How Much Money Do Solar Panels Save on Your Energy Bill?

Solar panels can save you thousands in the long term

The average solar owner saves about $34,500 over 25 years.

Savings vary due to state, climate, local grid rates, and more.

It takes five to 15 years for solar panels to pay for themselves.

The average up-front cost to install solar panels is $27,150.

Estimate your savings with online solar calculators or the help of solar contractors.

Installing solar panels can reduce your home’s carbon footprint—and your monthly energy bill. But how much money do solar panels save? The average solar owner saves about $1,380 per year on energy bills, which adds up to $34,500 over the 25-year warranty of most solar panels.

Savings are highly individualized and vary between $10,000 and $90,000. While it can be tricky to pin down exact numbers, certain factors can help you make an estimate. Here’s how to weigh the savings against the cost of installation and factor in home size, location, energy usage, and more.

Up-Front Costs to Buy and Install Solar Panels

The average up-front cost to buy and install a solar panel system in the United States ranges from $18,400 to $36,400. These costs vary by state and several other factors specific to individual households. Smaller systems cost as little as $4,500, while the largest high-end systems cost $50,000 or more.

Keep in mind that most solar owners will pay less due to the federal solar tax credit for renewable energy systems available in the U.S. between 2022 and 2034. In some cases, you can finance your solar panels, meaning you can put the sun to work for less of an up-front investment.

Cost to Add an Optional Solar Battery System

Solar panels only produce power when there’s sunlight. While you can use solar panels directly without a battery, solar batteries store excess energy that your system can use at night, on cloudy days, and during power outages. A single emergency-use battery costs about $200, while a long-lasting, high-efficiency lithium-ion system can add up to $14,000 to your costs.

Saving on Solar Panels Through Tax Breaks and Incentives

The cost to install solar panels can seem daunting. To help offset those costs, homeowners in the U.S. can take advantage of federal and state rebate programs. To find rebates, check out the Database of State Incentives for Renewables & Efficiency (DSIRE).

Federal Tax Credit

With the introduction of the Inflation Reduction Act in 2022, homeowners can now claim a federal solar tax credit of up to 30% for residential solar panel installation through 2034. This can add up to savings of $3,000 or more.

Net Metering

Solar panel systems can produce excess energy your home doesn’t use even after charging a solar battery. Many states and utility companies will let you sell that energy to them and feed it into the grid automatically, lowering your energy bills. This is known as net metering, and policies and prices vary significantly by the state and company.

Additional Solar Panel Savings Factors

Solar panels help you make the most of daylight hours, but their costs range widely. A good solar installer will review your past energy bills and use software to lay out the ideal setup for your home’s roof. They’ll consider the following factors:

Roof Size and Orientation

The more roof you have, the more solar panels you can fit. And the more solar panels you have, the more energy your system will generate. The orientation and angle of the roof matters, too. South-facing roofs at an angle of 30 to 45 degrees get the most sunlight and turn rays into serious savings.

Roof Material

Certain roof types require special equipment for solar installation. Metal or asphalt shingle roofs are easier and less expensive to install panels on, while adding solar panels to slate and clay tile roofs is more challenging and costly.

Solar Panel Type

The type of solar panel you choose influences your system's efficiency, cost, and space requirements. For instance, monocrystalline panels are more efficient and compact but cost more. Because of that, budget-friendly polycrystalline panels might be a better fit for larger roofs with more space for panels. Prices vary by the type of solar panel and manufacturer.

Climate

Solar panels work anywhere but are most efficient in sunny southern climates. However, they can still generate power in cloudy or colder areas. You’ll just want to match your expectations and your solar array to where you live. Your solar contractor can help you navigate your options.

Home Location

Nearby trees or buildings that cast shade across your roof will limit solar production. Your home’s geographical location also determines the number of peak sunlight hours, temperature, and climate. Your solar company should conduct a site assessment to evaluate shade and sunlight exposure throughout the year and suggest strategic panel placement and other ways to maximize how much sun your panels collect.

Energy Usage

Your home’s size and your family’s habits affect how much energy your solar system needs to produce to keep you in the light and avoid paying for power from the grid. Your usage will tell you how big of a system you need, how many solar panels to install, and what size battery you should buy. When calculating your energy use, look at past utility bills and think about seasonal fluctuations and peak energy use times.

Local Grid Rates

The higher the utility rates in your area, the more solar can save you. Homeowners in areas with net metering can also sell excess energy back to the grid and save even more.

Savings by Location

While the average homeowner will save roughly $34,500 over the 25-year warranty period of most solar panels, the exact amount you’ll save will depend on your location due to the cost of electricity.

