Introduction:

Every year at Angi, we help millions of people complete their home projects, providing us with unique insights into how homeowners are improving, maintaining, and repairing their homes. In our annual State of Home Spending report, we examine not only the projects completed by homeowners over the year but also how much they spent, the motivating forces behind their work, and their home improvement plans for next year and beyond.

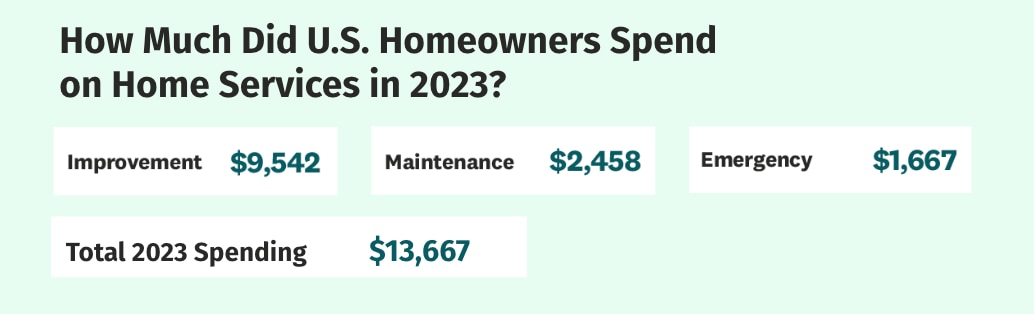

In 2023, our survey data shows consistently strong spending across all three categories of home services spending: improvement, maintenance and emergency repairs. On average, homeowners spent $13,667 across 11.1 projects this year. Spending levels rose slightly compared to 2022. Additionally, the overall trend of heightened spending on home improvement, which has been ongoing since 2020, remained consistent. This year, homeowners spent 51% more on home projects compared to home services spending in 2019.

Rising mortgage interest rates shaped homeowner perspectives and strategies for tackling home improvement projects this year. While the increased rates didn’t substantially change overall spending in 2023, they did affect the number of projects some homeowners took on this year. This year, 40% of homeowners reported taking on more home improvement work in response to rising interest rates that made moving or purchasing a new home less feasible. Looking forward, 30% of homeowners plan to undertake more work next year, motivated by rising mortgage interest rates. According to our data on the financing methods for this year’s home improvement projects, 46% of homeowners used cash from savings, while 20% used credit cards. Only 7% of homeowners refinanced an existing loan, and 5% used a HELOC loan.

When reviewing our data from 2020 to 2023, it becomes evident how the COVID-19 pandemic era reshaped the landscape of home improvement spending. These evolving motivations are highlighted in the trends, especially around project motivation, that emerged over the last four years in our State of Home Spending report and surveys.

However, we also saw some challenges from the last few years subside. For example, previous issues that prevented homeowners from completing projects, such as COVID-19-related disruptions and materials shortages, are no longer the primary causes of delays or postponements. For the first year since 2020, COVID-19 is not one of the most common reasons for incomplete projects, down 55% year-over-year. This year, the top two reasons for not completing work were budget-related: the total project costs or estimates were too high, and there was a need to prioritize emergency or unplanned projects. In another shift from previous years, homeowners who exceeded their time or budget on projects cited design choices as the core reason rather than material delays and shortages.

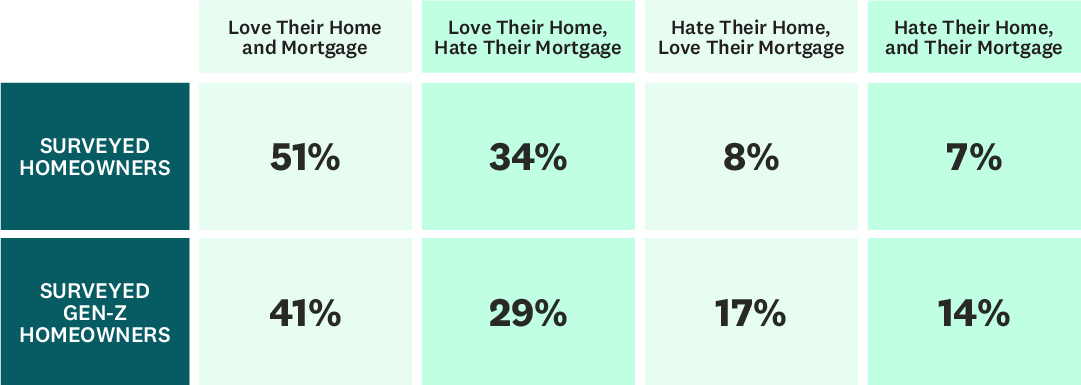

Lastly, we wanted to know how people felt about their homes and mortgages this year. There have been plenty of recent nationwide discussions about rising interest rates, and over the past few years, homebuyers have been operating in a market characterized by low inventory, high demand and elevated prices. Despite all of this, homeowners largely love their homes. This year, 51% of homeowners surveyed said they loved their home and their mortgage, 34% of those surveyed hated their mortgage but loved their homes, so a combined 85% of homeowners love their homes.

