Drone roof inspection costs vary depending on the roof’s size, complexity, and material. Use this guide to budget for a drone roof inspection.

It’s safety first when it comes to these required post-inspection home repairs

Home inspections uncover both mandatory repairs and nonessential fixes.

Some home repairs are required by state or municipal governments and lenders.

Payment for the repair costs can be negotiated between buyers and sellers.

Understanding which fixes are mandatory after a home inspection is a crucial step in closing a deal on a home. While many home inspection discoveries are cosmetic and nonessential, issues related to health and safety are taken much more seriously. Whether you’re a buyer or a seller, understanding the details of mandatory home repairs can save you time, money, and stress later on. In this guide, we’ll explain the top mandatory fixes you might need to make after receiving a home inspection report—ensuring your home sale or purchase goes as smoothly as possible.

In many cases, suggested repairs uncovered by a home inspector aren’t mandatory to complete the sale of a home. Plenty of houses are sold as-is, meaning it’s up to the buyer to decide whether to take the property in its current state—flaws and all. However, there are some cases where repairs are required, often by state safety regulations and lenders entrusting you with a mortgage. Mandatory home fixes can be broadly broken down into lending and government requirements.

Most home sales go through a lender. So unless you’re buying a home with cash, you’ll also need to deal with any fixes required by your bank or lending institution to secure financing. Different lenders and loan types affect the exact fixes you’re required to make, but some are more common.

Lenders may require you to address one or more of these issues:

Chemical hazards like lead-based paint or asbestos

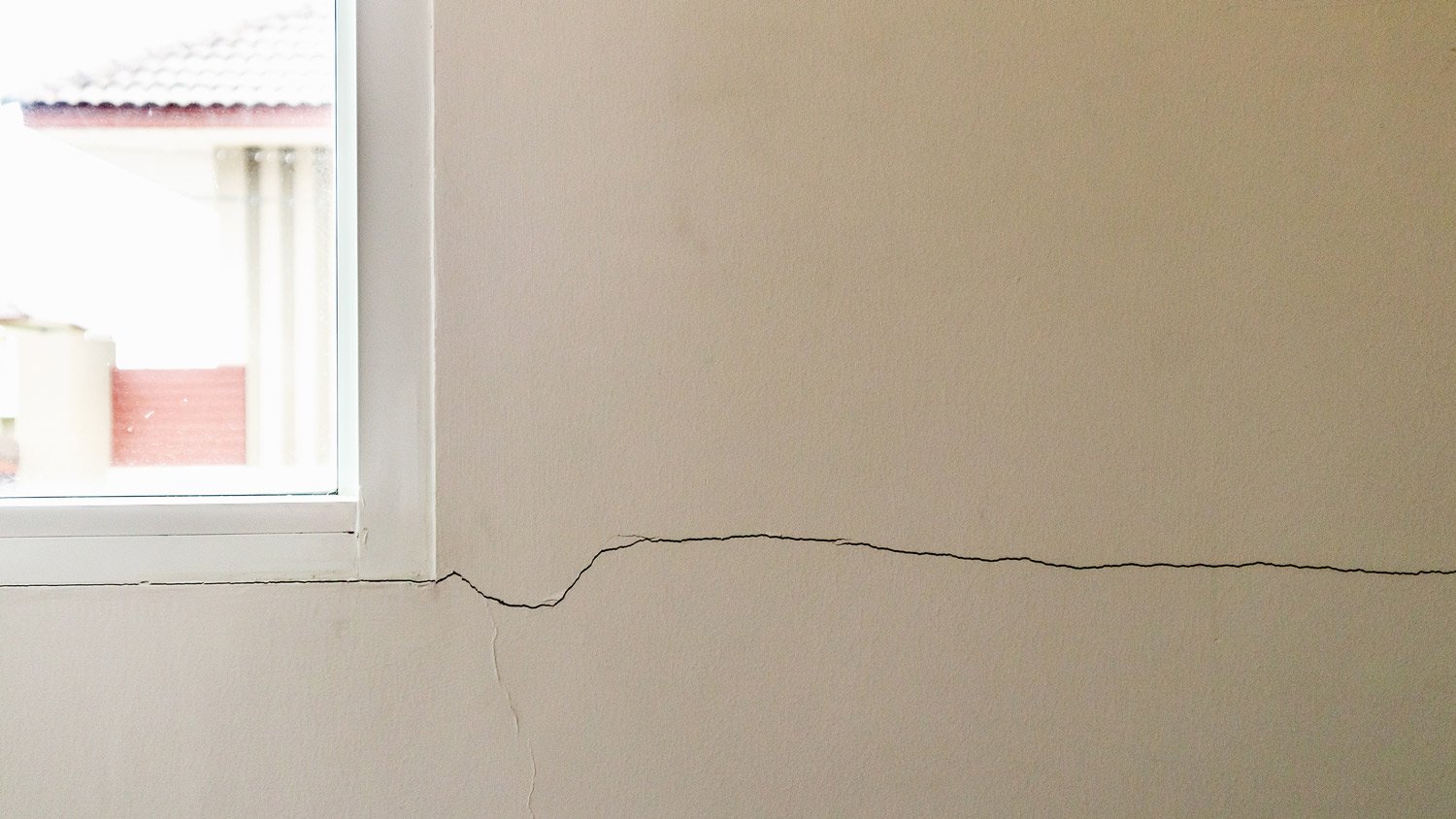

Structural defects (e.g., large foundation cracks)

Leaking or otherwise damaged roof

Damaged septic system

Old or damaged electrical

Outdated or damaged HVAC system

Pest infestations (e.g., termites, rats, etc.)

State and municipal governments aren’t normally concerned about the condition of a home being placed for sale. The exception, however, is in matters of safety—this is one of the top things that can fail a home inspection.

Radon is a very common, undetectable threat in homes, and it's not checked for in standard home inspections. A typical home inspection also won't check for other hazardous materials such as asbestos, radiation, formaldehyde, methane, and other substances. Many home inspection services will check for these hazards for an additional cost.

Exact requirements vary drastically from place to place, but there are a few common ones:

Installing or updating smoke alarms

Installing carbon monoxide detectors

Updating plumbing to current codes

Installing a seismic shutoff valve on your water heater

Redoing and/or paying a permit fee for prior work that isn’t up to code

Generally speaking, any issues with a home that are considered cosmetic or otherwise not related to livability are nonessential in the eyes of the government and lenders. Nonessential repairs might be big issues, but the seller still doesn’t have to fix them if they don’t want to.

Examples include:

Cracked floor tiles

Worn carpets

Uneven floors

Missing or damaged handrails on stairs

Rotting or warped wood on countertops and cabinets

Cracked or discolored concrete

Outdated or old appliances in need of repair

After an inspection, the home inspector will inform the buyer and the seller of all required and nonessential repairs they’ve discovered. No matter what repairs are suggested, it’s completely up to the buyer and seller to negotiate who will pay for them. With that said, sellers are typically expected to pay for the bulk of required repairs.

As a buyer, you can simply negotiate a price drop and arrange for the repairs yourself, which includes choosing a professional and scheduling it. On the other hand, you can leave it up to the seller to make the repairs if they agree, but you won’t have any say on the professionals they hire or other specifics of the work.

Depending on the contract in place, sellers may be able to refuse to make certain repairs. But in some cases, the contract will have a clause that requires the seller to foot the bill for major health and safety issues discovered by a home inspector. In any case, refusing to make required repairs can easily lead to lenders pulling financing or buyers backing out of a deal.

As a seller, experts recommend that you plan to spend between 0.5% and 1% of the home’s listing price on repairs. As a buyer, be prepared to foot the bill for the home inspection cost and let small, cosmetic repairs go in favor of repairing more serious issues with a property.

Whether you’re buying or selling, working out a plan for potential repairs ahead of time with a trusted real estate agent is helpful. Knowing in advance how much you’re willing to pay for repairs on the right home will help make the deal close more smoothly. Start making your home-buying plan a reality by finding the best local home inspector for you.

From average costs to expert advice, get all the answers you need to get your job done.

Drone roof inspection costs vary depending on the roof’s size, complexity, and material. Use this guide to budget for a drone roof inspection.

If you’re buying a home, having an inspection offers reassurance that it’s in good condition. How much a home inspection costs varies depending on the home's size, age, condition, and location.

Even though you may be able to get home insurance without one, an inspection is usually worthwhile. Learn more.

Who to call to identify a smell in your home depends on the type of smell. While a home inspector is the go-to, you may actually want to hire someone else.

Thinking about buying a condo? Use this comprehensive condo inspection checklist before you seal the deal.

In this guide, learn about the many things you need to cross off your rental property inspection checklist to comply with local regulations.