For example, in California, where the average electricity rate is $0.30 per kWh, homeowners can see savings of up to $90,300 over 25 years. In other states like Washington, where the average cost of electricity is only $0.11 per kWh, that average savings proportionately drops to about $20,600 over 25 years. To get a better idea of what your savings could be, speak with a local solar panel installer.

| Location | Average Electricity Rate (Per kWh) | Savings (Over 25 Years) |

|---|---|---|

| California | $0.30 | $90,300 |

| Washington | $0.11 | $20,600 |

| Texas | $0.14 | $34.800 |

| New York | $0.24 | $72,500 |

| Florida | $0.16 | $46,400 |

| Illinois | $0.18 | $52,200 |

| Arizona | $0.14 | $34,800 |

| Nevada | $0.13 | $32,300 |

| Colorado | $0.15 | $39,300 |

| Massachusetts | $0.31 | $93,400 |

| New Jersey | $0.23 | $69,200 |

| Oregon | $0.12 | $27,500 |

| Pennsylvania | $0.17 | $48,600 |

| North Carolina | $0.13 | $32,000 |

| Virginia | $0.14 | $35,200 |

| Georgia | $0.15 | $39,000 |

| Nebraska | $0.12 | $27,100 |

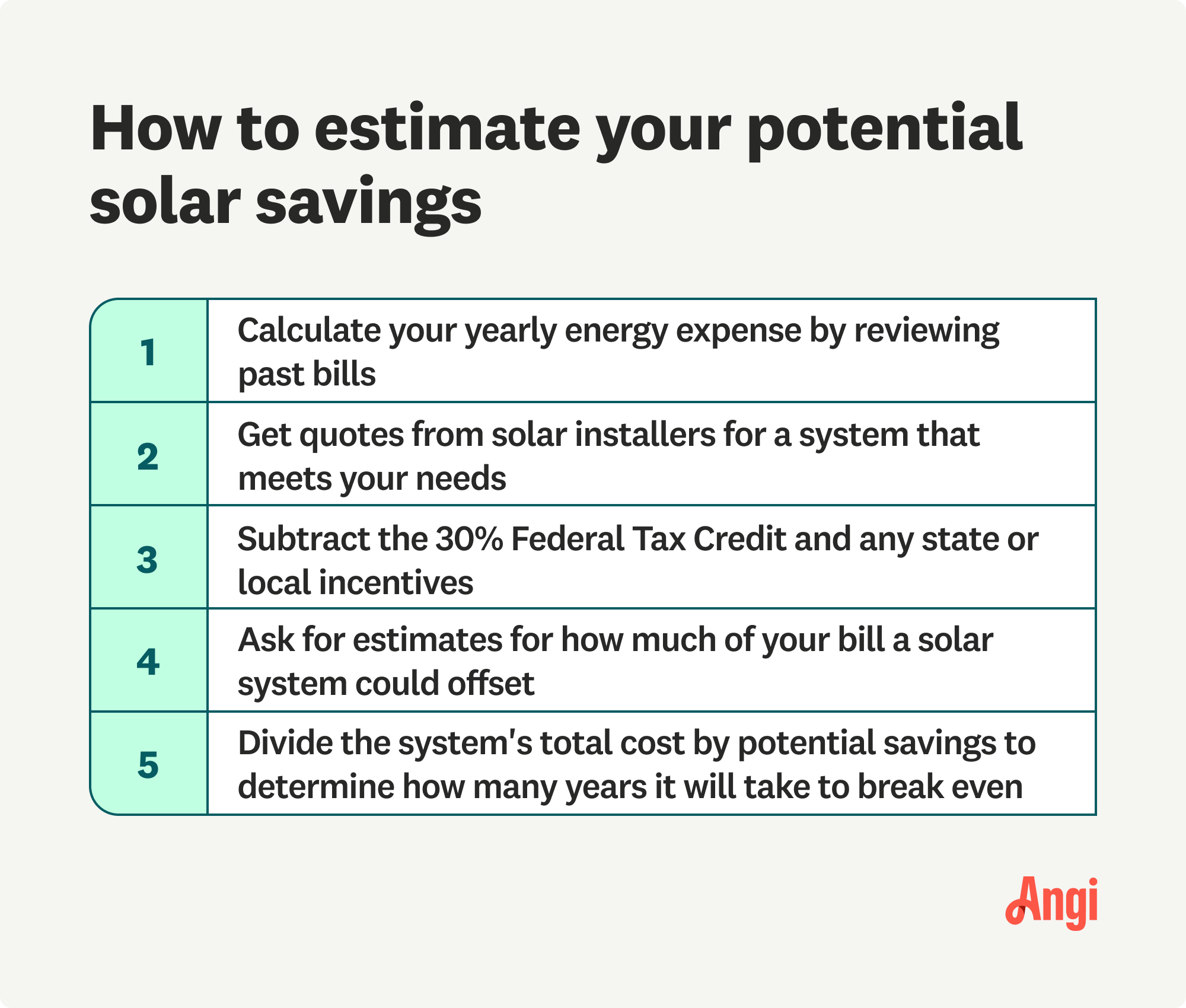

How to Determine Your Estimated Solar Savings

To determine your estimated solar savings, you’ll need to calculate the cost of your solar panel system, your energy use, and local electricity rates. You’ll also want to determine your payback period.

