Soffit replacement costs depend on multiple factors, like length, accessibility, and material. Learn about the cost factors to budget more accurately.

Don’t get swept away with worry after a storm

Homeowners insurance often covers roof damage due to severe weather.

Take photos to document damage and keep receipts for hotel stays and temporary fixes.

File the claim ASAP and expect to wait for an insurance adjuster to inspect the damage.

Once approved, you’ll get a reimbursement check within 30 to 60 days.

If insurance denies your claim, you can appeal.

When severe weather hits, your top priority is to keep yourself and your household safe. But after the storm rolls through, it’s time to assess the damage. If your roof suffers damage in a storm, your homeowners insurance will likely cover the costs. But how does a roof damage insurance claim work, and how can you get reimbursed for repairs?

Keep reading to learn about filing a roof damage insurance claim after bad weather.

It’s important to study up on what coverage your homeowners insurance provides well before a storm hits. Each company and plan differs, so thoroughly read any documentation your insurer provided. Some good news, though: roofs fall under the “dwelling coverage” portion of your plan, meaning repairs are almost always covered. Here are some things to think about if you are filing a claim to build a new roof or hire a local roofer to make repairs.

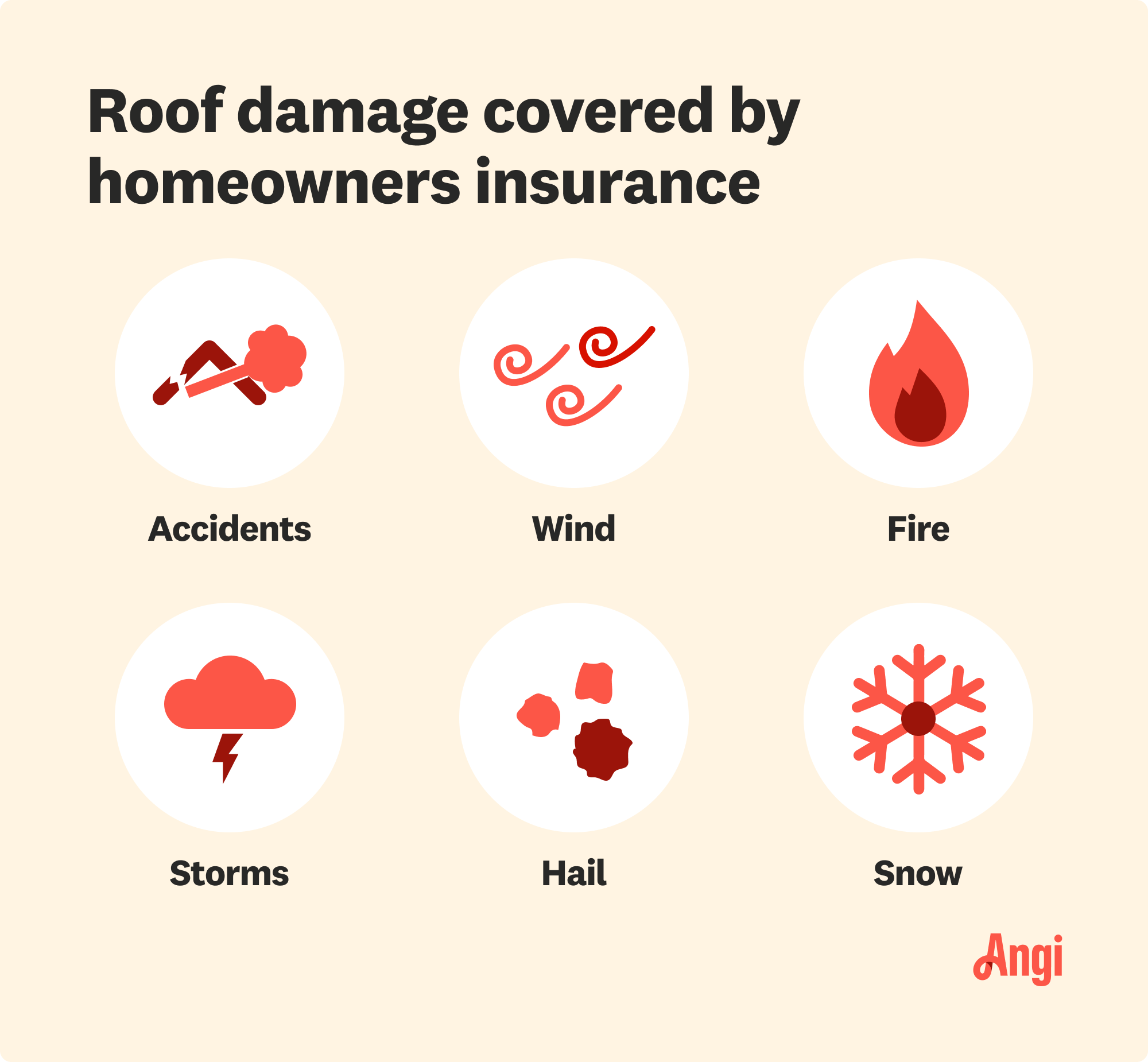

Most policies cover accidents, including wind, fire, storms, hail, and even snow.

An insurer could replace your whole roof even if it is only partially damaged. It all comes down to how severely the storm or related event shortened the roof’s life span. An adjuster makes that decision.

Your insurer may replace your entire roof if repair materials are not readily available.

Some plans only offer “actual cash value” for wind and hail damage, meaning the current value of the roof post-damage (rather than what it was worth before the damage).

Pros recommend homeowners have a “replacement cost value” (RCV) instead of an ACV policy. This is something you need to get before storm damage happens.

Insurance companies must let you choose your own contractor to make repairs. In other words, they can’t tell you who to hire; they can only make suggestions. You have the right to hire whomever you want to repair your roof.

If you don’t regularly clean and maintain your roof, the adjuster could refuse a full reimbursement.

Certain causes of roof damage are not covered by home insurance, including damage from earthquakes and floods. However, you can often buy additional flood and/or earthquake insurance if you live in a region that’s prone to these events.

