How to Finance a New Roof: 7 Options to Consider

Replace your roof without breaking the bank

On average, a new roof costs $9,500.

Some financing options are tied to credit score—others require equity as collateral.

Financing options may include additional fees.

Consider your initial budget and your ability to make monthly loan payments before deciding.

A new roof can put a serious dent in your budget. If you don’t have the cash on hand to pay for a new roof outright, you’ll want to look into roof financing options. There are a few different ways to finance a new roof, and knowing more about each choice can help you make the right decision. Find out more about seven popular roof financing options and how to choose the best one for your budget.

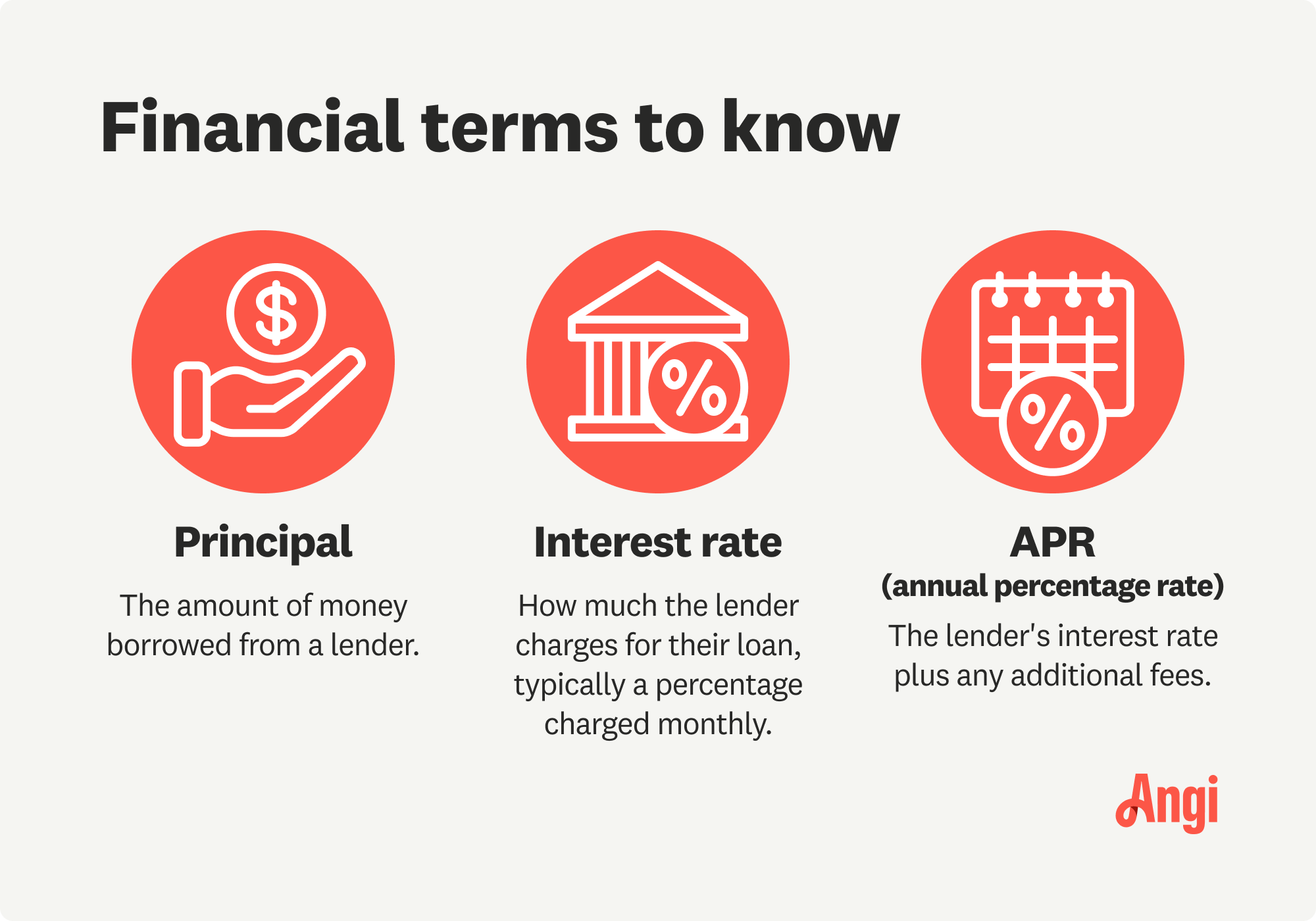

Similar to other financial agreements, your roofing financial documents will include some or all of the following terms.

