2024 State of Home Spending Report

Interest rates will continue to drive “renovate over relocate” mentality in 2025

Homeownership continues to play a central role in the American dream, and despite tighter budgets and significant stress levels, homeowners remain committed to maintaining and enhancing their homes. Angi’s 2024 State of Home Spending Report highlights how homeowners navigated an evolving economic landscape, marked by tighter budgets, rising stress, and shifting priorities. While total home project spending declined by 12% in 2024, the enduring commitment to maintaining and enhancing homes remains evident, with 93% of homeowners planning projects in 2025.

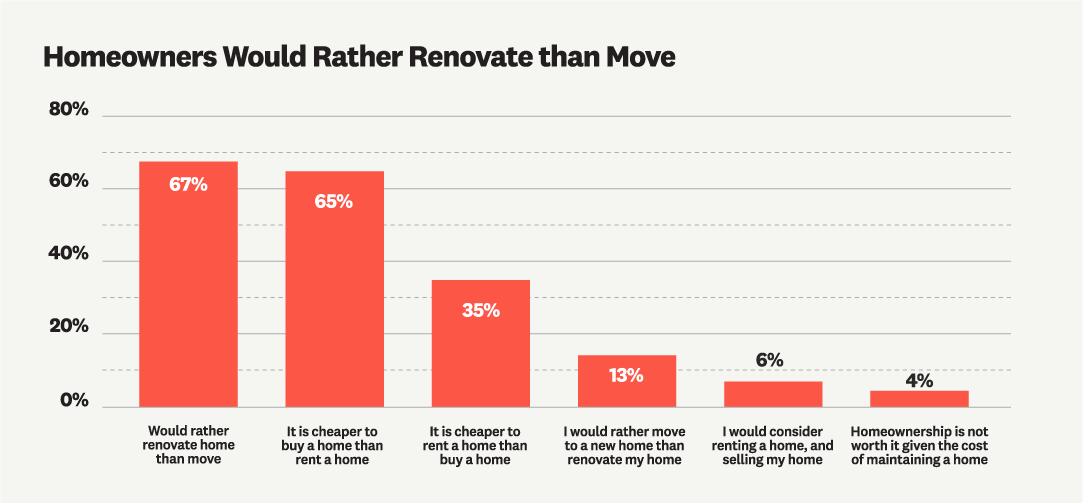

Amid high interest rates and limited housing inventory, 67% of homeowners express a preference for renovating their current home to better meet their needs rather than moving, underscoring the enduring value they place on their homes amid economic challenges and the ongoing stress of home maintenance. However, this commitment comes with challenges—ranging from surprise expenses and skilled labor shortages to growing financial stress. In fact, 43% of homeowners say stress related to home repairs has increased over the past year, which emerged as the most stressful budget item ahead of healthcare, debt, and childcare.

Despite these hurdles, the emotional rewards of homeownership continue to outweigh the difficulties for most. Over half of homeowners (62%) associate homeownership with feelings of responsibility and security, while 50% say it brings them happiness. Looking ahead to 2025, the focus is on strategic investments that adapt homes to changing lifestyles and environmental goals, multigenerational needs, and sustainable innovations. This year’s findings underscore a collective resilience among homeowners who are determined to preserve and enhance their most significant asset—their home.

Read the full report below or download it here.

Part 1: Pros Reflect on 2024 and Share Trends for 2025

As a new addition to our annual State of Home Spending Report, Angi conducted 5 focus groups among pros about some of the most popular project categories, discussing the evolving homeowner preferences across key areas of home improvement.

Painting and Design Updates - 22% of homeowners plan interior painting in 2025.

Simpler Palettes: Homeowners favor fewer colors and monochromatic designs with varying finishes to create modern interiors.

Cabinet Trends: White-painted cabinets offer an affordable and impactful way to refresh kitchens.

Bathroom Trends - 13% of homeowners plan bathroom remodels in 2025.

Larger, Easy-to-Maintain Showers: Homeowners are replacing bathtubs with larger, groutless showers minimizing maintenance.

Fixtures: Increasing interest in black and gold finishes, double showerheads, and handheld sprayers reflects a blend of aesthetics and functionality.

Floating Vanities: Younger homeowners are drawn to floating vanities, paired with durable vinyl and porcelain flooring for a modern look.

Flooring Innovations - 13% of homeowners plan flooring installation in 2025.

Hard Surface Preferences: Laminate and luxury vinyl plank (LVP) flooring are on the rise, replacing traditional carpeting.

Lighter Aesthetic: Natural, lighter shades and materials like white oak are popular among younger generations.

Landscaping Shifts - 12% of homeowners plan landscaping projects in 2025.

Smaller More Affordable Project: More homeowners were looking for smaller landscaping projects that they could do for $1,000-$2,000.

