Are Home Office Renovations Tax Deductible? Everything You Need to Know

Reduce your tax liability

The home office tax deduction lets self-employed workers deduct expenses from a home office renovation.

Taxpayers can choose to calculate deductions using the “simplified” or “regular” method.

The simplified method lets you deduct $5 per square foot of your home office, up to 300 square feet.

The “regular” method lets you calculate the percentage of your home used for work and apply that to renovation costs.

If you're considering a home office renovation, you may wonder: are home office renovations tax deductible? The short answer is yes, they can be—but only if they meet specific criteria set by the Internal Revenue Service (IRS). Whether you’re doing a large renovation or making small improvements to a home office, learn which costs qualify and how to claim them.

Understanding Home Office Tax Deductions

The home office tax deduction allows eligible individuals to deduct certain expenses related to their home office, including renovations. However, not everyone qualifies. According to IRS rules, only self-employed individuals, independent contractors, or those with gig-based businesses can claim home office deductions. Employees working remotely, even if required by their employer, are not eligible to deduct home office expenses.

To qualify, your home office—whether it's part of your home or a separate structure— must meet two important IRS criteria:

Exclusive use: The space must be used exclusively for business purposes.

Regular use: You must regularly use the space for business.

This qualification means the area can’t serve more than one purpose, like being a guest room. It also needs to be a primary work area where you perform substantial work for your business regularly.

What Home Office Renovations are Tax Deductible?

You can deduct two types of expenses for home office renovations: direct and indirect. All renovations must be necessary for the business use of the space. They may not be deductible if they don't meet the IRS requirements.

Direct Expenses

Direct expenses are renovations made to your home office space. Below are common examples of direct expenses:

Repainting the walls

Installing new shelves

Adding custom lighting

Replacing the flooring

Installing office-specific electrical outlets

Indirect Expenses

Indirect expenses are broader home improvements that affect the entire home. Only a percentage of these costs can be deducted, based on the percentage of your home used as your office. Below are a few examples:

HVAC upgrades

Roof repairs

Upgrading plumbing

Renovations That Don't Qualify

Not every home improvement qualifies for a deduction. Below are examples of non-deductible renovations:

Landscaping the yard

Renovating a kitchen or living room

Adding a deck or patio that is not connected to your home office

The IRS clearly states that personal expenses or general home upgrades that don’t directly affect the home office space are not deductible. Misclassifying personal expenses as business expenses can lead to penalties.

How to Calculate Home Office Renovation Deductions

You can choose from two methods of calculating home office deductions: the simplified method and the regular method. Choosing one depends on the scope of your renovation and the percentage of your home used for business.