1. Personal Loan

Perhaps the most flexible type of financing, a personal loan allows you to use the cash for almost anything, including a new roof. The amount of cash you can get for a personal loan varies by lender and based on your credit score, but most personal loans have minimum borrowing amounts of $1,000. The approval process is quick, so this is a good roof financing option to consider if you need to replace your roof in a hurry.

Personal loans don’t require equity, so they come with higher interest rates than home equity loans, HELOCs, and several other roof financing options. The loan will also have an origination fee.

| Pros | Cons |

|---|---|

| Flexible | High interest rate |

| No collateral | Based on credit only |

2. Home Equity Loan

A home equity loan is a second mortgage that uses your equity as collateral. This is a secured loan, which often means lower interest rates and a simpler approval process. However, if you default on home equity loan payments, you could end up in foreclosure rather than just ruining your credit.

Home equity loans can have lower interest rates but can take longer to hit your bank account relative to options like personal loans.

| Pros | Cons |

|---|---|

| Low interest rates | Not flexible |

| Easy to qualify | Equity as collateral |

3. Home Equity Line of Credit (HELOC)

A home equity line of credit, or HELOC, is a revolving line of credit. Similar to a credit card, when you have a HELOC, the lender gives you a maximum amount to borrow based on the equity you have in your home. You can borrow up to that amount or less, depending on your needs. Once you pay the HELOC down, you can once again borrow against the limit. Unlike a credit card, you will need to put your home up as collateral.

| Pros | Cons |

|---|---|

| Easy to qualify | Not flexible |

| Low interest rates | Equity as collateral |

4. Credit Card

Depending on your credit score and the speed at which you can pay back your financed amount, paying with a credit card could be a viable roof financing option. In fact, if you have very good or excellent credit, you may even qualify for a 0% interest promotion, where you do not have to pay interest on the balance of your card for up to 18 months in some cases. If you can manage to pay down the balance of the card within the promotional period, it is essentially an interest-free loan. If you can’t, though, or you’re not eligible for that introductory period, credit cards normaly have the highest interest rate of any roof financing option.

| Pros | Cons |

|---|---|

| Easy to qualify | High interest rate |

| No collateral | Based on credit only |

5. Roofing Company Financing

When you hire a roofer to replace your roof, some contractors may offer their own form of financing. Typically, a roofing company will work with a third party to provide home improvement financing. Roofing contractors may get kickbacks from the financier, so you may enjoy a slightly lower roof cost. Contractor financing will be tied to your credit history, just like a personal loan would be, not to the equity in your home like a HELOC.

Similar to unsecured loans, such as a personal loan, working with a roofing company to finance your project can mean variable APRs, origination fees, and more. This, however, can be a good option to pay your roofer for homeowners who may have a hard time getting financing somewhere else.

| Pros | Cons |

|---|---|

| Easy to qualify | Moderate APR |

| No collateral | Based on credit only |

6. Cash-Out Refinance

A cash-out refinance means replacing your current mortgage with a new one that covers only what you still owe on your original loan. You get the equity as cash, which you can then put toward your new roof.

A cash-out refinance can be a good idea when interest rates are lower than the interest rate on your mortgage. However, a cash-out refinance can take a while to process, so it might not be the best option if you need to replace the roof urgently.

| Pros | Cons |

|---|---|

| Potential lower APR | Long processing |

| Easy to qualify | Home as collateral |

7. Government-Insured Loans

Based on age, income level, and the location of your property, you may qualify for a government-backed home repair or home improvement assistance program. This could be a HUD (U.S. Department of Housing and Urban Development) loan or a local loan, depending on where you live. These loans may offer lower-than-average interest rates, fewer fees, or more lenient qualifications regarding financial history.

| Pros | Cons |

|---|---|

| Easy to qualify | Limited eligibility |

| Potential lower APR | Long processing |

How to Finance a New Roof

Ready for a new roof, but not sure where to start with your finances? Here is how to finance a new roof.

1. Get Estimates

You cannot get a loan until you know how much you need to borrow. Reach out to a few roofers to get estimates on the project, giving you a sense of how large the loan will need to be.

