Need a new roof in the city that never sleeps? Learn about metal roof costs in New York to see if this durable roofing material is within your budget.

There are some perks to sharing your estimate with a pro

An insurance estimate highlights the scope of repairs.

Showing your contractor your estimate can make the process go more smoothly.

Knowing when to show your insurance estimate is important.

It’s up to you whether you want to share your estimate.

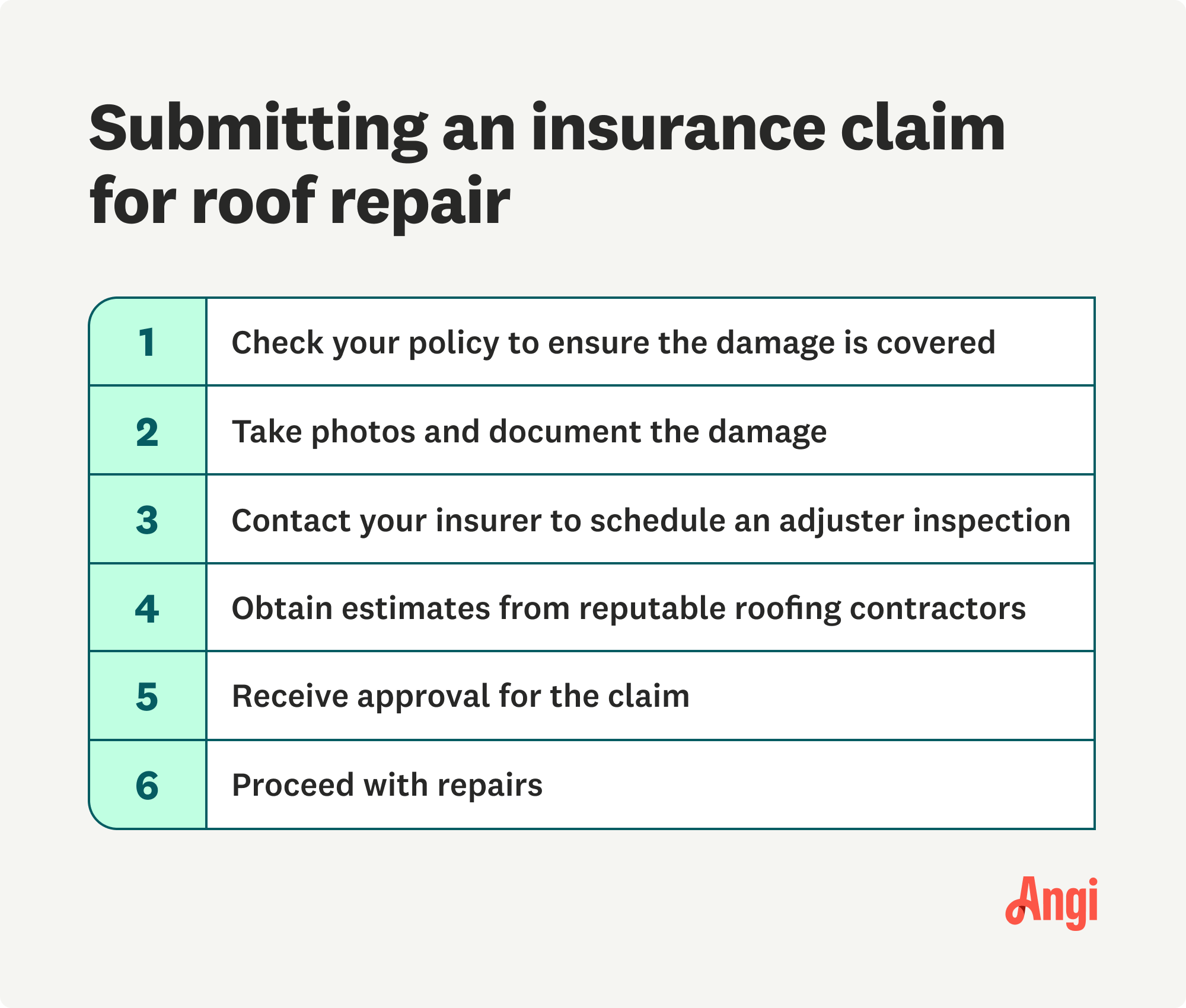

Wondering what to do next after your home sustains damage is normal—but hopefully, it's not something you'll have to deal with very often. The first step is to get started on the repair solution as soon as possible. While making an insurance claim is usually a relatively straightforward process, the question, "Should I show my contractor my insurance estimate," doesn't always have a straight answer. Here's how and when to share the information with your roofing professional.

After covered home damage happens, you'll need to obtain an insurance estimate for the expected repair costs. The estimate you receive will include numerous items and the correlating prices the insurance company is willing to pay.

Below is a list of the things included in your insurance estimate. Depending on your insurance company and the policy you hold, you may see some different items and expected costs for each one on your estimate.

Demolition, disposal, and site preparation costs, if necessary

Cost of replacement materials

Appropriate permitting and inspection prices based on rates in your municipality

Estimated labor costs that a contractor is likely to charge for the repairs

Additional necessary repair costs, including extra work that needs to happen in order to complete the primary repairs

Your estimate will also contain a description of the damage and a repair assessment, including the anticipated scope of work.