Estimate the Solar Panel System Cost

Find the net cost of your solar panel system by collecting bids from local solar installers. Make sure the quotes are specific to your home’s size and location. Then, subtract any incentives you qualify for, including federal tax credits and state rebates that will lower your up-front cost.

For example, if your solar panel system costs $20,000 and you qualify for the 30% federal tax credit, your net cost will be $14,000.

Calculate Your Annual Energy Production

Using a solar calculator, like the one from the National Renewable Energy Laboratory, enter your location and the estimated size of your system to calculate the annual energy production you can expect. Locations with more sunlight hours get better electricity production and, therefore, see greater savings. For example, a 6kW system in a sunny location can produce 8,000 kWh of power every year.

Find Your Annual Energy Savings

Look at a recent utility bill or use your state’s average from the U.S. Energy Information Administration (EIA). Multiply your system’s annual energy production by your electricity rate to find your annual savings.

For example, If you pay $0.15 per hWh and your system produces 8,000 kWh per year, your annual energy savings will be:

$0.15 x 8,000 = $1,200 per year

Determine Your Payback Period

Divide the net system cost by your annual savings. This will give you the number of years it will take to recoup your initial investment. So, if your net system cost is $14,000 and your annual savings are $1,200, you’ll divide $14,000 by $1,200 to get 11.7 years for the total payback period.

Evaluate Your Long-Term Savings

If you multiply your annual savings by the number of years your solar panels should last, subtract your payback period, and account for rate increases, you can estimate your total savings over the life of your solar panel system.

To get the most accurate number, remember to subtract maintenance costs, like cleaning and inverter replacements, and factor in a slight reduction in energy production due to system degradation over time. If you’re part of a net metering program, add those savings.

If this feels like rocket science, talk with your solar installer and ask them to run the numbers for you.

Is Solar Panel Installation Worth the Cost?

Factoring in potential energy savings, tax credits, and other incentives, solar panels pay for themselves in about 13 years on average. Since most solar systems have a warranty of 25 years, that’s an additional 12 years to save on your energy bills. If you plan to sell your home, solar panels can increase your home’s value by more than 4%.

So, are solar panels worth it? To put the numbers into perspective, consider the average cost of $27,000 to install a solar panel system. With the 30% tax credit applied, it's about $18,900. According to the EIA, the average monthly electric bill is $115, or $1,380 annually.

"Once your solar panels are paid off, they're officially your property. If you move, you can reinstall them on a new rooftop. Alternatively, they can increase the value of your home by 3% to 4% and attract more buyers. They can also give your property a competitive edge in a buyers’ market."

— Mike Naughton, CEO and Founder of Integrity Energy, Cleveland, OH

If your solar system fully covers those costs over 25 years, that amounts to $34,500 in savings.

| Average Solar System Installation Cost | 30% Federal Tax Credit on Solar System Installation | Average Cost With Federal Tax Credit Applied |

|---|---|---|

| $26,000 | $7,800 | $18,200 |

| Solar System Warranty | Average Annual Household Electricity Expenditure | Total Electricity Savings Over 25-year Warranty Period |

|---|---|---|

| 25 years | $1,380 | $34,500 |

You’ll save even more if your area gets a lot of sun or has higher local utility rates. Plus, most panels still produce energy well past the end of their 25-year warranty period.

- Are Solar Panels or Solar Shingles the Better Fit for Your House?

- How Do Solar Panels Work? The Homeowner’s Guide to Understanding Solar Power

- Will Adding Solar Panels Increase My Home’s Value?

- How Many Solar Panels Do I Need? Explore Typical Panel Wattage and Costs

- Is Removing Trees for Solar Panels the Way to Go?

- 15 Questions You Should Ask a Solar Company Before Hiring

- 6 Pros and Cons of Leasing Solar Panels

- Explore the Possibilities of Solar Panel Financing

- Everything You Need to Know About Starting a Solar Farm

- Solar-Powered HVAC Systems: What You Need to Know