This love for our homes is helping to drive continued investment in them. It makes sense that our motivations for improving our homes have changed, and return on investment isn’t the sole factor guiding our decisions. We want to maintain our homes because we love them; we want to make our homes work for us as our lives and families change because we love them and we want to enjoy our homes more. In a year of transition, with often challenging news and uncertain signals from the economy and global stage, this positivity towards our homes and continued investment is a bright spot.

KEY TAKEAWAYS

- Total spending across home improvement, maintenance, and emergency repairs increased 6% to $13,667 compared to 2022. However, the number of total projects declined 11% compared to 2022, with an average of 11.1 jobs per household. The growth in spending and the decline in total projects is likely due to the impact of inflation on the cost of home improvement projects or a change in the type of work done.

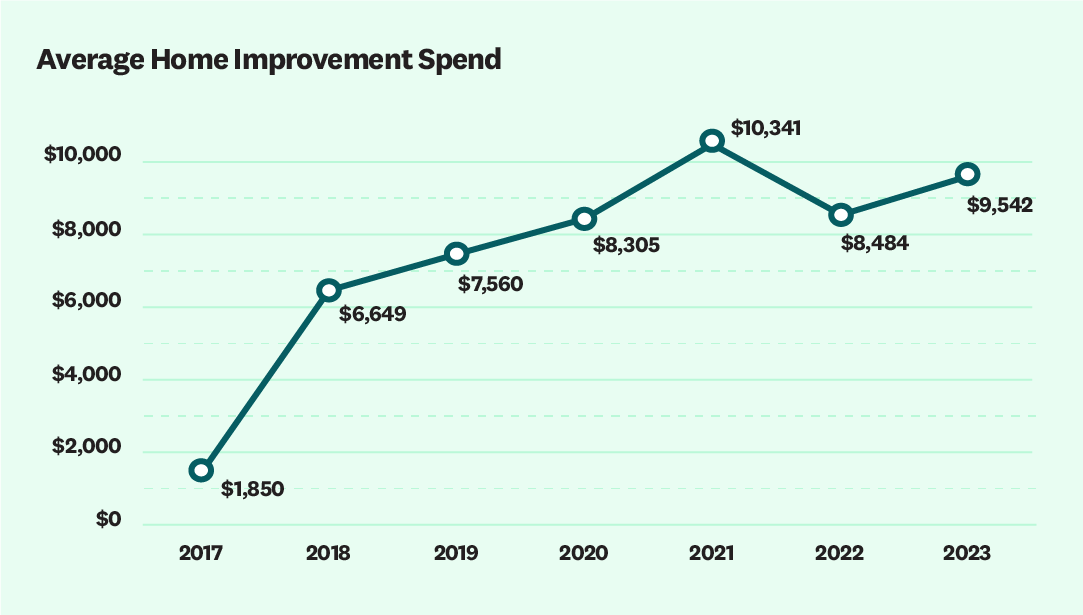

- Home improvement spending was $9,542 per household in 2023. Homeowners who invested in home improvement did an average of 2.8 projects. Spending on home improvement increased 12%, but the average number of projects decreased from 3.2 to 2.8.

