Get a detailed breakdown of thermal imaging home inspection costs, including average prices, cost factors, and tips to help homeowners budget.

Don't let the cost of your monthly utility bills catch you by surprise

As a homeowner, there's nothing worse than receiving your monthly utility bill only to realize it’s higher than you anticipated. The average cost of house utilities varies based on many factors, including your home’s location, energy usage, home size, and the age of your appliances.

Whether you’re moving to a new state or learning more about how your utility expenses stack up to other homeowners in your area, our guide has got you covered. Read on to find out which states you'll pay the most (and the least) for basic utilities.

While some homeowners consider streaming services a monthly essential, utilities refer to electricity, water, natural gas, internet, and cable. In some cities and states, home services like garbage and sewer are also charged as utilities.

The calculations we used to find out which states have the highest and lowest utility costs only include electricity, water, natural gas, and internet and cable.

Methodology: To understand the cost of various utilities, we pulled data from several publicly available sources.

Electricity costs were derived from the U.S. Energy Information Administration. To calculate monthly costs, we used information that included the average cost of electricity in each state and the average monthly electricity consumption.

Average monthly and annual water costs were determined using Dripfina’s 2023 Report on the Average Monthly Cost of Water by U.S. States.

Internet and cable costs were identified using Doxo’s 2021 U.S Cable and Internet Market Size and Household Spending Report.

Monthly and annual natural gas costs were calculated using average gas prices and usage amounts from the U.S. Energy Information Association.

The 2022 Census on Median Household Income in the U.S. calculations were determined using the 2022 Census Bureau Income Report.

If you live in Hawaii, New Hampshire, Connecticut, California, or Alaska, you're likely used to paying a premium for your basic utilities (among other things). Did you know you're paying an average of $100 to $200 more per month than homeowners in the states with the lowest utility costs?

