If you want to avoid unforeseen repair costs, it’s a good time to look at home warranties. Learn more about home warranty costs and if it’s right for you.

Avoid unexpected repairs and attract more buyers—a win-win

A seller’s home warranty can help avoid unexpected repair costs leading up to closing, ultimately saving you money.

The warranty normally transfers when you close, which makes your home more attractive to buyers.

A seller’s home warranty costs an average of $1,049, which includes a year of coverage for your buyer after closing.

Once your home is on the market, the last thing most sellers want to have to do is dump money into repairs on a home they’re leaving behind anyway. This is where a seller’s home warranty can come in handy. These warranties insulate you from those pesky last-minute repairs, and they can also make your home more attractive to buyers. We’ll discuss what this coverage is and how it benefits you to help you decide if you should buy coverage.

A seller’s home warranty is similar to insurance, but it covers home appliances and systems instead of your entire home. You’ll pay an annual or monthly premium to maintain coverage, and if something breaks down or needs repairs leading up to closing, you’ll pay a small service fee—often around $85. The local home warranty company will cover the rest.

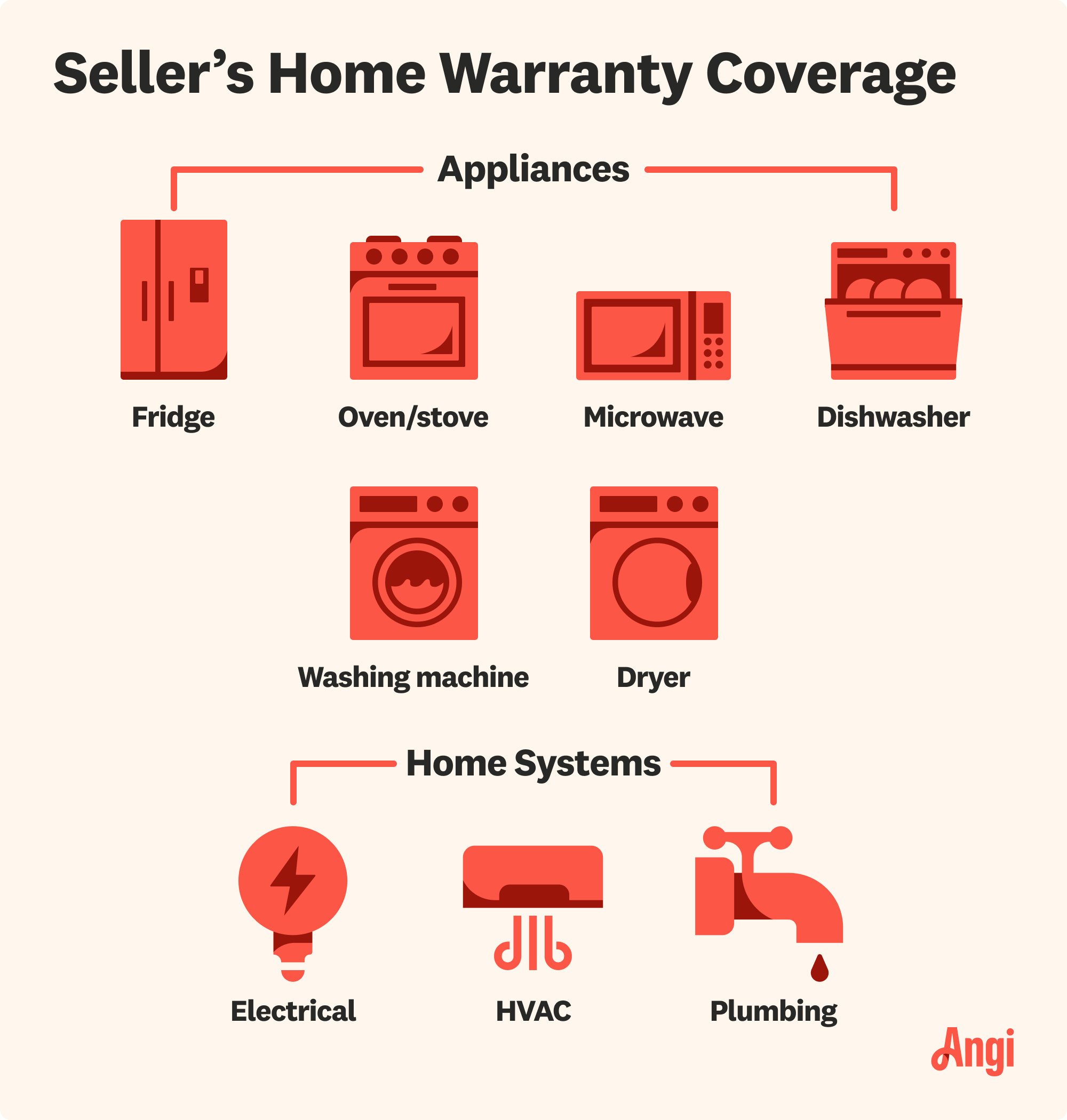

Home warranties cover appliances, home systems, or both. The coverage you get depends on the plan and provider you choose, with more comprehensive coverage costing more per year.

Many home warranty companies also let you customize your coverage with add-ons, which can include the following:

Pools and spas

Well pumps

Septic system

Septic pumping

Roof leaks

Sprinkler system

Central vacuum

And more

There are three main benefits you’ll see from buying a seller’s warranty when you list your home.

Since a seller’s home warranty promises to pay repair and replacement costs for covered items, you stand to save money if something goes wrong while your home is listed. The amount you’ll save will depend on the cost of the repair and the underlying issue, but savings could fall anywhere between $150 to several thousand dollars if you end up needing a new fridge or HVAC unit.

Even if you don’t end up calling on the warranty and saving money, you may find that a seller’s home warranty is worth it for the peace of mind it provides. You can rest assured that you won’t be on the hook for expensive repair costs leading up to closing. In many cases, your home warranty provider will hire technicians for you, so you won’t have the stress of having to find and vet professionals to conduct the repairs.

Finally, a seller’s home warranty can make your home more attractive to buyers because the warranty may transfer to them and insulate them from unexpected repair costs, too. Some buyers may even be willing to pay more for a home that includes a home warranty because it provides greater peace of mind, something that’s often sorely needed after paying a down payment and closing on a home.

A seller’s home warranty costs an average of $1,049, but you could spend anywhere from $220 to $1,900, depending on the provider you choose and what you want or need to be covered. Most home warranties last for a year, but you could see lower annual prices if you sign up for longer coverage.

You should also consider the service fee you’ll have to pay if you need to call on the warranty at any point, which averages around $85 per call but can reach as high as $125.

In most cases, yes, the seller’s home warranty will transfer to the buyer. However, it depends on the provider. Some companies will automatically transfer the coverage to the new owner, others may require you to file some additional paperwork, and some may not allow the transfer at all. Check your sample contract for specifics to make sure you understand your home warranty before buying.

From average costs to expert advice, get all the answers you need to get your job done.

If you want to avoid unforeseen repair costs, it’s a good time to look at home warranties. Learn more about home warranty costs and if it’s right for you.

If you’re looking to add a level of protection to your home’s appliances and systems (like plumbing), you may be considering purchasing a home warranty. Keep reading to learn about the various pros and cons associated with common home warranty plans.

A home warranty can be a helpful tool to make a real estate transaction go smoothly, but who pays for a home warranty? Learn who pays and why in this guide.

Home warranties can provide peace of mind and savings on repairs and replacements. Learn how long a home warranty lasts and how to extend one.