Executive Summary

Even before the global COVID-19 outbreak, 2020 was shaping up to be a robust year for home service spending. Every year we conduct a survey of homeowners across the United States and look specifically at the data from homeowners who have completed projects in the last 12 months.

This year, we found, in our annual survey, the average household spending on home services rose to $13,138, an increase over last year’s survey results, where homeowners spent $9,081 on average in 2019. These new topline spending numbers represent an increase in home service spending by homeowners who have completed projects, however they are very likely driven by factors like increased supply and labor costs due to the initial onset of the COVID-19 pandemic. As people spent more time at home, we asked homeowners this year specifically about cleaning and landscaping projects, which are commonly forgotten maintenance projects. This update to our methodology does contribute to the year over year growth in both spending and total projects but is an important way to look at home maintenance.

Breaking down spending further across three key categories, home improvement spending was $8,305, home maintenance spending was $3,192 and home emergency spending was $1,640. The biggest change in spending compared to last year is in maintenance, likely due in part to our updated methodology.

We also found that total projects, including landscaping and cleaning projects, rose to 11 projects from an average of 8.1 projects in 2019. Diving a bit deeper into home projects, home improvement projects grew from 2.2 projects to 2.77 projects, a more modest 25% increase. We also saw a boost in total maintenance projects, which we attribute partially to our change in methodology, where on average homeowners surveyed completed 2 general maintenance projects, 2.1 cleaning projects and 3.4 landscaping projects. This category breakdown is new to our report and contributes to the year-over-year project growth.

People also had more emergency projects this year, an average of 1.2 projects, compared to 0.4 projects in 2019. One major reason for the increase in emergency projects has been the volume of severe weather over the last year and unseasonable or extreme weather is a key driver of unexpected home emergencies.

What fueled this boost in spending and projects?

This year’s topline growth in spending and projects is a story of both increasing costs of supplies, increasing cost of professional labor and homeowners shifting spending from things like entertainment and travel to their homes. While the cost to do projects compared to last year did increase, we also found that homeowners were spending more as well.

The acceleration of home buying this year and underlying drivers of consumer spending like shifting demographics, baby boomers renovating to age-in-place, Millennials changing layouts to raise their growing families, a greater cultural focus on home design and home entertainment, an aging housing stock and a shortage of new home construction – among many other fundamental factors – were already resulting in more spending on home improvement, home maintenance, and home emergency repair and also continued this year.

This year, as homeowners were spending more time at home, we wanted more additional information regarding maintenance and asked specifically about cleaning and landscaping, two very important aspects of home maintenance. Last years’ survey did not look at this aspect specifically, so this year’s increase in home services spending does likely include a bump from our interest in these two categories.

However, adding on top of these underlying trends, has been the widespread outbreak of COVID-19. Homes have always been important, but the once in a century global pandemic has fundamentally shifted the relationship we have with our homes.