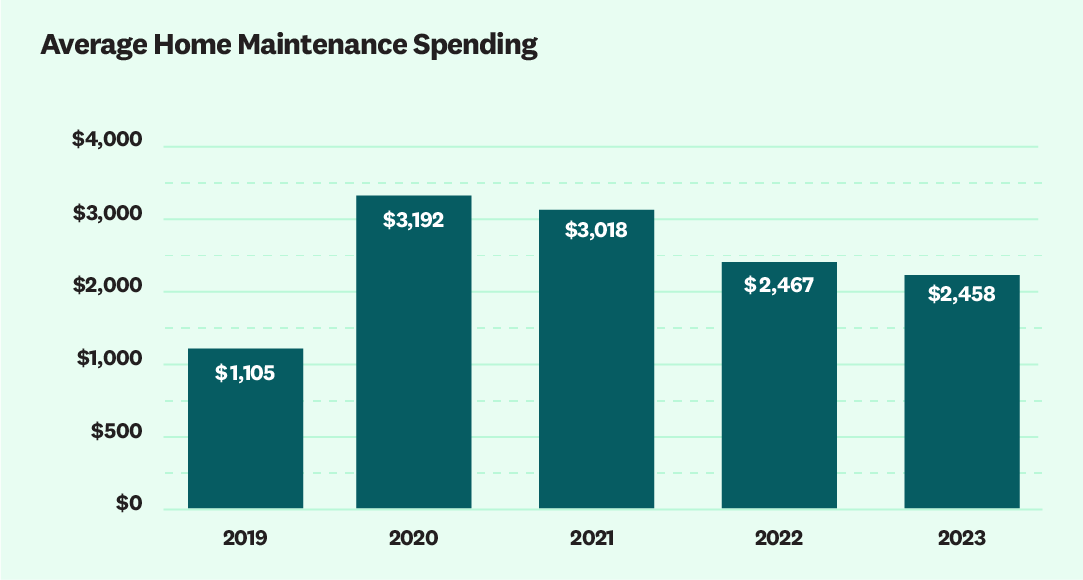

- Home maintenance spending was $2,458 per household in 2023, and the average number of completed maintenance projects was 6.8. Homeowners completed an average of 3 landscaping jobs, 1.8 cleaning jobs, and 2 other maintenance projects.

- Home emergency spending was $1,667 across 1.5 projects per household.

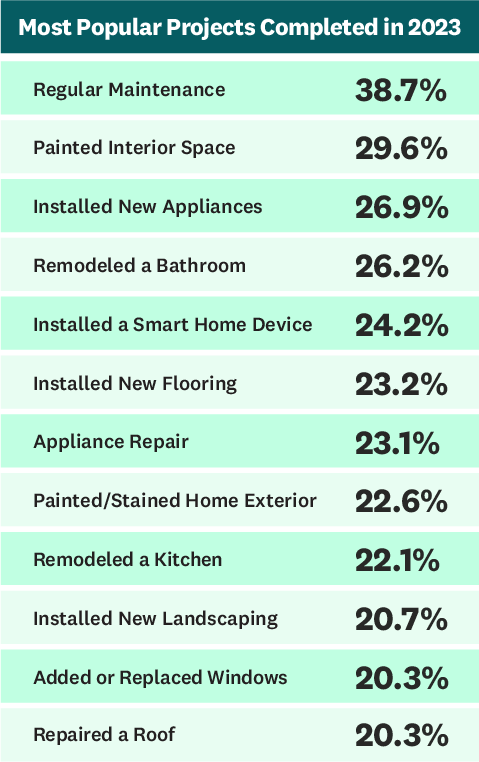

- In 2023, the top three projects were regular maintenance (39%), like lawn care and gutter cleaning, followed by interior painting (30%) and new appliance installation (27%). Bathroom remodels dropped to fourth place at 26%, breaking a two-year streak in the top three most popular projects by a slim margin.

- 2023 marks the fourth year that return on investment (ROI) as the primary motivator of home improvement spending has declined. Prior to the start of the COVID-19 pandemic, 2020, ROI was consistently a top motivating factor for doing work on our homes, but as the pandemic changed the way we think about our homes, it also changed what motivates American homeowners to take on improvements.

