What Will Mortgage Rates Do Next? History Offers Some Clues

Key Takeaways:

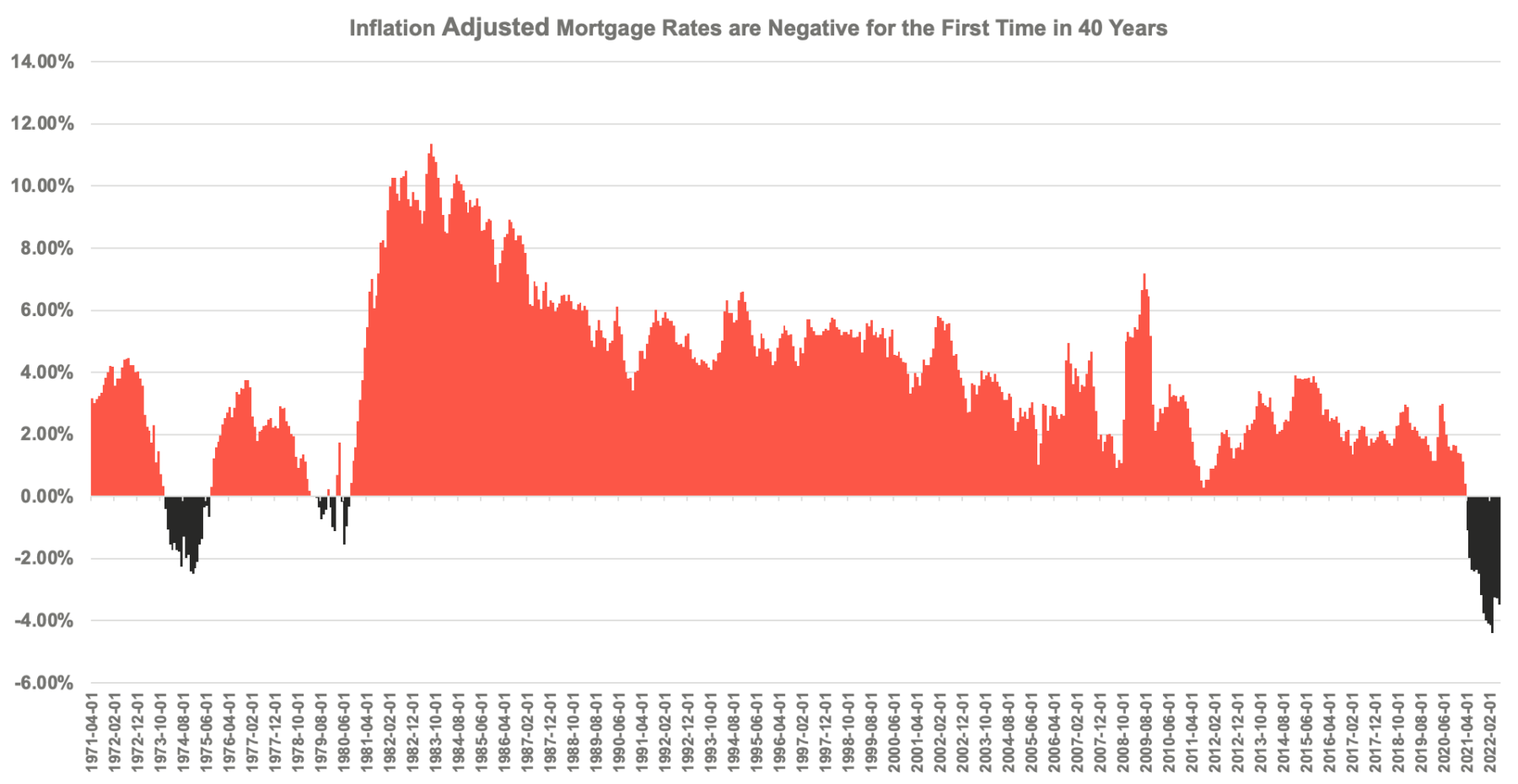

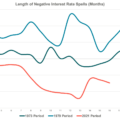

- This is the first time in over 40 years that mortgage rates – after controlling for inflation – have been negative.

- Inflation is 9.1%, nearly twice as high as 5.5% mortgage rates, the gap has never been this high before.

- While now remains the least affordable time to buy a home in the last 30-years, negative real mortgage interest rates effectively reduce some of that pain.

- History suggests that either inflation has to come down, or mortgage rates have to rise further… or some combination of each.

As an economist I am always on the lookout for either unique macroeconomic conditions worth highlighting or for when events in the past can help inform our expectations for the future. Right now the relationship between mortgage rates and inflation satisfies both those conditions.

Specifically, even though current mortgage rates of 5.5% are painful relative to recently available rates of below 3%, high inflation effectively reduces some of that pain by shrinking the cost of the debt at a faster rate. And in fact the gap between inflation (9.1%) and mortgage rates (5.5%) is at an all time high. We have never seen before this size of negative real mortgage rates, so the current rate environment is a very unique economic development.