2. Consider Available Cash

With a rough budget in mind, check how much of the total you can cover yourself. Do you have any cash or savings free to cover a portion of this project? You could pay for a portion of the new roof upfront, cutting down on how much you have to borrow and, in turn, reducing your total interest amount paid.

Determine how much flexibility you have in your budget to make monthly payments, too. Understanding how much you can afford in monthly payments may influence the roof financing option that’s best for you.

3. Shop Around

Check out the different financing options available (more on that below), and if possible, go through the lender’s prequalification process. Prequalification is relatively simple and will not affect your credit score. Getting prequalified with lenders can give you a better idea of their loan offers and rates.

4. Apply

Once you choose the right new roof financing option, it is time to apply formally. You will probably need financial documents for this process, including, but not limited to, pay stubs, bank statements, mortgage statements, and more.

Should You Finance a Roof?

Even if you have some savings set aside to pay for a new roof, you may still benefit from financing the project. However, there are some drawbacks to consider.

Pros of Financing a Roof

You save your funds for emergencies: Even if you have the money to cover a new roof, financing will let you keep those funds in reserve for other things that you can’t finance in the future.

They improve credit: Repaying a loan on time over the length of the agreement can help your credit score.

You may enjoy a lower roof cost: In some cases, roofing companies will offer discounts on their services if you finance through them, as they may get kickbacks for referring a client to the financier.

Cons of Financing a Roof

Risk going over budget: Because you do not need the cash all at once, you might find yourself going over budget and paying for it in the long term.

Another monthly payment: No matter what financing option you choose, you will need to repay the cost of the new roof each month. Depending on how much flexibility you have in your monthly budget, tacking on another monthly payment could make expenses tight.

Fees and interest rates: Unlike paying cash upfront, financing a roof will come with fees and an interest rate. That means you will pay back more on the loan than its initial amount when all is said and done.

How Much Does a Roof Replacement Cost?

Nationally, the average homeowner can expect to pay around $9,500 in new roof replacement costs. Those costs will change significantly depending on where you live, the type of roof, and the roofing materials you choose. Certain higher-end materials—like slate, metal, or natural stone shingles, can increase costs to $32,000 or more.

If left untreated, roof damage can lead to other issues over time, like mold and damage to other areas of the house and your belongings. So, do not delay a roof replacement due to concerns over cost, as these additional repairs could end up making it far more expensive in the long run.

Frequently Asked Questions

If you choose to get a personal loan to finance a roof, you will want to aim for a “good” or “excellent” credit score for the best rates. That means a credit score of 690 or more. If you aren’t sure of your credit score, you can request one free credit report per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Many banks also provide free credit reports monthly.

Most traditional lenders will not loan against a house with a leaking roof, and some lenders won’t lend against a home with a roof near the end of its lifespan. If the roof on your new home is in poor condition, you may need to have the seller offer a credit for a roof replacement after closing, or you can opt for a renovation loan—also called a 203k loan—to bundle the house and the roof replacement into one loan.

Yes, replacing a roof is always a good investment if the current one is in poor condition. Not only will it preserve the structural integrity of the home, but it can also add value at the time of sale. The average return on investment for a new roof is between 48% and 61%. Prospective buyers are also more likely to purchase a home with a recently replaced roof since that means they won’t need to worry about that expense in the near future.

- Roofers

- Metal Roofing

- Roof Repair

- Roof Inspection

- Vinyl Siding Repair Contractors

- Flat Roofing Companies

- Commercial Roofing

- Emergency Roofing Companies

- Leaky Roof Repair

- Metal Roof Repair

- Business Roof Repair

- Flat Roof Repair

- Tile Roof Repair

- Slate Roofers

- Rubber Roofers

- Roofing & Siding

- Metal Roof Installation

- Affordable Roofing

- Roof Sealing

- Attic Ventilation Contractors

- How to Finance Home Renovations: Explore Your Options

- How to Finance a Home Addition to Achieve Your Dream Remodel

- How Do Home Improvement Loans Work? Get All the Details

- What to Know About Using a Home Equity Loan For a Remodel

- 8 Must-Know Tips for First-Time Home Buyers

- How Do Construction-to-Permanent Loans Work?

- Can You Add Renovation Costs to Your Mortgage?

- Explore the Possibilities of Solar Panel Financing

- How Much House Can I Afford to Buy?

- 14 Things to Avoid Before Buying a House