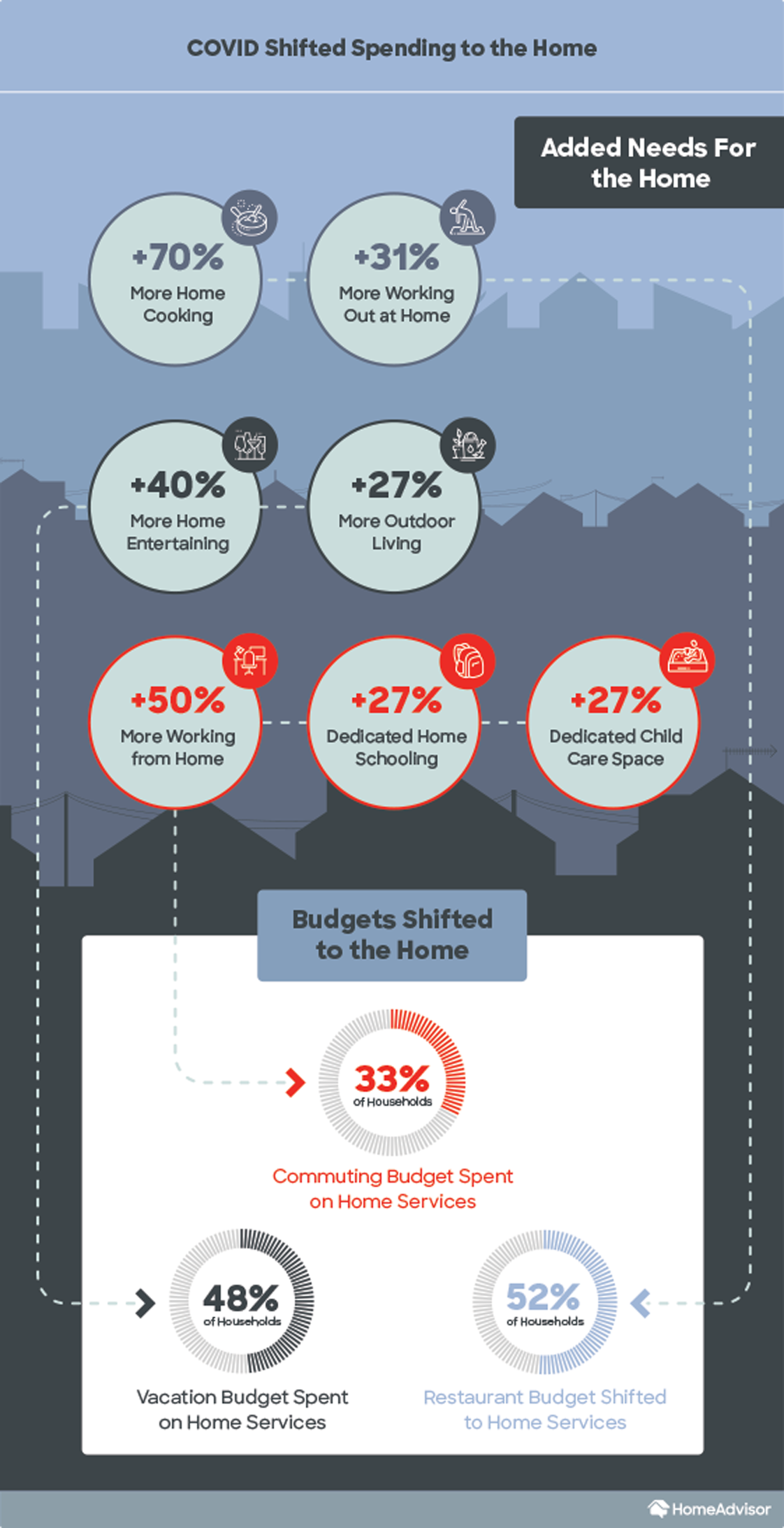

Those factors, combined with a shifting range of needs for households as a result of coping with COVID-19, such as 27% more outdoor living needs, 40% more home entertaining, 50% more working from home, and 70% more home cooking, resulted in shift in spending patterns, with 33% shifting commuting budget, 48% shifting vacation budget, and 52% shifting restaurant budgets into home services.

The combination of social distancing, closed schools, transition to working from home, the sudden loss of appeal of high density living, and closed restaurants has had a lasting impact on both the economy and our daily lives.

These dual changes have fundamentally reshaped our relationship with housing in four keyways:

- People are using their homes more, which is causing more wear and tear of existing spaces

- More time spent at home, also means more time noticing problems in the home

- Americans have started adopting new uses for existing home spaces

- Spending substitutions away from other common expenditures and into home services

Key Takeaways

In 2020, total home service spending among homeowners completing home projects, was on average, $13,138 per household and homeowners completed an average of 11 home service tasks or projects.

- Home improvement spending in 2020 averaged $8,305 representing a $745 increase from 2019, across 2.77 projects.

- Home maintenance spending in 2020 averaged $3,192 representing a $2,087 increase from 2019 across 7.48 projects, representing 2 general maintenance projects, 2.1 cleaning and 3.4 landscaping projects.

- Home emergency spending averaged $1,640 representing a $124 increase from 2019 across an average of 1.2 projects.

- The top three completed home projects are bathroom remodels, interior painting, and installing new flooring.

- The top reason for home improvement spending was to make the home better suit lifestyle needs, 41% of all consumers surveyed. This stands in contrast to 2019, where the number one reason was to replace or repair a damage, defect or decay, suggesting that COVID-19 is impacting people’s lifestyles.

- Despite strong spending trends, 30% of projects were not started or completed as a result of COVID-19.

- 85% of Americans are spending more time at home as a result of COVID-19, with 67% spending significantly more time at home, resulting in 63% noticing more areas in need of improvement around their homes.

- 70% of people are doing more home cooking as a result of COVID; 52% have shifted some of their restaurant spending into home improvement projects; and a kitchen remodel is the most desired home improvement project, with 27% of people saying they would remodel their kitchens if given $10,000 for home upgrades.