Emergency Work: With more hurricanes and storms throughout the country, there has been more work to clean up yards.

Economic Influences on Renovations

Affordability and Financing: Inflation has prompted budget-conscious choices, with homeowners prioritizing essential upgrades, exploring financing options, and looking at cheaper materials and alternatives to more expensive projects.

Aging in Place and Multigenerational Needs: Homeowners are adapting spaces for accessibility and accommodating larger household structures.

Part 2: The Hurdles of Homeownership

Despite their dedication to maintaining and enhancing their homes, homeowners faced challenges in 2024. From unanticipated expenses to difficulties in securing skilled labor, these hurdles underscored the complexities of homeownership in today’s economic climate.

Unexpected Costs: Managing budgets was top of mind for homeowners in 2024. Over 50% encountered surprise expenses, particularly for materials and labor. Improvement projects were prone to running over budget compared to maintenance tasks. While over half of homeowners reported staying within their budgets, going over budget was a more common experience than coming in under. Labor costs and unforeseen material expenses were cited as the most significant contributors to budget overruns. A majority of homeowners faced some form of budget-related issue with 1 in 5 having to adjust their project budget due to rising labor costs or contractor fees. Another 1 in 5 encountered unexpected material costs, adding strain to already tight budgets.

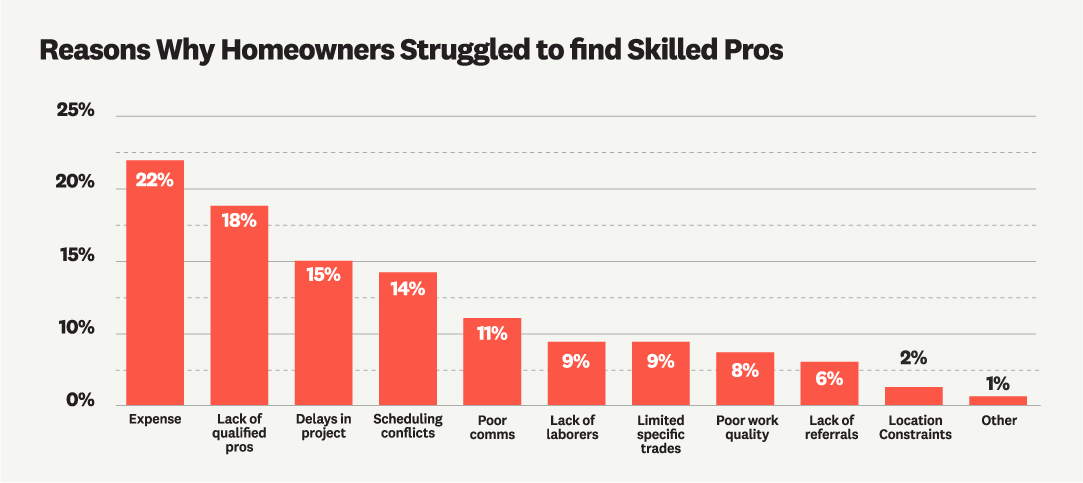

Skilled Labor Shortages: More than half (54%) of homeowners struggled to find skilled professionals, encountering too high of costs (22%), difficulty locating skilled workers (18%), and delays (15%). Younger homeowners faced greater challenges in securing skilled labor compared to older generations.

Rising Stress Levels: The financial and logistical demands of homeownership have taken a toll on stress levels. 43% of homeowners reported increased stress related to home repairs and maintenance in 2024. Home projects emerged as the single most stressful budget category, ranking ahead of other significant expenses like healthcare, debt, savings, childcare, education, and entertainment.

Affordability Concerns: Looking ahead, 61% of homeowners are concerned about affording maintenance or repairs in 2025, with younger homeowners feeling this pressure more acutely.

These findings highlight the ongoing hurdles homeowners face as they navigate the responsibilities of homeownership. Despite these challenges, the determination to invest in their homes remains a defining characteristic of today’s homeowners.

Part 3: Generational Spending Trends: Boomers Lead, Millennials Prioritize Maintenance

