How Tariffs Could Impact your Bottom Line when Renovating your Home

Whether a kitchen remodel, updating flooring or a full addition, home improvement takes resources and materials. Recently, there has been a lot of news about additional and increased tariffs on goods from countries like Canada, Mexico, and China. Many of these goods are commonly home improvement jobs, like countertop materials, hard and soft woods, other stone, cement, steel, appliances and appliance parts.

But what does that actually mean, and will it impact my bottom line?

Tariffs are taxes on goods that are brought into the United States from another country. There are many reasons for tariffs such as raising revenue, protecting domestic industry and as a tool of diplomatic negotiations with another country; however, they can have unfortunate side effects like higher prices on consumer goods.

More home improvement goods and materials could be subject to increased tariffs, and that has a ripple effect throughout home services. For example, 11% of U.S. steel imports are from Mexico, and Mexico is the 5th largest supplier of cement in the United States.

Many appliances such as air conditioners, refrigerators, furnaces and ovens sold in the United States are imported from Mexico. Dishwashers, laundry machines and other household appliances amount to $1.1 billion worth of imports from Mexico.

It’s also important to remember that the effect of the tariffs can be spread out by distributors, retailers and importers to non-tariffed items. Splitting tariffs on washing machines across both washers and dryers to keep the price increase low across the board.

Key Home Improvement Goods & Materials Impacted by Tariffs

- Stone Countertops

- Wood – Flooring, Cabinets

- Vinyl tile flooring

- Tile

- Steel

- Aluminum

- Tools

- Appliances

- Heating and Air Conditioning Systems

- Concrete

- Electric ceiling or wall lighting fixtures

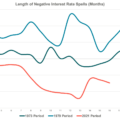

Although tariffs on home improvement goods and supplies are not new, pros and businesses have done a lot to absorb as much of the cost as possible, there is a limit to how much businesses can take.

So, tell me what I need to know?

Be smart and plan to pay a bit more for your home improvement and emergency needs for the time being.

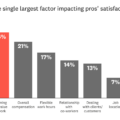

Why? Increased labor and material costs. Home service pros can’t mitigate the tariff costs to consumers much longer. The already pervasive labor shortage in home services is about to be more acutely felt by home and property owners.

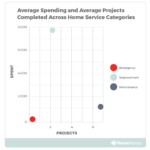

And material costs, which now are a good portion of the cost of home projects, could also rise.

For example, we know, according to the HomeAdvisor True Cost Guide, how much granite countertops cost. You can purchase slab granite countertops for $40 to $60 per square foot, while you can get granite tile for $5 to $15 per square foot. On average, homeowners spend $2,000 to $4,500 on installation and materials to install a granite countertop. All that is before the material is subject to increased tariffs.

Or take the cost to install wood flooring. The average homeowner spends about $4,400 to install wood floors, but again those prices could go up as much as 10% from some manufacturers as the tax on imported hardwood increases.

And above materials and labor, increased tariffs on imports from Mexico could significantly increase gas prices in the United States. Although U.S. energy production is booming, Mexico is an important source as OPEC has continued production cuts.

Gas prices have already been stubbornly high and more taxes on this important resource is absolutely going to have an impact on home pros. Even a $0.25 increase in the price of a gallon of gas will put stress on a business.

For a homeowner or customer, this could mean added service charges or an increase in the base price of services as these small businesses are pinched.

This seems like bad news? Tell me something good.

In the end, it is really about smart financial planning.

Our homes are often our biggest financial investment. The potential for increased prices on goods and materials that go into keeping our homes in working order is not a good reason to not take care of your investment. Plan accordingly, budget smart and keep up your investment.

Press & Media Inquiries

Press & Media Inquiries Angi Economics

Angi Economics