- 71% of people want to see COVID-related business updates from home professionals and 73% say that knowing a home service professional shares COVID-related information and actively promotes safety measures will influence their hiring decisions.

- The number one reason for projects to go over time or over budget was products or materials taking longer than expected to arrive, with 24% of respondents listing this as the primary reason for delayed or over-budget projects.

Part 1: The State of Home Spending in 2020

Our homes are intimate spaces where we spend most of our time; study and work; and raise our kids, grow old and retire. While this has always been true, it is even truer in 2020 as people across the U.S. cope with the COVID-19 pandemic.

As the intrinsic meaning and value of our homes has evolved over this year, the home is most certainly having its moment in the spotlight. Spending significantly more time at home has encouraged Americans to spend significantly more money on their homes.

Total home service spending among homeowners who completed home improvement projects in the last 12 months was $13,138, from $9,081 spent during 2019. This was driven by across-the-board increases in home improvement, home maintenance, and home emergency spending.

1.1 Improvement and Remodeling Spending

In 2020, home improvement and remodeling spending among homeowners who completed home improvement projects was $8,305, a $745 increase from 2019 and a healthy increase despite economic and general uncertainty due to COVID-19. Home improvement and remodeling includes projects like remodeling a bathroom, remodeling a kitchen, painting, building a deck or porch, adding an addition, installing new flooring, and making big landscaping improvements.

Even under normal circumstances, a similar increase in spending is impressive; however, it is an impressive increase in spending relative to the overall change in consumer spending during the same time.1

The growth in improvement and remodeling spending reflects both the anti-cyclical strength of home service spending, where when the economy decelerates home services benefits from built-in strength, and the unique role our homes are playing during this global health crisis.

The yearly spending numbers averaged over 2.8 projects per homeowner household, for an average remodeling project value of $2,995 — approximately equal to the average price of installing a bathtub, a shower, or new countertops.

This level of spending varies, however, based on the unique attributes of a household or home type. For example, single-family houses make up an overwhelming share of total improvement spending — with average spending on single-family homes being about 10% greater than spending on townhouses, over double the spending on condos, and nearly four times higher than spending on high-rise apartments. This is likely due to two reasons: First, owners tend to spend more than renters, and a higher percentage of single-family homes are owned; and second, because single-family homes have a wide variety of remodeling and improvement potential. Most home types could potentially require kitchen or bathroom work, but only single-family homes typically allow simultaneously for roofing, landscaping, interior remodels, fencing, and other types of work all on the same home.

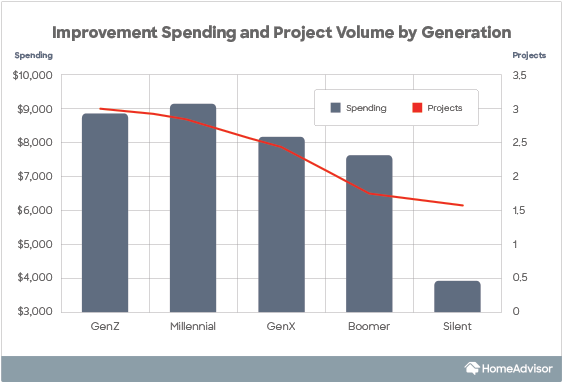

The age of people in a household also has a direct impact on home improvement spending. Millennials are spending the most on home improvement projects. On average, millennial households spend or plan on spending nearly $10,000 on home improvement projects this year. Homeownership rates for millennials have jumped significantly, especially as COVID-19 has reemphasized the importance of the home and many companies move to flexible work location options. Millennials are not only rapidly becoming homeowners, but they are also spending more on home improvement than any other generation when they do.

Millennials, on average, spend $9,206 on home improvement. In contrast, the silent generation spends the least on home improvement, $3,966. These trends are exactly what we would expect from two very different generations — the former of which is at the peak of both home buying and family building, and the latter of which has, for the most part, settled into fixed-income retirement.

However, when it comes to the number of home improvement projects completed, GenZ homeowners are leading the pack, completing an average of 3.5 projects. Millennials closely follow GenZ, taking on an average of 3.3 projects, followed by GenX at 2.8 projects. Boomers completed an average of 2 projects, and the Silent Generation completed the fewest projects, on average, at 1.8 per household.

Compared to 2019, millennials are spending 60% more on home improvement and doing on average 30% more projects.

Younger cohorts are not only spending the most money, but they are also taking on more projects. That could be happening for a number of reasons.