Home insurance also doesn’t usually cover damage from lack of maintenance or normal wear and tear, so it’s important to perform regular maintenance on your roof to avoid additional costs from these things. Cosmetic damage from hail isn’t likely to be covered either.

Here are the most common factors that affect your roof damage claim. It’s important to note all of these points before rushing out to contact your insurance company.

Number of Claim Files in 1 to 5 Years: Your insurance company can raise your premium if you file more claims than the typical number. People who file too many claims risk increased premiums and possible cancellation.

Your Deductible: Consider the approximate amount of the repair versus your deductible before filing a claim. If the repair cost is close to your deductible, you should consider paying for the expenses out of pocket if it’s worth having fewer claims on your record.

Severity of Your Roof Damage: Before filing a claim with your insurance company, conduct a roof inspection to determine whether your roof damage is cosmetic or structural. If the damage is cosmetic—like superficial damage to your soffit and fascia materials—it may be better to pay for the expenses out of pocket when your budget allows it.

How Much Your Roof Is Worth: Your policy covers your Actual Cash Value of the roof or the Replacement Cost Value. If your roof is newer, it’s worth more than if it’s nearing the end of its life span. After all, wear and tear isn’t covered under insurance. You’re also expected to follow maintenance schedules to keep your roof in tip-top shape. If your roof is close to the end of its life span, you may not have a strong case when filing a claim.

Your Advisors: Hiring a reputable roofer who knows how to work with insurance companies can work in your favor. In particular, you can have a professional roofer present when the insurance adjuster makes their visit. That way, the roofer can help point out all the signs of damage so the adjuster doesn’t accidentally miss anything.

Here are the steps you should take to file a homeowners insurance claim for roof damage.

First, assess the damage once the storm is safely behind you. Take photos and document any damage you see.

Review your insurance policy to make sure the damage is covered and get an idea of how much your policy may pay out.

Next, contact your insurance company as soon as possible. If you can’t remember your provider’s contact information, call your mortgage company.

Once you initiate the insurance claim, your provider will send an adjuster or a roof inspector to assess the damage. These technicians work with the insurance company and the roofing contractor to determine how much of your claim to reimburse.

The adjuster or inspector assesses roof damage with photos and documentation that, ideally, matches your personal records.