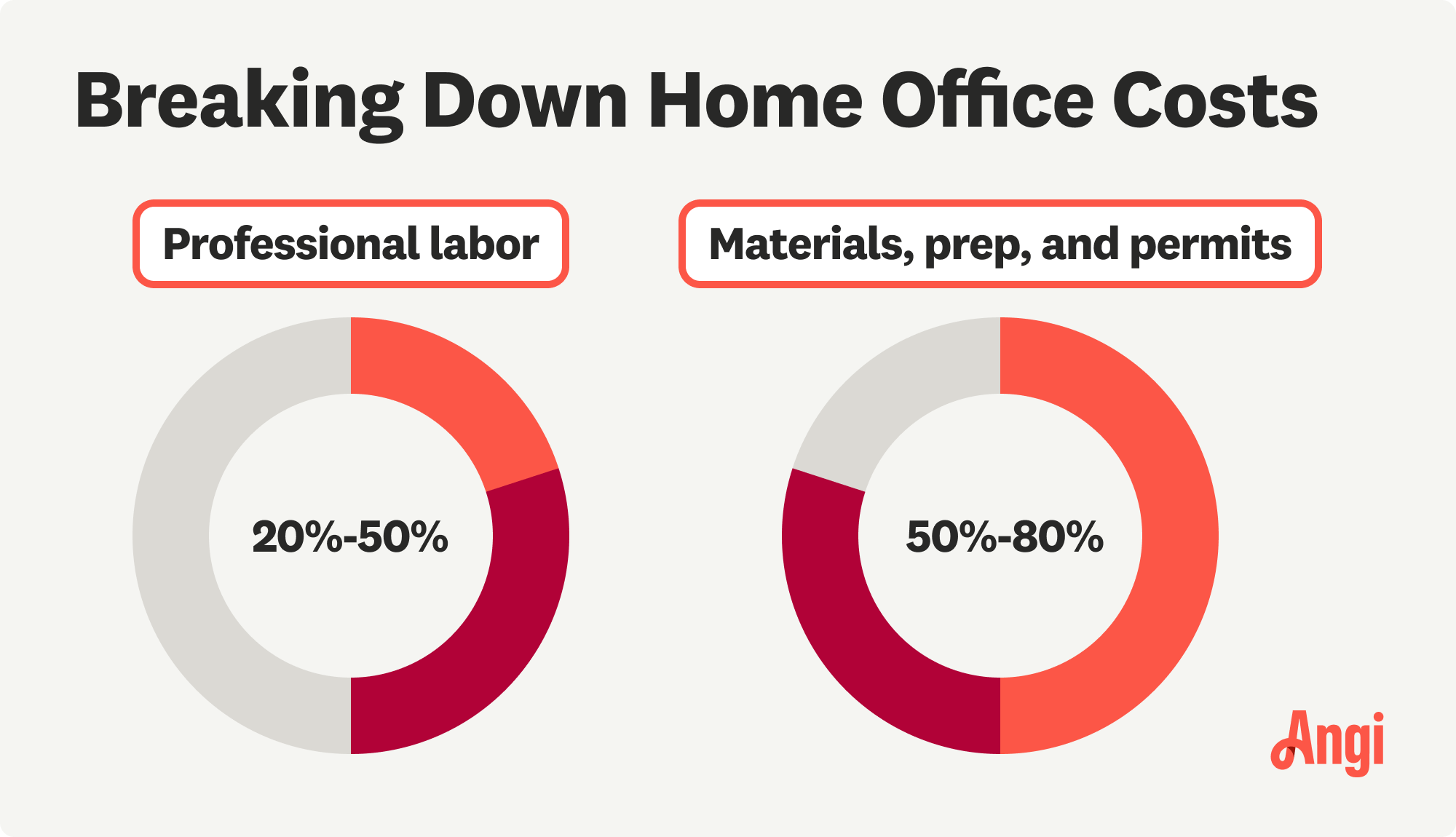

Simplified Method: This method allows you to deduct $5 per square foot of your home office, up to 300 square feet, for a maximum deduction of $1,500. This provides a straightforward option for small home offices with minimal renovation expenses.

Regular Method: With the regular method, you calculate the percentage of your home used for business purposes and apply that percentage to your renovation costs. For example, if your home office takes up 10% of your home’s total square footage, you can deduct 10% of the costs of indirect renovations.

How to Handle Documentation and Record-Keeping

Accurate documentation is critical when claiming home office renovation deductions. Keep receipts for all renovation costs and detailed records of when the renovations were completed. Track the percentage of your home used for business purposes, which will be key for calculating indirect expense deductions.

The IRS has the right to audit your tax returns, so maintaining meticulous records ensures you can prove your claims. Keep these records for at least seven years, as audits can happen long after the tax year. While some local home remodeling experts are familiar with tax deductions, you should also consult a tax pro to ensure you follow the latest regulations to maximize your deductions.

Frequently Asked Questions

You can write off a portion of your utilities for a home office, including electricity, heating, water, and internet. The deductible amount is based on the percentage of your home used for business purposes. For example, if your home office takes up 10% of your home’s square footage, you can deduct 10% of your utility expenses.

The home office deduction increases the risk of an IRS audit, as home office claims are often scrutinized. Strict eligibility requirements can make it difficult to qualify and the deduction may only offer limited financial benefits if the space occupies a small part of your home. If you sell your home, claiming depreciation for a home office could impact your capital gains exclusion, meaning you might owe more taxes on the sale.

- Bathroom Remodeling

- Kitchen Remodeling

- Shower Installation

- Stair Installers

- Bathtub Installation

- Shower Door Installers

- Kitchen Design

- Bathroom Design Companies

- Storm Shelter Builders

- Pre-Made Cabinets

- Kitchen Refacing

- Bathtub Replacement

- Ceiling Tile Installation

- Suspended Ceiling Companies

- Residential Designers

- Stair Builders

- Remodel Designers

- Shower Enclosures

- Home Renovations

- Kitchen Renovations

- Garage Remodeling

- Grab Bar Installation

- Walk-In Tub Installers

- Tub to Shower Conversion

- Balcony Contractors

- Is Landscaping Tax-Deductible? Here Is What to Know

- Are Home Improvements Tax Deductible? 5 Potential Write-Offs

- Are Moving Expenses Tax Deductible? What You Need to Know

- 11 Tips for Creating the Most Productive Home Office Layout

- How to DIY Home Office Built-in Cabinets and Bookshelves

- 11 Motivating Office Decor Ideas to Update Your Workspace

- 15 Surprising Things That Can Actually Devalue Your House

- Unexpected Renovation Costs and How to Budget for Them

- How Long Does It Take to Renovate a Bedroom?

- What Is the Best Time of Year to Remodel Your Home?