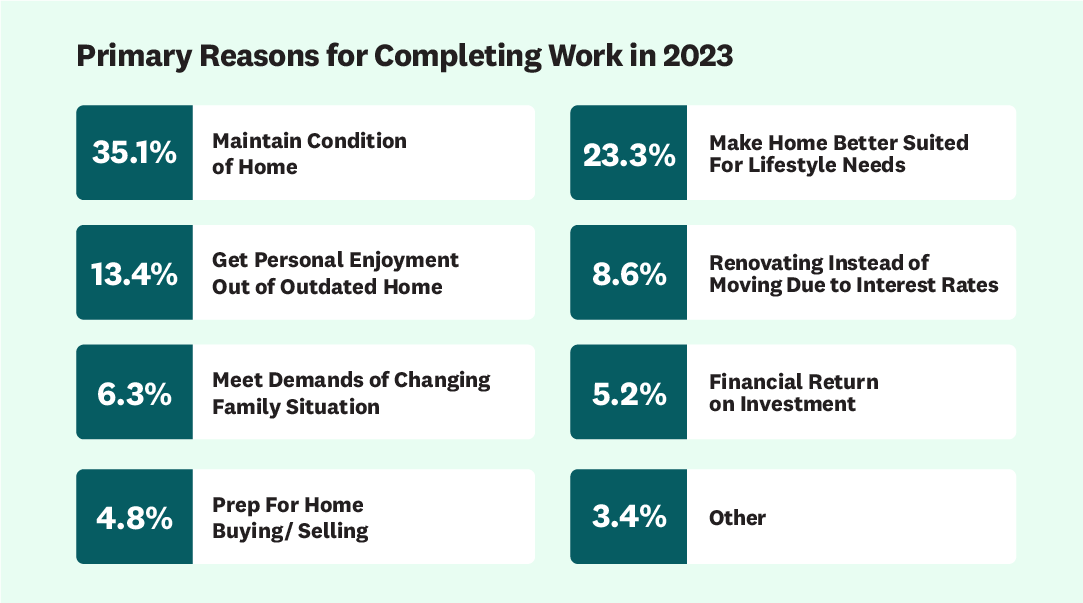

- This year, the top motivator was to maintain the condition of my home (35%), followed by the desire to make their home better suited to lifestyle and needs (23%). In contrast, ROI was only 5% of American homeowners’ top motivation. What motivates us to do home improvement work has been changed by the pandemic, and even as many pre-pandemic activities returned in 2023, this pre-pandemic motivation did not.

- Rising mortgage interest rates influenced how people thought about and took on home improvement projects this year. However, it did not meaningfully change home spending in 2023. This year, 40% of homeowners said they completed more home improvement work due to rising interest rates making moving or finding a new home less feasible. Looking forward, 30% of homeowners plan to make home improvement changes to their current home next year due to increased mortgage interest rates.

- For the first year since 2020, COVID-19 is no longer one of the most common reasons for incomplete projects, down 55% year-over-year. Common issues (like permitting delays and materials shortages) in the home improvement space over the past three years are not impacting home improvement projects like in previous years. This year, homeowners who went over time or budget with projects cited design choices as the core reason, not material prices or shortages.

PART 1: THE STATE OF HOME SPENDING IN 2023

In 2023, homeowners continued to invest in updating, maintaining and repairing their homes. Spending on all types of home projects rose 6% in 2023, maintaining the elevated spending trend of the pandemic era.

Home Improvement Spending

Home improvement spending increased over the last year by 12% to an average of $9,542, and the number of projects decreased from an average of 3.2 projects in 2022 to 2.8 projects per household in 2023. The increase in home improvement spending coupled with a slight decrease in total projects suggests that inflation is moderately impacting home improvement. Additionally, the top-cited reason for not completing home projects this year was due to higher than anticipated costs or estimates. However, despite the moderate impact of inflation, homeowners are still improving their home, especially over the past five years.

In the eight years we have tracked homeowner spending on home improvement and remodeling, 2023 is the second-highest average.

Home Maintenance and Emergency Spending

Home Maintenance Spending

Year-over-year, home maintenance spending remained flat; however, it remains significantly higher than the pre-pandemic years. In 2023, homeowners spent an average of $2,458 across 6.8 home maintenance projects. This year, homeowners completed an average of 2.9 landscaping maintenance projects, 1.8 cleaning projects and 2.1 other maintenance projects.

For the second year, home maintenance projects were the most common projects completed and the most planned projects for 2024. Over the last three years, average maintenance spending jumped more than 150% as people started to spend more time at home due to the pandemic.

As noted in last year’s State of Home Spending report, this four-year trend is particularly important given the increase in the average home’s value. A common rule of thumb is that homeowners should budget approximately 1% of a home’s value annually for home maintenance. Following that guidance, the average home maintenance spending would be about $4,300 since the average home price in the United States in 2023 is $430,000. It is encouraging to see homeowner behavior moving in the right direction, but on average, homeowners still need to invest more in maintenance.

Home Emergency Spending

Home emergency spending declined year over year, which is generally positive and could be the result of consistent maintenance spending. This year, homeowners spent an average of $1,667 across 1.5 home emergency projects.

Most Popular Projects and Why Homeowners Completed Them

Most Popular Projects

Since our homes now serve multiple purposes—as work, recreational and entertaining spaces—it’s unsurprising that the most popular project of the year was home maintenance, completed by 39% of homeowners. Beyond maintenance, the top projects of the year were painting an interior space (30%), installing new appliances (27%), remodeling a bathroom (26%) and installing a smart home device (24%). This year, our data revealed some fluctuation in the top ten home projects, where projects like installing new appliances and smart home devices rose to the top five. However, many of the most common projects we see year-over-year remain top projects.

This year marked a continued decrease in pool installations from the peak years of 2020 and 2021. On the other hand, our data showed a slight increase year-over-year in home office remodels or additions. And with an eye toward a growing focus on sustainability, 15% of surveyed homeowners installed solar panels in 2023.

Similar to last year, many of the top projects in 2023 are non-discretionary tasks, specifically maintenance, replacing windows, and repairing a roof. With more budgetary demands and the impact of inflation, it’s not a surprising trend among homeowners.

Lastly, this year’s data showed that homeowners take on a repair or remodel approach with many home improvement projects. This year, 26% of surveyed homeowners remodeled a bathroom, while only 12% added a bathroom. This trend continued with roofing, where 20% of surveyed homeowners repaired a roof compared to 15% who installed a new roof.