At the same time, while interest rates have nearly doubled from their recent lows (driving down home affordability in the process), there are still unanswered questions about where they will go next given expectations of higher overall interest rates for the rest of the year.

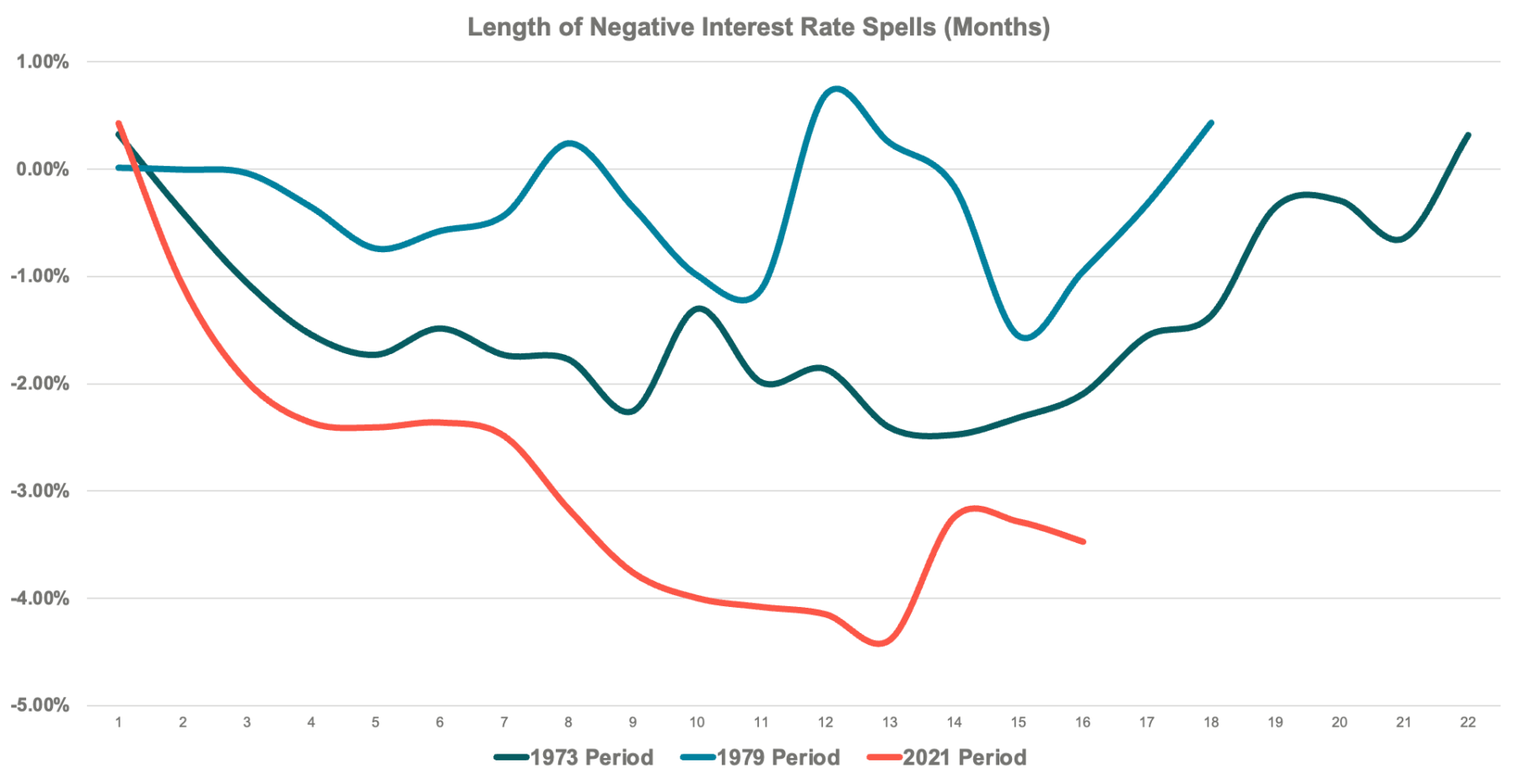

So looking at previous (albeit rare) spells of negative real rates on mortgages could give us some clues about what to expect next.

The growing remodeling market is benefiting from rapidly increasing mortgage rates, because homeowners are incentivized to stay in place and remodel instead of selling their homes and giving up their cheaper mortgages in the process.

But will mortgage rates go even higher, increasing this incentive further, or have they reached their peak? If history is any guide, rates either have to rise further, or inflation has to come down.

This is because only 48 total months in the last 51 years have had negative interest rates. And the record for the duration of the negative rate environment was 20 months from December 1973 to July of 1975.

Current real mortgage rates have been negative for the last 15 months, so the past trend suggests, pressure will continue to mount for inflation rates to come down, or mortgage rates to rise even further over the coming year if inflation remains elevated.

Methodology

Author’s calculations using weekly 30-year mortgage rate averaged monthly, less the year-over-year change in the consumer price index.

Data sources: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPIAUCSL, July 25, 2022. and Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, July 25, 2022.

Press & Media Inquiries

Press & Media Inquiries Angi Economics

Angi Economics