Drone roof inspection costs vary depending on the roof’s size, complexity, and material. Use this guide to budget for a drone roof inspection.

Appraisals focus on value, while inspections focus on condition

Appraisals determine the value of a property, usually to confirm that a mortgage lender is within loan-to-value ratio guidelines.

Inspections focus on the condition of the property and point out things that may require repairs after closing.

Appraisals are mandatory if you’re taking out a mortgage, and inspections are optional but always a good idea.

Buying or selling a home is a complicated process involving many moving parts, and home appraisals and home inspections are two different reports that are easy to confuse. Home appraisals are a necessity if there’s a mortgage involved, as they help ensure a lender isn’t overlending on a property. A home inspection is technically optional but gives you vital information about the condition and longevity of a property.

The point of a home appraisal is to determine what a property is worth. It takes comparable sales in the area into consideration, as well as the property’s condition, location, age, and overall desirability. Appraisals mostly confirm that a lender’s investment is protected. A home inspection is for the benefit of the buyer. It focuses solely on the condition of the property and aims to identify any active or potential problems that could demand repairs after closing.

| Home Appraisal | Home Inspection |

|---|---|

| Determines value | Determines condition |

| Necessary for loans | Technically optional |

| Affects negotiation | Affects negotiation |

| Around $350 | Around $350 |

| Wider scope | Narrower scope |

| Done by appraiser | Done by inspector |

One of the biggest differences between appraisals and inspections is how the professional assesses the home and what, specifically, they take into consideration.

A home appraiser will begin by inspecting your home from top to bottom to determine the condition of your roof, siding, foundation, and mechanicals, and they’ll also look at structural components, floor plan, and storage space. Appraisers look for anything that affects value. Old or damaged building materials, structural damage, fewer bedrooms or bathrooms than is normally desirable, and many other considerations can all affect your appraised value. Appraisal inspections take three to four hours.

Next, the appraiser will look at the surrounding area. They may lower the value based on an undesirable location, like on or near busy roads, close to airports or railroads, or under high-tension power lines. They’ll also see if your home conforms to the surrounding area, and they may lower the value if it’s near different zoning, like a residential property in close proximity to commercial or industrial real estate.

Finally, the appraiser will either look at recent comparable sales in the area, the income potential of the property, or other factors to complete their value assessment.