One category that bucks this trend—appliances. 27% of surveyed homeowners installed new appliances, slightly higher than the 23% who repaired an appliance. Cost is likely a determining factor influencing the decision to repair and remodel or build and buy new appliances. For high-consideration projects like roofs and bathrooms, there can be a substantial cost difference between choosing to repair and remodel versus adding or installing a new roof or bathroom. In contrast, the cost differential for replacing or repairing appliances is often smaller, leading homeowners to install new ones and start fresh. And in 2023, homeowners experienced fewer delays from appliance suppliers than in recent years, which likely contributed to more people choosing to update and install new appliances.

Motivations

Since 2020, we have consistently observed a change in homeowners’ primary reason and motivation for taking on home improvement projects. Prior to 2020, homeowners reported being more financially driven to complete home improvement projects, with return on investment (ROI) at the top of the list. Since 2020, motivations have shifted as use, lifestyle needs and enjoyment now drive the majority of home improvement work.

In 2023, home maintenance emerged as the most popular category of projects completed by homeowners. The primary reason for this work was to maintain the home’s condition, as cited by 25% of surveyed homeowners. Close behind, 23% of surveyed homeowners were driven by the goal of making their homes better suited for their lifestyle needs. These data points show that the pandemic changed our motivations for tackling home improvement work. Although many pre-pandemic activities resumed in 2023, the pre-pandemic motives for upgrading and fixing our homes did not.

PART TWO: HOW DIFFERENT GENERATIONS APPROACH HOME IMPROVEMENT

Over the past few years of collecting data on home spending, there have been continual trends in how age influences how homeowners approach home improvement, the types of projects they take on and how they relate to their home. 2023 was no exception, and this year’s results provided some unique insights by generation.