- Recent homebuying activity and the desire for customization following a move

- Buying older homes in need of work closer to city centers

- Buying older homes or homes that need more work due to the rising prices of homes

- Desire for customization and personalized spaces

While spending and number of projects by young generations has risen sharply over the last year, boomers are some of the most consistent consumers of home services. Boomers still have high degrees of personal wealth accumulated and are more likely to be preparing their homes for their retirement years. For example, while the number of improvement projects undertaken by millennials increased by 30% on average, for Boomers it only increased by a third of that, around 10%. Similarly, total spending on all home services approximately doubled year over year for millennials, while for boomers it only rose by 20%, representing one-fifth of the change.

A final interesting distinction between the generations is how optional or discretionary each generation viewed remodeling projects. Perhaps underscoring the different values placed by each generation on being happy at home, the degree to which each generation views their remodeling projects as entirely optional directly drops with age and the number of projects completed. Controlling for the number of projects completed, we find that older generations view their projects half as optional as younger generations. When one considers all the cumulative stages of life — schooling, child-rearing, marriages, divorces, and experience with a multitude of structures — it makes sense that older generations consider remodeling to be less optional than younger generations who do not have as much experience with homeownership as their older counterparts.

1.2 Home Maintenance Spending

In 2020, maintenance spending among homeowners who completed home maintenance projects was $3,192, a $2087 increase from 2019. The yearly spending numbers are averaged over 7.48 projects among all owner households who completed home improvement projects, an increase in projects completed of 23%.

The increase in projects is further broken down by type of project, with homeowners completing an average of 2 standalone maintenance projects, 3.4 landscaping projects, and 2.1 cleaning projects per household.

As people spend more time at home during 2020, and as their homes see more wear and tear, this jump in year-over-year spending is not unreasonable — especially when prompted to think about landscaping and cleaning as parts of home maintenance. We asked homeowners whether COVID-19 and the time at home has caused them to notice more issues, imperfections, or areas in need of maintenance or improvement in their homes. Nearly 64% said yes.

We also found there is an interesting relationship between income and maintenance spending. Low-income, median-income, and upper-income households all complete roughly the same number of maintenance projects, around 7, with higher-income households ($125K or greater) completing 10 projects on average (driven by higher levels of landscaping and cleaning work).

It makes sense that the households with the highest incomes complete more projects, but why no drop-off for lower-income households? In all likelihood, this is because when households are on a tight household budget, they still see the same need for maintenance spending to help prevent any unexpected and costly home emergencies and to protect their housing assets.

Within specific types of recurring maintenance jobs, purchasing behavior is also driven at least in part by the type of home people live in or own, with the biggest gap between high-rise apartments, which take on 25% more cleaning projects than landscaping, and single-family homes and townhouses, which undertake more than 60% more landscaping projects than cleaning projects.

1.3 Home Emergency Spending

In 2020, spending among homeowners who completed home emergency projects was $1,640, a $124 increase from 2019. The yearly spending numbers are averaged over 1.2 projects among all owner households who completed home improvement projects.

Diving deeper into home emergency spending, where a homeowner lives makes a difference in how much they generally spend on this category of home services. Home emergency spending is lowest in the Midwest, where hurricanes, earthquakes and forest fires are all relatively less frequent than other parts of the country. Compared to the Midwest, the West and Northeast both had about 10% higher average spending on emergencies, while the South had spending 35% higher than the Midwest, likely in part because of hurricanes that impact the southern coast of the Atlantic and the Gulf Coast.

This year, we also found that the type of home can impact how much one will spend on emergency projects. Owners of apartments spend considerably more than any other home type. Although some of this increased spend is capturing owners of structures who have tenants and multiple units (among renters, single-family home spending on emergencies is more than four times higher than apartment spending), it is still a significant increase. There are many reasons why this could be true, including that apartments typically contain more complex systems with elevators, pools, large HVAC and water systems — and that, due to ownership, less remodeling activity could be happening, favoring repairs and projects to keep systems running rather than updates or aesthetic changes.

1.4 Most Popular Projects

This year, we saw a shift in the most popular home improvement projects. The top projects were interior painting projects, followed by bathroom remodels and installing new flooring. This marks a departure from prior years, with painting, instead of a room remodel, being the most commonly undertaken project. 35% of households undertook a painting project, compared to the next most frequent, a bathroom remodel, at 31%. Last year, room remodels were the top project with bathrooms being the most popular option.