Jot down the adjuster’s name for your records and ask any questions that come to mind. The insurance adjuster has the final say regarding claim approval or denial, but they can make mistakes. Most companies offer a robust appeal process that starts by asking for a second adjuster or hiring your own public adjuster.

Make any temporary repairs necessary to avoid further damage.

“If you have a contractor you would like to use, it can be very helpful to have them present when the insurance adjuster comes to look at the damage,” says Feller. “This way, both parties can come to an agreement on what the damage is and what the scope of the project will be in order to make the repairs.”

Here are some more helpful tips for filing an insurance claim.

Document everything: Document damage for an insurance claim by taking photos of everything. Keep any documentation provided by emergency workers. Keep receipts for food and hotel stays if your home is unlivable.

Avoid major repairs until approved: If possible, don’t hire a contractor for major repairs or a total roof replacement until the insurance company has approved an affirmative claim. You can hire a roofing repair pro near you to make small repairs and tarp the impacted area while you wait.

Get estimates: Collect at least three roof repair estimates, then compare prices, reviews, and estimates before booking the best pro for the job.

“If you are unsure if you have damage, sometimes it is best to ask a contractor to come assess the situation before you open up a claim on your homeowners insurance,” says Ami Feller, Expert Review Board member and owner of Roofer Chicks in New Braunfels, TX. “Some insurance companies will count the claim against you, and if you do not have any damage, you do not want the open claim. Make sure you hire an honest contractor whom you trust for this assessment.”

Expect an approval or denial within a week to ten days after the adjuster inspects the damage and then 30 to 60 days to receive a reimbursement check. But the timing depends on various factors, including the type and severity of the damage, how busy the company is dealing with other claims, adjuster availability, and how quickly you make a claim.

Some state laws require reimbursement checks to be received within 30 days of settlement, so check with local regulatory agencies.

The majority of homeowners report that they want to schedule roof repairs within two weeks, closely followed by a demand for urgent repairs within one to two days. When filing an insurance claim for roof damage, be sure to maintain contact with your insurance company and your roofing pro to stay on track.

According to the Insurance Information Institute, home insurance companies pay an average of $13,000 for wind and hail home insurance claims. The following table outlines common causes and home insurance claim amounts.

| Cause | Average Home Insurance Claim Amount |

|---|---|

| Fire and lightning | $83,519 |

| Bodily injury and property damage | $31,663 |

| Wind and hail | $12,913 |

| Water damage and freezing | $12,514 |

| Medical payments | $10,179 |

Filing a claim for roof damage could possibly raise your insurance premium, but multiple factors go into that decision. Is this roof damage claim the only time you’ve made a significant insurance claim in the past few years? Your premium will likely stay the same. Have you made several claims within the last three years? You might experience an increase. An algorithm typically sets premium rates; factors include the cause of the claim, the total cost of the claim, and where you live.

If you live in an area often hit by storms, your rates will likely increase overall.

If your insurance denies your roof claim, the first thing you can do is file an appeal. An independent insurance adjuster will check out your roof to see if you qualify for coverage or if your insurance company was correct in denying your claim.

Since roof repair or replacement isn’t something you can put off, you should secure funding for it if it turns out that you need to pay out of pocket. Roof replacement costs $9,150 on average, and although some very experienced DIYers may be able to learn how to replace a roof, it’s a job better left to the pros. Hiring a pro ensures the job is completed correctly and safely.

If you believe you have a strong case, consider consulting with a lawyer. You can also escalate the issue to upper management to get more information about your claim or file a complaint with the appropriate local government office.

From average costs to expert advice, get all the answers you need to get your job done.

Soffit replacement costs depend on multiple factors, like length, accessibility, and material. Learn about the cost factors to budget more accurately.

Roof trusses are the literal backbone of your roofing system, and replacing one can get costly. Use this roof truss cost guide to set your budget properly.

Discover how much it costs to install a drip edge, exploring how factors like your roof’s size, height, and layout affect your final costs.

If you need a new flat roof, learn about tar and gravel roof costs and what can affect your total to make sure you budget accurately.

With so many different types of roofs, it’s important to know the pros and cons of your roof’s style. Learn about 14 common roof types and how they measure up.

Roof sheathing is another name for the strong layer of wood boards that are attached to your roof’s framing. Learn how much roof sheathing costs in this guide.