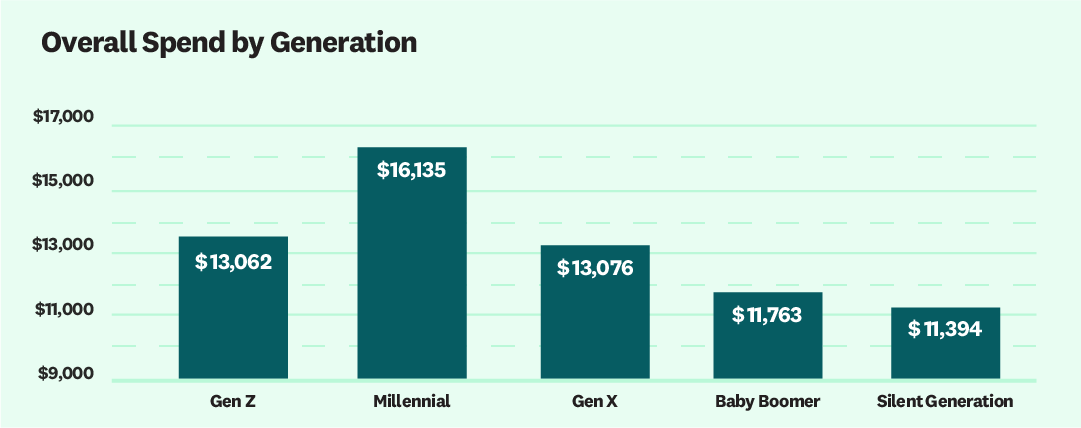

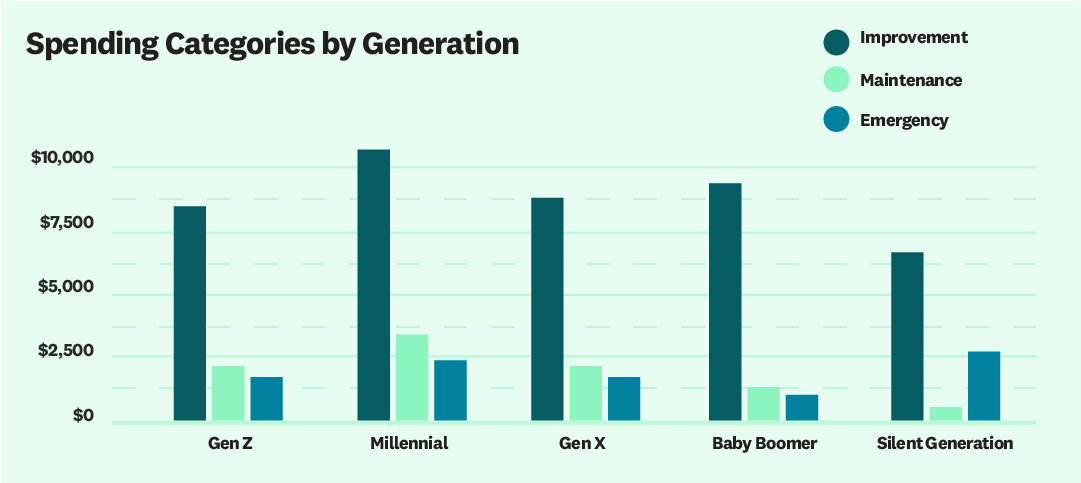

Spending by Generation

Millennials were the top spending age cohort in 2023, spending an average of $16,136 on home improvement, maintenance and repairs combined. On home improvement projects, millennials spent $10,164 this year, which is 2% more than last year. Last year, millennials were also the top spending age cohort for home improvement, spending $9,958. Millennials are still in prime home-buying and family-formation years and may have benefited from a post-pandemic rebound in salaries and earnings, likely driving them to be the top spenders on their homes.

This trend contrasts the Baby Boomers and Silent Generation, who spent less on home improvement in all categories combined than other generations this year. It is important to note that while Baby Boomers and Silent Generation spent less than Millennials and Gen Z, they still spent a considerable amount on their homes. Interestingly, the Silent Generation cohort spent around $7,600 on improvement and over $3,000 on home emergencies (the highest emergency spending of any generation this year), yet only spent around $600 on maintenance. This group is likely making some household improvements (due to an aging home or aging themselves) and is dealing with home emergencies, too.

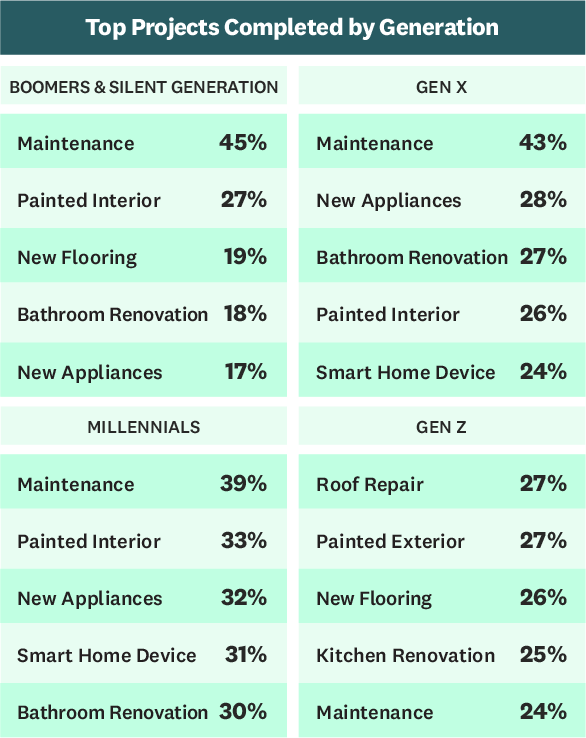

Top Projects by Generation

Our data on the top home projects completed in 2023 highlighted how different Gen Z’s most common projects look from every other generational cohort. Gen Z’s top projects were closely ranked and included projects that were not part of other age cohorts’ top projects: 27% repaired a roof and the same percentage painted or stained their home’s exterior, followed by 26% who installed new flooring, 25% remodeled a kitchen, and 24% undertook general maintenance.

All other generational cohorts reported maintenance as the top home project completed in 2023. Many Gen Z are at the prime age to be a first-time homeowner. Due to the macroeconomic and home-buying conditions like low inventory, high mortgage rates and high home prices surrounding their home purchase, Gen Z likely purchased a home that required some work after purchase, and they are starting to take on these repair and upgrade projects.

Do We Love Our Homes and Mortgages?

This year, we wanted to learn how people felt about their homes and mortgages. Overall, homeowners love their homes and mortgages more often than not loving their home or mortgage. 51% of surveyed homeowners said they loved their home and their mortgage, 34% of those surveyed hate their mortgage but love their homes, 8% love their mortgage and hate their homes and 7% hate their homes and hate their mortgage. Given the evolved significance of our homes over the past few years, it’s unsurprising that people have developed a deeper appreciation for their living spaces..

However, one age cohort had different thoughts compared to other age groups – Gen Z. These surveyed homeowners have more mixed feelings about their homes and mortgages, only 41% love their home and mortgage and 29% hate their mortgage but love their home. For Gen Z, 17% love their mortgage but hate their home, and 14% hate their mortgage and their homes. This mindset of loving their mortgage more than their home, the “hate my home, love my mortgage” phenomenon, is most present with Gen Z and could be attributed to many of them buying fixer-upper homes before mortgage rates rose, settling for a home that needs improvements but locking in a great rate.