The remaining top 10 projects in 2020 included flooring (26% of households), landscaping (24%), kitchens (23%), painted exteriors and smart home device installations (both 19%), new roofing (16%), fencing (16%), and installing a deck or porch (14%). All these top 10 choices offer homeowners either a relatively low cost, a high visual change, added functionality, or some combination of the three.

When homeowners were asked what projects they plan to complete this year, interior painting again was the top choice, closely followed by bathroom remodels and kitchen remodels. Outdoor updates, such as painting the home exterior and new landscaping, were also popular choices for future projects.

Millennials drove painting to its top spot, with 45% of millennial households taking on a painting project. Painting was one of the most popular projects across nearly all age groups, because it is relatively affordable and offers a lot of visual value in terms of the look and feel of a room.

This was true for some other related categories – like new flooring – which was also relatively popular across all age groups, changing only about 10% in popularity across all ages. In contrast, there was more variance in projects directly attached to home utility, where something very specific like adding a new home office varied dramatically by age groups. Millennials are three times more likely to take on home offices project or addition than older and younger age groups.

When asked about what projects they would most like to take on if they were given $10,000, over one-quarter (27%) of homeowners would take on a kitchen update. Bathroom updates and outdoor space updates (respectively 18% and 17%) were the next most desired projects. Homeowners’ current focus on updating the most used parts of the home (kitchen and bath) and maximizing the full potential of the home’s outdoor space is very likely due to how COVID-19 has changed our daily lives and increased the time we spend in our homes.

Part 2: Home in the Time of COVID-19

The once-in-a-century global pandemic of COVID-19 has forced significant parts of the population indoors, resulted in the deaths of over 200,000 people and counting, and has caused previously never seen levels of economic hardship. As a global pandemic swept around the world, we took shelter and refuge in our homes.

Our homes became our offices, schools, gyms, movie theaters and more. Spending time in our homes, we began to see issues and the things we want to change. Millions of homeowners across the U.S. decided to take on projects, both by hiring pros and by doing it themselves. And we have strong reason to believe, due to the fundamentally high intrinsic value of our homes, demand will continue to be strong.

There has not only been a shift in home service activity, but also a fundamental shift in the way people think about their homes and spend money on their homes.

2.1 The Year of the Home

With the pandemic changing everyday life and forcing homeowners to spend more time in their homes than ever before, the primary reason homeowners are improving their homes is to better suit their changing lifestyle needs. From our research, we found this was one of the biggest shifts in home services spending.

This year, 41% of homeowners said that “making their home better suited for lifestyle needs” was the top reason they completed home improvement projects. In 2019, homeowners listed replacing or repairing damage, defects and decay as the number one reason for spending on home improvement projects.

One major reason for this shift is due to COVID-19 and the amount of time people are spending at home. Nearly 86% of homeowners say they are spending more time at home due to the pandemic, with 67% spending significantly more time at home, resulting in 63% noticing more areas in need of improvement around their homes.

Unsurprisingly, this has also dramatically reshaped how we interact with our homes in 4 key ways.

- Spending more time in our homes is resulting in more wear and tear on our houses.

- Spending more time in our homes is resulting in more awareness of shortcomings and areas in need of improvement.

- Public health risks and local business and economic restrictions have resulted in the need to get more uses, and often unique uses, out of the existing spaces in our homes.

2.2 Same Homes, New Needs

Despite spending a lot of additional time at home with needs growing and changing, people are not actually moving to meet those new needs. When we asked people if they were more likely to move as a result of COVID-19, only 17%, roughly 1 in 6, said yes.

As a result, even though people are not moving, their needs have shifted. Because of COVID-19, homeowners are needing more from their homes as they make more meals at home, find new ways to entertain in the home, and work from home. 70% of homeowners indicated that COVID-19 added the need for more home cooking, 50% for more working from home, and 40% for more home entertaining.

This added demand also changed how people were looking for pros, what they needed from them, and the nature of their projects being completed.

For example, the new COVID-related demand for home services shifted the way people are looking for pros, with 71% of people said they want to see COVID-related business updates from home professionals, and 73% say that knowing a home service professional shares COVID-related information and actively promotes safety measures will influence their hiring decisions.