For example, your insurance company will send an adjuster to perform a roof inspection for a roof damage insurance claim. The resulting estimate will likely list the roof replacement costs broken down into materials, labor, profit, and soft costs, such as permits, additional repairs, and contingencies.

While it may seem counterintuitive to tell your contractor how much your insurance company is willing to pay, in many cases, showing them the estimate after the contractor provides one is beneficial for all parties involved.

Home insurance companies must control spending to remain profitable while you need your house fixed without breaking the bank. Your roofer also needs to make a profit while providing its customers with excellent service and high-quality repairs.

Here are the benefits of allowing a reputable contractor to see your insurance estimate:

Sharing allows the contractor to see what is and isn't included in the insurance estimate and make adjustments if necessary.

It can help the contractor negotiate for a better claim amount in the case of significant discrepancies.

It provides the contractor and insurance company a means of working together to repair your home.

It allows you to have a voice in your insurance claim.

It protects all parties from inadvertently engaging in insurance fraud.

For example, your insurance adjuster may or may not include the cost of soffit and fascia materials in a roof repair estimate. The exclusion may be due to missed details or because your policy doesn't include those items for the type of repair necessary. Your roofing contractor can identify the situation and either exclude the repair or negotiate with the insurer to include the additional costs.

On the other hand, there are some situations where it might be beneficial not to show your estimate.

If you’re able to estimate the cost of replacing your roof yourself and find that the insurance estimate far exceeds it, showing your contractor first might lead them to inflate their costs to get closer to the approved coverage amount. Reputable contractors won’t do this, but there’s always a chance that yours will. You’re under no obligation to use the insurance check for repairs, so a more affordable repair could mean some extra money in your pocket.

If your estimate comes in significantly lower than what you believe the work will actually cost, showing your contractor the estimate first could lead them to source more affordable but less durable materials to get their total under the coverage amount. In that case, it’s best to get a quote for the roof repair or replacement first and then share the insurance estimate. Doing so could lead your roofer to negotiate the coverages on your behalf.

While the vast majority of roofing contractors are honest and reputable business entities, homeowners need to remain vigilant against shady companies out for a quick buck. One way to protect yourself is to have your candidate roofing company provide an estimate of its own before revealing details of your insurance estimate.

After the contractor provides an initial estimate, you can share the insurance adjuster's estimate and negotiate any discrepancies or allow the roofer to negotiate the claim with your insurer for you.

Of course, there are exceptions to the rule. In an emergency, you may not have time to go back and forth between the contractor and your insurer for several days. In that case, you may need to hire a local roof repair company to seal up damage quickly to prevent more problems. Showing them the insurance estimate for that portion of the work can expedite the immediate repair. You can then take your time identifying the best contractor to replace the roof for a more permanent solution.

Exercise caution in these types of emergencies, and be sure not to sign an agreement with the roofer that includes the entire repair project, and pay your roofer only you receive the insurance check and work is completed.

It's never mandatory to show a contractor your insurance estimate, and early in the process of choosing a repair company, it may not be a good idea. However, after selecting a contractor, receiving an estimate, and before signing a contract, it's good practice to compare the insurance estimate against the restoration company's estimate to ensure your financial safety.

You don't need to use the insurance-suggested contractor to perform repairs under a claim. However, there may be times when doing so is most beneficial to you. Contractors that partner with specific home insurance providers are well-equipped to handle the repairs quickly in an emergency while minimizing the time it takes to make a claim.

On the other hand, using our earlier roofing repair example, if your metal roof is damaged in a storm, your insurer's recommended contractor may or may not be skilled in performing the task or aware of additional metal roof costs that need inclusion in the insurance estimate. In these cases, hiring your own contractor who is experienced in metal roof installation is often your best bet.

Regardless of the timing or scope of work, you're free to choose your own roofer to repair the home independent of your insurers' recommendations while still expecting reimbursement for the project.

Exceptional quality of work, customer satisfaction oriented. I wanted to do interior work and was so impressed I asked for shingle roof and siding work on my home also, which came out very great. Any questions and concerns, Galaxy contractor answered my questions. Thank you guys.

I received the perfect roofing service from Top Roof Contractor. It has been very pleasurable experience working with the guys. I would like to thank them here as well for the amazing job they have done with replacing the roof of my house!! Thanks

Excellent overall, very efficient and professional. The owner Chuck addressed an issue immediately after the roof was installed. Would highly recommend.

Professional, courteous and great quality. Would hire the team again.

From average costs to expert advice, get all the answers you need to get your job done.

Need a new roof in the city that never sleeps? Learn about metal roof costs in New York to see if this durable roofing material is within your budget.

Learn about average roof repair costs in New York City and what factors can affect your total to set your budget appropriately.

A new roof boosts curb appeal and home value and keeps your property protected. Learn about roof replacement costs in New York City to budget accurately.

Your home's new tin roof cost will depend on several factors, including its size, materials, style chosen, complexity, and added options.

An attic without proper ventilation can cause a number of roofing problems, inside and out. Here’s how you can tell if a poorly ventilated attic is wrecking your roof.

This guide lays out the cost to install a roof vent on your home depending on the type of ventilation that's best for your roof based on several factors.