Reasons for Completing Work by Generations

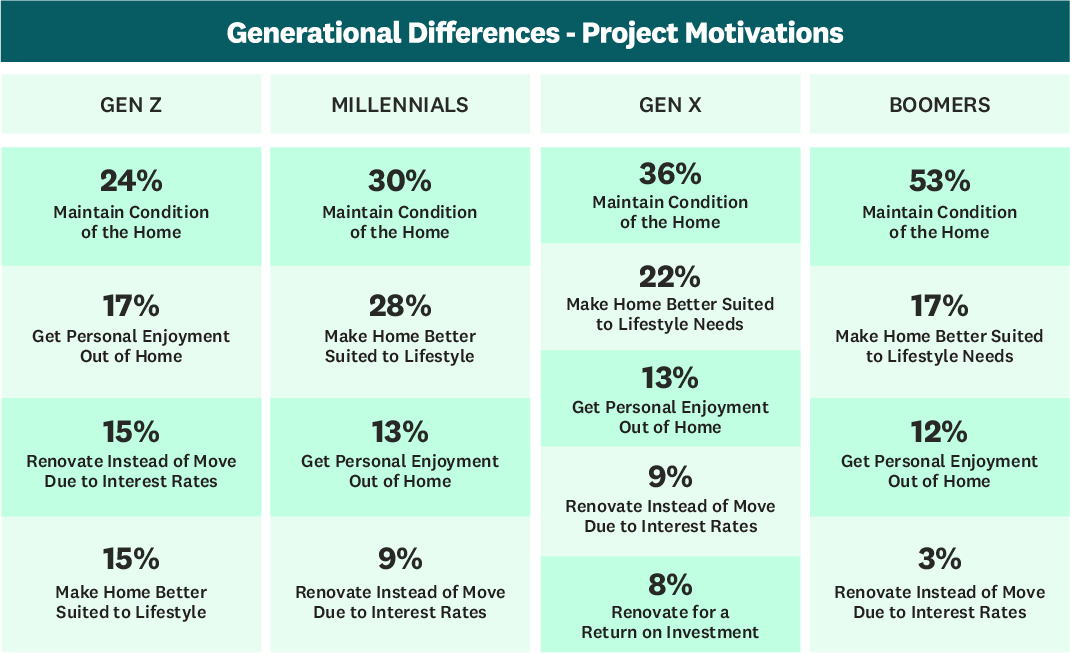

Similar to the data trends on home spending and projects, motivations to take on and complete work differ by generation. According to homeowner reports, age impacts our willingness to undertake projects to preserve our home’s condition. We observed this motivation growing with each successive generation, as Baby Boomers said maintaining their home was the top reason for doing home projects. This trend suggests that the longer people own a home, the more they understand the importance of maintaining it well.

Gen Z surveyed homeowners were the most likely to renovate their homes instead of moving due to interest rates, with 17% of Gen Z homeowners indicating that reason was their primary motivation. In contrast, only 3% of Baby Boomers said this was the main reason they made home improvements.

PART THREE: WHAT TO EXPECT IN 2024

What Do Homeowners Plan to Complete in 2024?

Looking forward, we expect homeowners to continue prioritizing their homes and invest in improvement and maintenance projects. Despite continued maintenance work, it’s inevitable that home emergencies, especially weather-related events, will continue in 2024.

Given the enduring shift in motivations to undertake home improvement work, it’s clear there will be a continued focus on projects that are not only functional but also enhance livability and adapt the home to better suit homeowners’ current needs.

We anticipate an ongoing emphasis on maintenance projects and improvements to high-function spaces, such as kitchens and bathrooms, and high-function features, such as appliances, flooring and roofs.

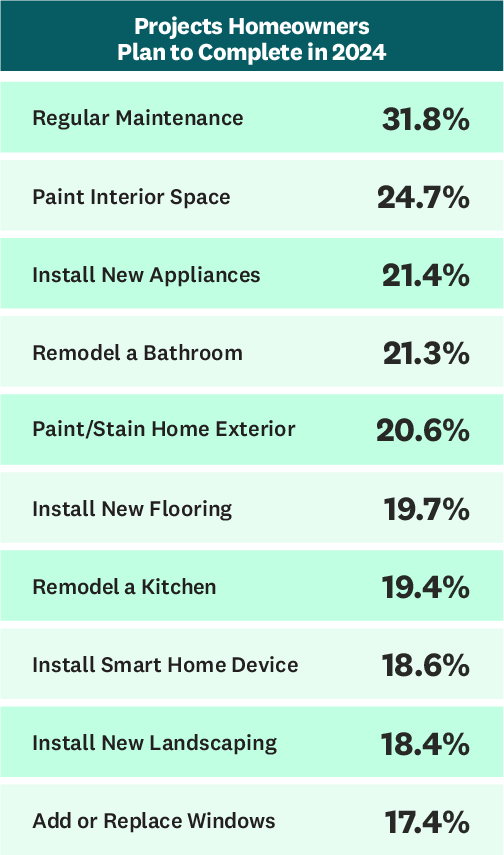

Next year, 32% of surveyed homeowners plan to complete maintenance, the most commonly planned project for next year. After maintenance, painting an interior space, installing new appliances, remodeling a bathroom and painting or staining the home’s exterior round out the top five projects planned for 2024.

