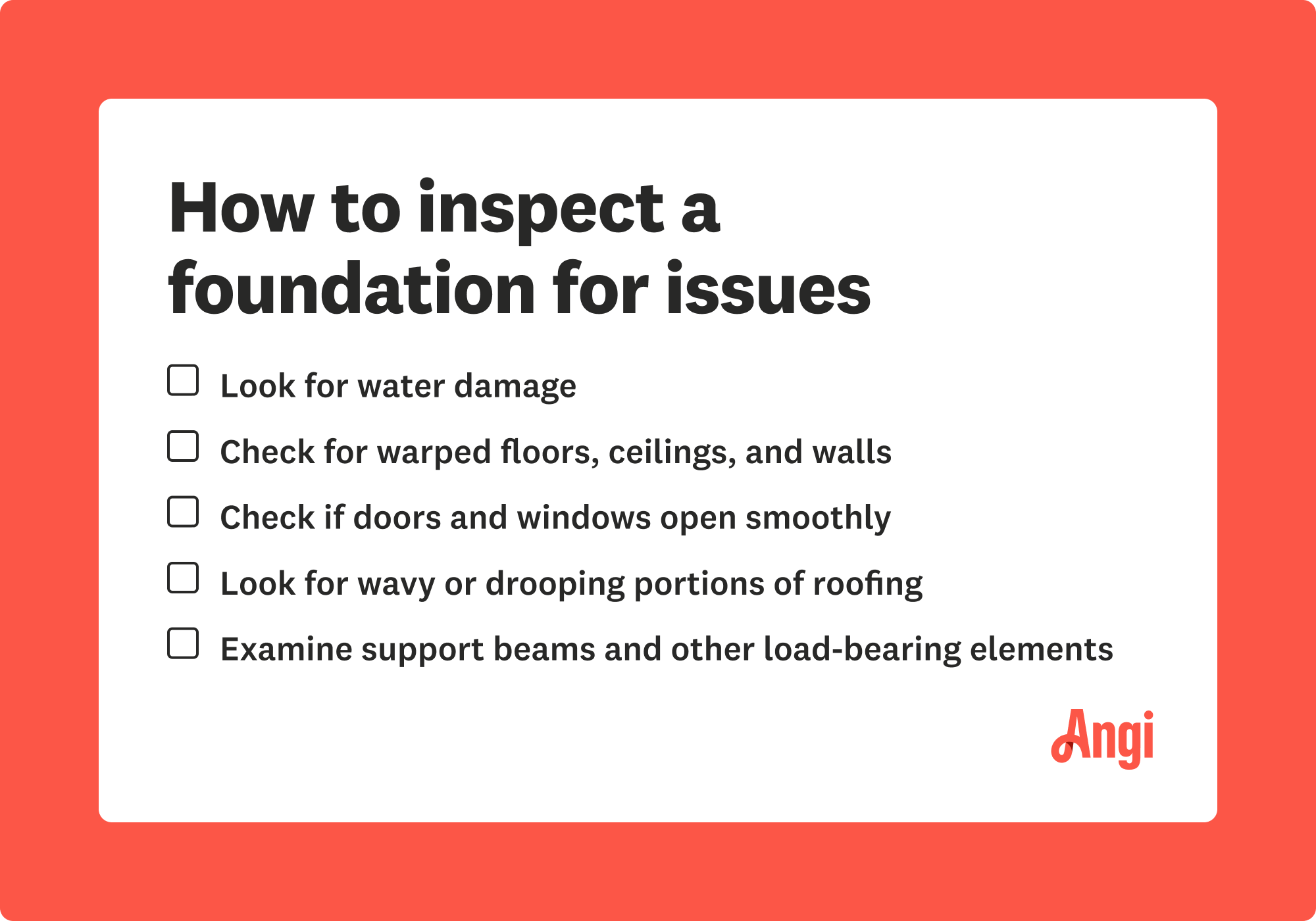

While it is recommended that homeowners inspect their house for foundation issues on a regular basis by keeping an eye on warning signs, a professional foundation inspection is necessary to ensure that the inspection is totally comprehensive. If you suspect there’s an issue, it’s great that you’re paying attention, but you may still want to have a pro check it out to ensure that everything is handled safely.

It might be worth looking into foundation repair options near you if you or an inspector suspect issues, so you can handle them promptly and safely.

From average costs to expert advice, get all the answers you need to get your job done.

A bowing basement wall needs immediate repair. Learn how much it costs to repair a bowing basement wall and what factors can affect the final price tag.

Foundation repair costs can be tricky when you have a large repair on your hands. This guide walks through costs from small cracks to total replacement.

Whether trying to protect it or transport it, raising a house is no small feat. Read on to find out everything you need to know about the cost to raise a house.

Foundation problems can be dangerous and expensive. Hire a structural engineer who inspects home foundations to catch any potential problems early on.

If you have noticed cracks on your house’s foundation, uneven floors, or you think you may have damaged foundation, follow these tips to get the best home foundation inspector for your property and have a smooth hiring experience.

When constructed correctly, a concrete foundation can last more than a century. Learn what factors influence how long a concrete foundation can last.