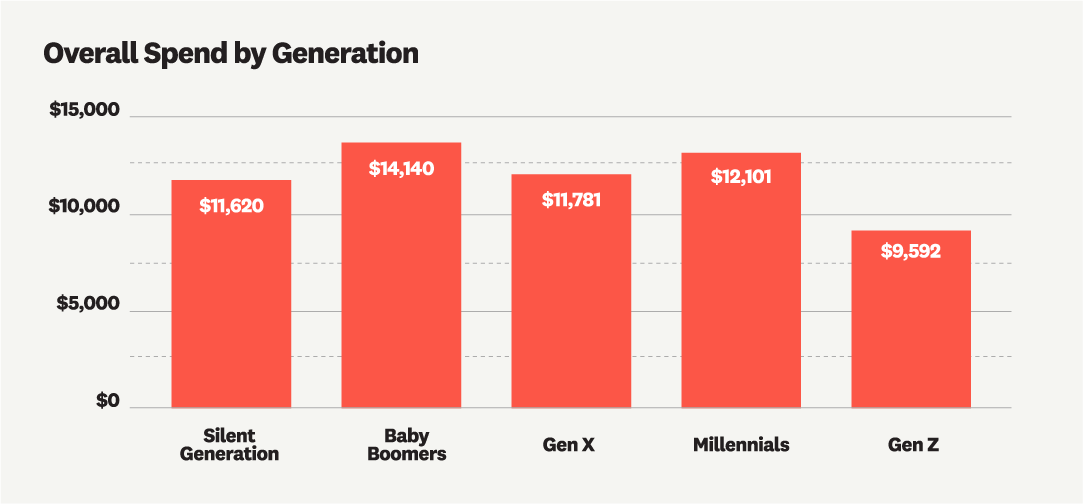

Generational differences in home spending reveal distinct priorities and patterns, shaped by age, income, and lifestyle. In 2024, Boomers led the way in overall spending, while Millennials focused on maintenance and younger generations handled the most projects.

Boomers Lead Home Spending: Boomers invested an average of $14,140 in home projects, the highest among all generations. They prioritized home improvements, spending $12,093—far more than any other generation—to enhance and upgrade their homes.

Millennials Prioritize Maintenance: Millennials stood out for their focus on home maintenance, spending $2,316—$1,000 more than the next highest generation. This reflects a practical approach to ensuring the longevity of their homes amid rising costs.

High-Income Households Drive Growth: Households earning over $150,000 increased their home spending to $21,958, up from $20,649 in 2023, demonstrating their ability to invest heavily in both improvements and maintenance.

Rising Costs and Younger Generations’ Concerns: 85% of homeowners believe the cost of owning a home has increased in the past year. This sentiment is especially pronounced among younger generations, who are navigating financial challenges while managing homeownership.

Emergency Spending Trends: Younger generations allocated more to emergency projects than any other age group. Gen Z spent $1,387 on average, while Millennials spent $1,329—over double what older generations spent. This may indicate less predictable maintenance patterns, lack of proactive upkeep and less homeownership experience.

Volume of Projects by Generation: Gen Z conducted the highest number of projects, averaging 10 per homeowner in 2024. Millennials followed closely with 9.3 projects, highlighting their hands-on approach to home management.

Part 4: 2025 Home Trends: Sustainability, Innovation, and Multigenerational Living

As homeowners look ahead to 2025, their plans reflect future-focused budgeting, and adapting homes to meet the needs of multigenerational households.

Future-Focused Budgeting: A majority of homeowners (54%) are actively budgeting for home projects in 2025, but a significant portion (25%)haven’t yet thought about budgeting. Interestingly, younger generations are leading the charge in financial planning for home improvements:

63% of homeowners aged 18-44 are actively saving for upcoming projects, compared to just 49% of those aged 65 and older.

Among those planning large investment projects, 45% have not begun actively budgeting despite their intentions.

Younger homeowners are more likely to explore alternative financing options, such as credit cards or refinancing existing loans, whereas older generations prefer to rely on savings.

Notably, 33% of homeowners aged 65 and older have not thought about budgeting at all, compared to just 11% of those aged 18-34.

Sustainability Gains Momentum: Sustainability continues to be a top priority as homeowners plan for the future. Upcoming projects highlight an emphasis on eco-friendly and energy-efficient upgrades:

Continued interest in solar panel installations and energy-efficient home improvements.

Outdoor spaces remain a key focus, reflecting the ongoing trend of integrating sustainable and functional designs into home exteriors.

Multigenerational Needs: The rise of multigenerational households is reshaping home design and renovation priorities. With 1 in 4 homeowners living in multigenerational households, these households are more likely to be taking on larger renovations and adding lifestyle-enhancing features to their homes.

Homeowners’ plans for 2025 highlight a clear shift toward modern and adaptable living spaces. Whether through strategic financial planning or innovative project choices, they are poised to make meaningful investments that align with evolving household dynamics and environmental goals.

Part 5: Despite Challenges, Homeowners Continue to Invest Strategically

Amid economic challenges, homeowners in 2024 demonstrated resilience and foresight, prioritizing thoughtful investments and long-term planning.

A Strong Outlook for 2025: Despite declining spending in 2024, 93% of homeowners plan to take on home projects in the coming year. The most anticipated projects include routine maintenance (36%), interior painting (22%), bathroom remodels (13%), flooring installations (13%), and new landscaping (12%).

Long-Term Planning: Nearly half of homeowners (46%) are looking beyond 2025, intending to tackle larger-scale projects over the next five years, such as kitchen remodels (31%) and bathroom upgrades (28%). These plans underscore a focus on enhancing both functionality and long-term value.