There are a few insights from the projects homeowners plan to complete in 2024 that are worth noting.

For example, projects with an eye toward sustainability gained traction, where 14% of surveyed homeowners plan to install solar panels and 13% plan to install or take on energy efficiency or eco-friendly projects. And despite many people returning to offices, 12% of surveyed homeowners plan to add or remodel their home offices.

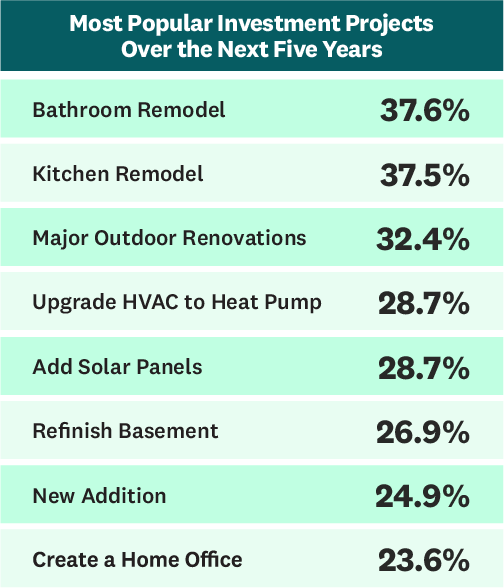

Homeowners Plan on Making Large Investments Over Next Five Years

Considering the significant role our homes play in our lives and the love most people feel toward them, it is no surprise that 65% of surveyed homeowners intend to make a large investment in their homes over the next five years. These major-spending projects differ from those planned for the upcoming year. The most common planned investment projects are bathroom and kitchen remodels, followed by major outdoor renovations, upgrading HVAC systems to heat pumps and installing solar panels.

Many of the projects homeowners plan to do in the next five years will improve the use and enjoyability of their homes. Bathrooms and kitchens are high-use, high-function spaces where improvements or renovations yield noticeable benefits due to the amount of time we spend in them. On the other hand, outdoor spaces often start as blank canvases, offering opportunities to create areas to entertain and enjoy the outdoors.

Interestingly, this year, our data revealed two projects with an eye toward sustainability in the top five investment projects, including upgrading the HVAC system to a heat pump system and installing solar panels. These projects not only enhance energy efficiency but also contribute to reducing the overall environmental impact of our homes. Plus, both types of home projects may qualify for federal incentives and rebates.

And homeowners are serious about these investments. 67% of surveyed homeowners are actively budgeting for these large investments, 20% plan on financing when they start the project and only 15% have not yet considered the budget for these large investment projects.

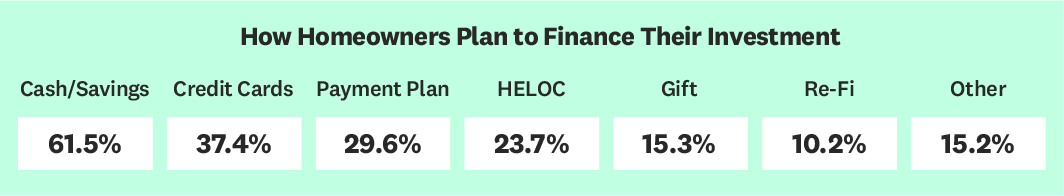

Despite rising interest rates on loans and current macroeconomic conditions, many homeowners plan on financing their projects with cash, credit cards and installment-based payment plans. The payment methods homeowners plan to use to finance future large home investment projects remain unchanged from those used in 2022.

Methodology

The State of Home Spending is based on Angi analysis of surveys fielded to 6,400 consumers between October 22, 2023 and October 23, 2023. The full sample consists of a survey of the general population (n=5,000) and a survey of homeowner households that completed a remodeling project in the last 12 months and hired someone else to do at least some of the work for them (n=1,500). The general population survey was post-sample weighted to balance the sample against general population statistics for age, gender and income to determine average spending and project volume. All statistics, unless otherwise noted, refer to homeowner households that completed an improvement project.

US Population Estimates: https://www.census.gov/quickfacts/fact/table/US/PST045219

Contacts

For information about this report or other Angi research, you can contact the Angi Research team:

Mallory Micetich

Vice President, Corporate Communications

Angi

mediarelations@angi.com

Press & Media Inquiries

Press & Media Inquiries Angi Economics

Angi Economics