The nature of COVID-19’s impact on project completion was not limited to just consumer preferences. Added demand, in addition to supply chain disruptions, has resulted in supply shortages across the industry. The number one reason cited for projects going over time or over budget was products or materials taking longer than expected to arrive, with 24% of respondents listing that as the primary reason for delays and budget issues. The impact on overall completed volume is in fact even worse than these numbers would suggest, because many projects failed to even get off the ground to begin with despite the overall boost in demand and strong spending. This is captured by the 30% of planned projects that were not started or completed as a result of COVID-19.

Despite COVID-19 and its impact on demand and the nature of the demand, Americans are adapting their spending and saving habits in order to satisfy these new needs and cope with the challenges associated with it.

2.3 Saving is Turning into Spending

Americans are changing their spending on home services in order to adapt to the challenging realities of 2020. In the beginning of the year before the onset of the pandemic, consumers were spending on a broad range of items, things like travel, entertainment, clothing and restaurants. As the pandemic set in that spending shifted into savings, before turning into consumer spending on home improvement.

We looked at three common household expenditures that were susceptible to the impacts of COVID-19: restaurant spending, commute spending and vacation spending. We found across-the-board spending substitutions on home services from each of these three large categories.

With restaurant spending, such as eating out at bars and dining establishments, we found more than half of all consumers, 52%, adjusted their spending from eating out at restaurants into improving their homes. This trends very closely with the 70% of consumers who say they’re doing more cooking as a result of COVID-19. It also trends with the kitchen remodel being the most desired home improvement project, gaining a majority of respondents – 27% – saying they would prioritize remodeling their kitchen if given $10,000 for a home upgrade.

This shift, highlighted so clearly by reduced restaurant spending shifted to home spending, follows a similar pattern as the other two major categories we looked at. For commuting spending, on things like gas, insurance, parking, and public transit costs, 33% of Americans reported transferring some of those savings into home spending. This likewise tracks closely with the 50% of people saying they have more work from home needs.

Finally, for vacation spending, on things like vacations, hotels, and airlines, 48% of consumers shifted some of the savings from reduced spending there into their homes — also closely mirroring the 27% of people who have added outdoor needs and 40% of people who had added home entertainment needs.

Summary

2020 was the year when underlying, long-term demographic and housing trends combined with an unprecedented global pandemic to create an unexpectedly large boost of spending on home services by American consumers.

Total spending grew by over $4,000 for households completing home projects, rising from $9,078 on average in 2019 to $13,138 on average in 2020. These new topline spending numbers represent an increase in home service spending by homeowners who have completed projects, however they are very likely driven by factors like increased supply and labor costs due to the initial onset of the COVID-19 pandemic.

This increase was further driven by across-the-board increases in spending for both more expensive categories like home improvement, with spending reaching $8,305, to less expensive categories like home maintenance and emergency repair, with spending reaching $3,192 and $1,640, respectively.

The long-term trends driving home service spending remain unchanged. In demographics, there is a swelling need for older generations looking to age in place, and for younger generations with growing families or keeping up with the latest trends. Within the housing stock itself, the average age of homes continues to increase, as new homes are built at a lower rate than in prior decades.

Those factors, combined with a shifting range of needs for households as a result of coping with COVID-19 — such as 27% more outdoor living needs, 40% more home entertaining, 50% more working from home, and 70% more home cooking — resulted in a significant shift in spending patterns, with 33% shifting commuting budgets, 48% shifting vacation budgets, and 52% shifting restaurant budgets into home services.

For all of these reasons, the outbreak of COVID-19, colliding with long-term demographic trends, combined to make 2020 the year of the home.

Appendix: Methodology & References

In our survey of 5,000 Americans, we developed a representative sample of the entire U.S. population: homeowners with mortgages, homeowners with mortgages paid off, renters, people living rent-free, those who conducted home improvement projects, those who did not, those who had maintenance and emergency expenditures, and those who did not.

This is a groundbreaking level of detail on home spending that provides new insights into how people spend on their homes. For most of the averages we will look at, those consumers who conducted all three sets of projects, regardless of their living situation.

Prior-year surveys have looked at the narrower subset of homeowners who complete projects. So, to benchmark our year-over-year growth, we identify the subset of our results against this baseline of homeowners who completed home improvement projects in order to accurately estimate year-over-year spending increases.

Samples of U.S. general population

N = 5000, July 21-23, 2020

N = 1200, July 21-23, 2020

1 https://fred.stlouisfed.org/series/PCE

The material and information contained in this report is for general information purposes only. You should not rely upon such information as a basis for making any business, legal or any other decisions.

Press & Media Inquiries

Press & Media Inquiries Angi Economics

Angi Economics