Renovation Over Relocation: With high interest rates and limited housing inventory, 67% of homeowners express a preference for renovating their current home to better meet their needs rather than moving. Among those who would like to move but are unable, 55% cite high interest rates as the primary reason for staying put, rather than the lack of available homes.

Time at Home Inspires Projects: Over half (54%) of homeowners report spending more time at home in the past year. Among those spending more time at home, 60% feel motivated to undertake more home projects, reflecting a renewed emphasis on making their spaces comfortable and functional.

This forward-looking approach highlights a trend toward strategic investments in home improvements, as homeowners continue to prioritize making their spaces more livable and tailored to their evolving needs.

Part 6: Home Project Spending Declines 12% in 2024, with Focus Shifting to Essentials

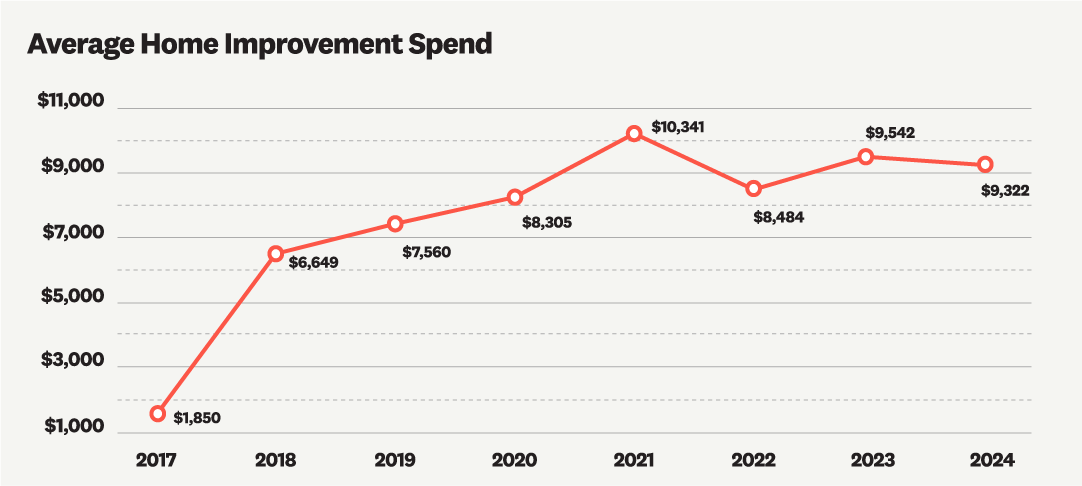

In 2024, homeowners spent an average of $12,050 on home projects, down from $13,667 in 2023. This shift reflects a reprioritization of spending, with essential upkeep and lifestyle-enhancing upgrades taking precedence over discretionary improvements.

Home Improvements: These remained the largest spending category, with an average of $9,322 per household, nearly steady compared to $9,542 in 2023. This flat spending reflects the "improve versus move" trend, as many homeowners chose to enhance their current properties rather than relocate in response to high interest rates and limited housing inventory. However, the average number of projects decreased from 2.9 to 2.3.

Home Maintenance: Spending fell to $1,750 in 2024, down from $2,458 in the previous year. On average, homeowners completed 5.6 maintenance projects, with landscaping (2.6 projects) and cleaning (1.4 projects) being the most common tasks.

Emergency Repairs: Spending on emergency projects dropped to $978 in 2024 from $1,667 in 2023. This decline suggests that proactive maintenance efforts are helping homeowners mitigate costly emergency repairs. The frequency of emergency projects also decreased, with homeowners completing an average of 0.8 projects, down from 1.5 in 2023.

Popular Projects: Routine maintenance, interior painting, installing new appliances, and bathroom remodels were among the most common projects undertaken in 2024, reflecting a focus on functionality and essential upkeep.

Discretionary Versus Non-Discretionary Home Spending: In 2024, more home projects were seen as non-discretionary this year than discretionary, highlighting a shift toward addressing immediate needs rather than pursuing purely aesthetic upgrades.

These spending trends reflect a cautious, but determined approach as homeowners adapt to economic pressures while continuing to invest in their most valuable asset–their home.

Methodology

The State of Home Spending report is based on an analysis of surveys fielded to 6,961 total individuals, between Nov 8, 2024 and Nov 18, 2024. The full sample consists of a survey of the general population (n=5,000) and a survey of homeowner households that completed a remodeling project in the last 12 months and hired someone else to do at least some of the work for them (n=1,961). The general population survey was post-sample weighted to balance it against general population statistics for age and gender to determine average spending and project volume. The homeowner survey used quotas for age and gender to ensure a representative sample of US homeowners. Unless otherwise noted, all statistics refer to homeowner households that completed an improvement project.