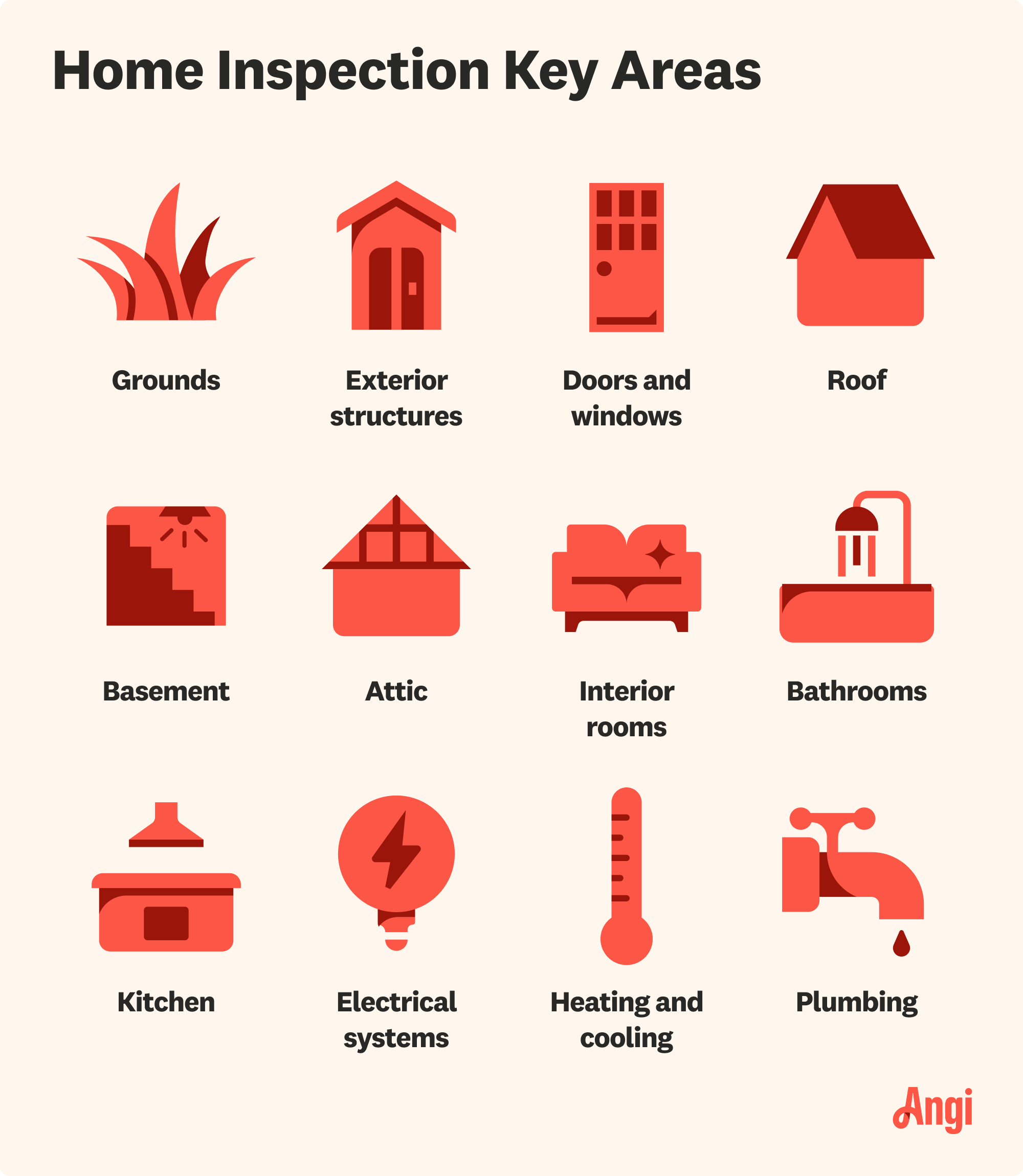

A home inspection focuses more on the condition of the property and anything that may demand repairs after closing. The process begins with a similar inspection, but the inspector will also consider the age, condition, and remaining lifespan of appliances, flooring, plumbing and electrical fixtures, and other finishes that an appraiser might not take into consideration. Home inspections take between three and four hours, in most cases.

Local home inspectors also look for safety concerns, like the presence of mold, asbestos, or lead paint in the home, evidence of pest infestations, missing handrails, missing GFCI outlets in kitchens and bathrooms, and more. Their home inspection checklist focuses more on condition than value.

A home appraisal costs around $357, on average, and prices can range from $250 up to $500. The cost of a home inspection averages around $340 and can range from $190 up to $510. The cost of these reports is similar in most cases, but keep in mind that you may need to pay for both when purchasing a home.

Appraisals and home inspections aren’t always technically required. While they’re often both worthwhile, even if they aren’t mandatory, the cases where you can skip each differ.

A home appraisal is required in any real estate transaction that involves a mortgage. The primary purpose of a home appraisal is for the lender to confirm the loan-to-value ratio and confirm that the collateral they’re using for the mortgage is worth within a certain percentage of the loan amount.

If you’re purchasing a home in cash, an appraisal isn’t required, but it’s still a good idea to confirm that you’re not overpaying for the property.

A home inspection is technically never required. Lenders will get all of the information they need from the appraisal report, so a home inspection only serves to benefit the buyer. In fact, some real estate agreements include a clause that states the buyer will waive their right to a home inspection, often in a highly competitive market, to secure a deal.

Keep in mind, though, that home inspections are always worth it, even though they aren’t required. They can identify major problems that could lead to significant repair costs for you down the road.

Appraisals and home inspections demand different professionals with different qualifications and training.

You’ll need to hire a certified home appraiser to conduct a home appraisal. In most states, there are specific training and certification programs an appraiser must go through.

It’s worth noting that the buyer often pays for an appraiser, but the lender is the party that chooses an appraiser they trust.

You’ll need to hire a home inspector to conduct a home inspection. Most states require that an inspector meet specific education requirements and pass the National Home Inspector Examination.

The buyer often hires and pays for a home inspection, although the seller may offer to pay to facilitate the deal.

The results of the two reports mean different things for the buyer and seller in a real estate transaction.

The results of a home appraisal or land appraisal can kill a deal if the value comes in too low for the lender to remain within acceptable loan-to-value ratios. Appraisals can also lead both buyers and sellers to renegotiate the sale price, even if they don’t interfere with the mortgage process. The only exception would be if the offer agreement documents include language that prevents renegotiation based on the appraised value.

A pre-list appraisal could direct a seller toward renovations that would maximize home value.

A home inspection report will tell a buyer exactly what they’re buying, as well as give them an idea of any repairs and repair costs they might face after closing.

In most cases, buyers will be the ones to renegotiate based on inspection results, asking for credits to carry out repairs post-closing, requesting a reduced sale price, or asking the seller to carry out the repairs before moving forward with the sale. The only exception would be if the buyer waives their right to a home inspection, which prevents renegotiating based on the results.

A pre-list home inspection could direct a seller toward necessary repairs before selling.

From average costs to expert advice, get all the answers you need to get your job done.

Drone roof inspection costs vary depending on the roof’s size, complexity, and material. Use this guide to budget for a drone roof inspection.

If you’re buying a home, having an inspection offers reassurance that it’s in good condition. How much a home inspection costs varies depending on the home's size, age, condition, and location.

Knowing the right questions to ask during a home inspection gives you a better idea of your home’s condition before you buy or sell.

Enjoy your view by ensuring the safety and longevity of your balcony. Use our balcony inspection checklist to monitor everything from railings to waterproofing.

Use this comprehensive mobile home inspection checklist to ensure your home is safe.

Protecting your home from severe wind is a big job. Keep your house and family safe from the elements with this handy wind mitigation inspection checklist.