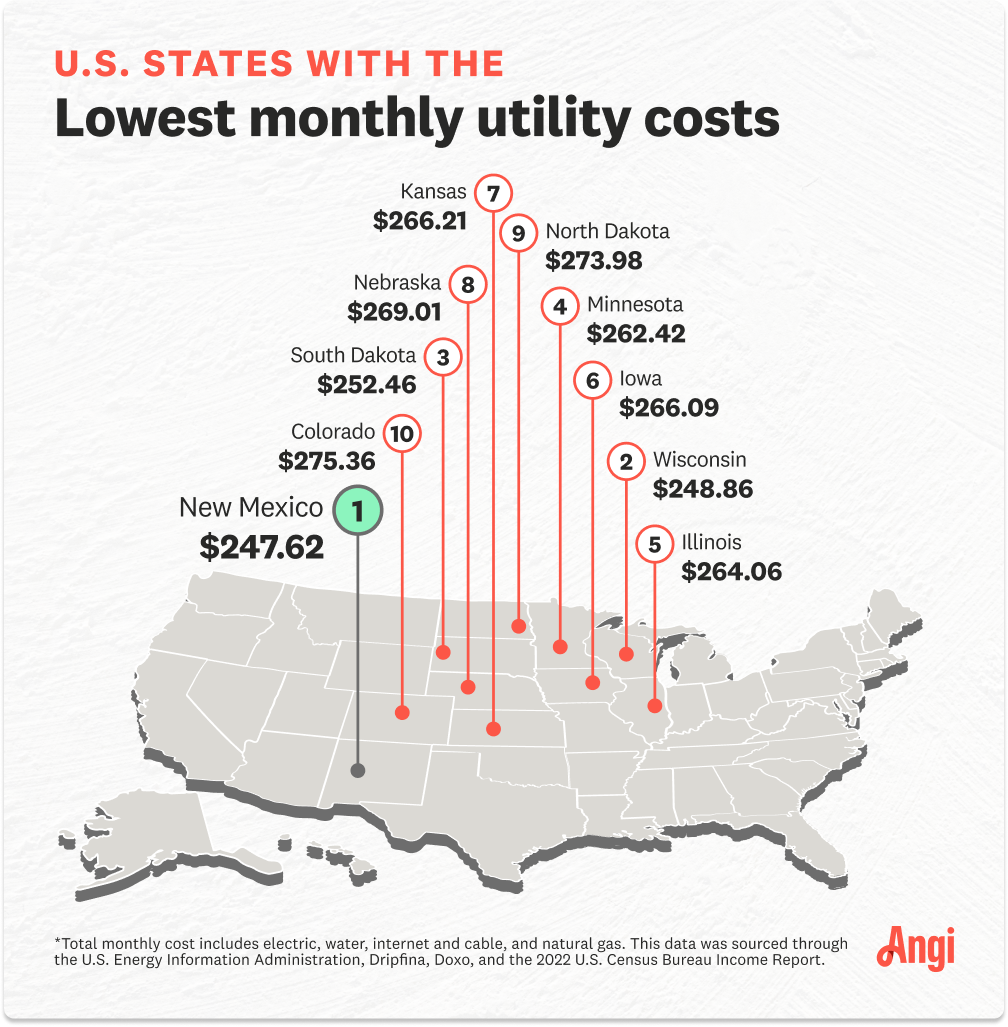

If you live in Colorado, New Mexico, Iowa, or Wisconsin, you’re paying less for monthly utilities than homeowners in other states. Homeowners in New Mexico (the lowest-costing state for utilities) save an average of $2,327 per year compared to their counterparts in Hawaii, which is the highest-costing state for utilities.

There are clear reasons why the overall cost of utilities varies from state to state. Let’s review why prices for electricity, water, internet, and cable, and natural gas fluctuate based on where you live.

Electricity fluctuates the most based on location, with monthly costs averaging $214.24 in Hawaii and $89.95 in New Mexico. Prices vary per state because of factors like local fuel costs, availability of fuel, power plants, and state and local regulations.

For example, in Hawaii, the state with the highest electricity costs, prices are high primarily because most of the electricity is generated with costly imported fuel.

If you’re paying more for electricity than you’d like, there are several ways to lower your electric bill, including upgrading to energy-efficient appliances, weatherizing your home, and adding a smart thermostat.

Monthly water bills range in cost from $21 per month in Wisconsin to $105 in West Virginia. Water costs vary based on each region’s access to fresh, self-renewing water sources and local regulations on usage and billing.

Generally, areas with easier access to water offer lower water costs, while dryer areas have higher costs. While reducing your water usage can certainly help you lower your water bill, if it’s surprisingly high, you might also want to check for water leaks.

The internet may not have been considered a utility in the past, but we all know how essential it is for work, learning, entertainment, and connecting with friends and family in today’s era.

Internet and cable costs range from $95 per month in South Dakota to $156 per month in Delaware. Local markets largely impact these prices rather than true infrastructure costs.

Natural gas ranges in average cost from $6.51 per month in North Dakota to $45.30 per month in Hawaii. While a relatively low bill, there's still quite a difference depending on where you live.

Like other utilities, natural gas prices are impacted by the local retail climate, operating costs, local taxes and regulations, and the distance each area is from the natural supply. Hiring an energy auditor can help you identify ways to save on your natural gas bill each month.

From 2022 to 2024, the average median household income rose from $64,963 to $74,580. Unfortunately, we’ve also seen the price of household utilities increase. The average annual cost of utilities has risen $293.30 in two years, with electricity experiencing the most significant increase.

Additionally, some notable states that have had significant changes in total monthly utility costs:

West Virginia: $106.84 more expensive than 2022

Oregon: $94.51 more expensive than 2022

Wisconsin: $34.58 less expensive than 2022

Oklahoma: $22.45 less expensive than 2022

No matter where you live, cutting the cost of monthly utility bills is often a high priority. Although you can’t unsubscribe from electricity and water services like you would streaming services, there are a few ways to lower your costs:

Servicing your AC yearly: An annual AC tune-up can save money on your electricity bill, as unserviced air conditioners become 5% less efficient every year.

Finding a water leak: Identifying and resolving household leaks can help minimize unnecessary water usage.

Installing energy-efficient windows: Adding or replacing current windows with energy-efficient models can lower your energy bills by keeping the air inside your home comfortable.

Inspecting your insulation: Hiring an insulation pro near you inspect your insulation to determine whether you need to replace it can help maintain your home’s ideal temperature.

If your state isn't one of the top 10 least or most expensive, you might wonder how it stacks up. Check out the list below to find out whether residents in your state are paying more or less than most other U.S. households.

From average costs to expert advice, get all the answers you need to get your job done.

Get a detailed breakdown of thermal imaging home inspection costs, including average prices, cost factors, and tips to help homeowners budget.

Discover the average home energy audit cost, what impacts pricing, and how to save money on your audit. Get transparent, expert-backed cost info for homeowners.

A home energy audit is a detailed write-up of how to lower your utility bills and increase your comfort level. Find out if they’re worth the cost.

Home energy audits can identify ways to make your home more energy-efficient. Learn whether an energy audit is a good investment for your home.