Get transparent shrub removal cost info. Learn average prices, key cost factors, and tips to save on your next shrub removal project.

Will My Homeowners Insurance Cover Tree Removal?

Never pay out of pocket when you don't need to

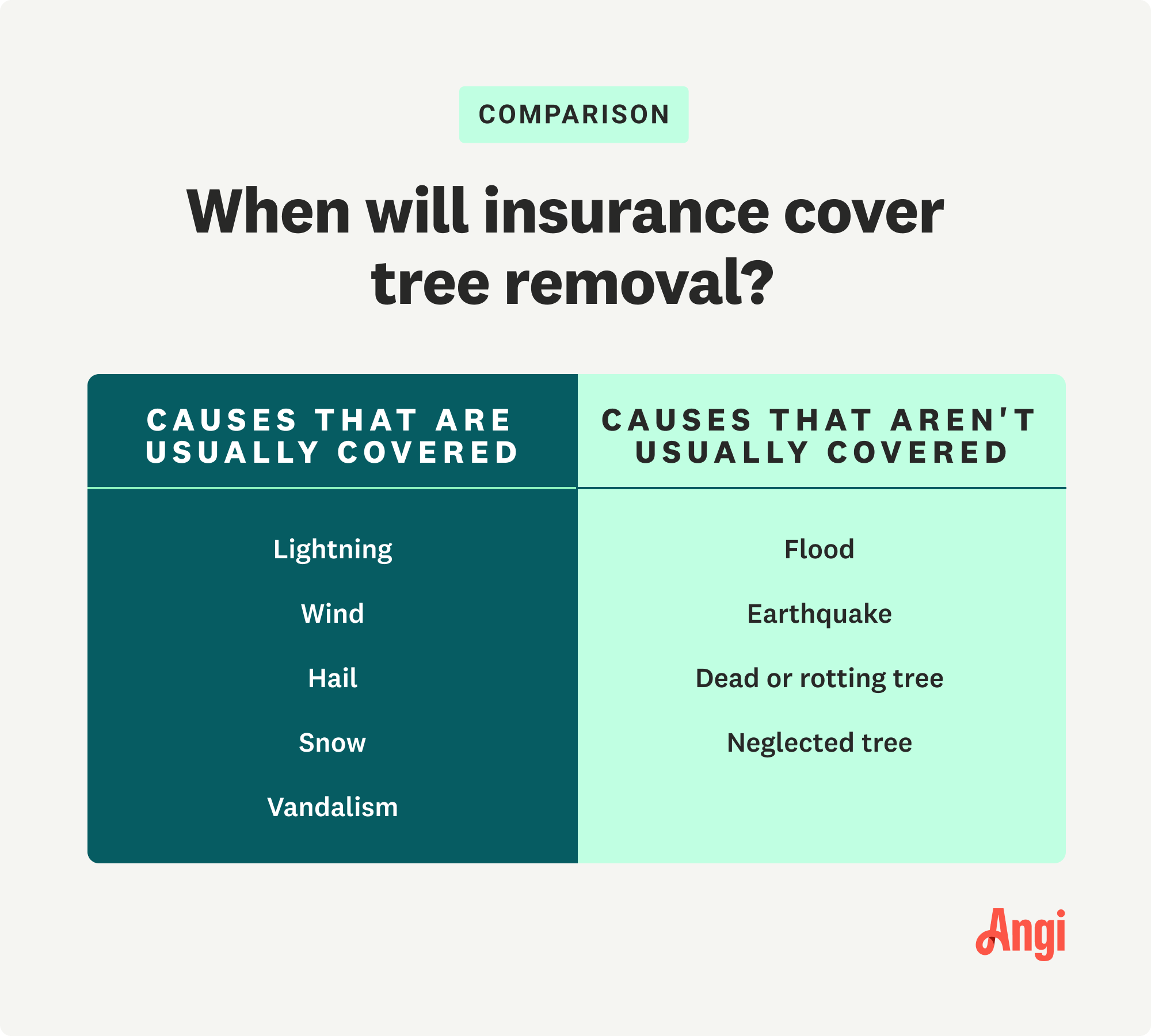

Homeowners insurance covers tree removal in the event of lightning, wind, hail, snow, or vandalism.

Homeowners insurance doesn’t cover tree removal as a result of neglect, rot, flood, or an earthquake.

Homeowners insurance doesn’t cover preventative tree removal, only after it’s fallen in select scenarios.

If a tree falls on a structure, like your house or garage, homeowners insurance is more likely to cover it than if it falls on your lawn.

Check your homeowners insurance policy to determine whether it will cover tree removal, depending on your situation.

If a tree falls in your yard, your first question is likely, “Will my insurance cover tree removal?” In some cases, your homeowners insurance will cover the cost of removing it, but only if it falls in the event of wind, lightning, snow, hail, or vandalism.

While every policy is different, this guide can help you figure out when policies typically cover the cost of tree removal and when you'll likely need to pay for the service out of pocket. Your best bet for specific advice is to speak to an insurance professional.

This task has serious personal and home safety risks. You should strongly consider hiring a tree removal professional to ensure it's completed safely and effectively.

When Homeowners Insurance Covers Tree Removal

Whether or not your homeowners insurance will cover the cost of removing your tree depends on what caused the tree to fall and where it fell. If a tree falls on your home, garage, or another structure on your property due to covered perils, you can expect your homeowners insurance to cover it. Additionally, if a tree falls on your driveway and prevents you from using it, insurance will likely cover that as well.

Insurance policies will typically cover tree removal costs if the tree falls on a structure due to:

Lightning and the resulting fire

Wind, hail, ice, or snow

Vandalism

Other covered perils (check your individual policy for specific details)

However, if the tree falls on your lawn or another empty space, the reason it fell becomes especially important. For instance, if your tree falls on your lawn or another empty space due to lightning and the resulting fire, many homeowners insurance policies will cover the cost of removing it. They'll also usually cover it if it falls on an empty space due to vandalism.

But most policies won't cover it if the tree falls on an empty space due to wind, ice, hail, or snow.

When Homeowners’ Insurance Doesn't Cover Tree Removal

In some cases, your homeowners insurance won't cover the cost of tree removal. While insurance covers many weather events, if a tree falls due to an earthquake or flood, your insurance probably won't cover it. Additionally, if your tree falls because it's dead, rotting, or you neglected to maintain it, your insurance isn't likely to cover that either.

Trees That Fall on Your Neighbor's Property

If your tree falls on your neighbor's property due to covered perils, like most weather events, the cost of removing it will usually fall on your neighbor's insurance policy rather than yours. However, if the tree falls because it's dead, broken, or rotted and you neglected to remove it, your neighbor could potentially take you to court for negligence and damages. This risk is just another reason why removing dead trees is so important.

Will My Homeowners Insurance Cover Preventative Tree Removal?

Unfortunately, most homeowners insurance policies don’t pay for preventative tree removal. It’s still a good idea to do this work, however, because it can save you from having to deal with a more complex and costly problem in the future. You may be able to save on preventative tree removal costs by scheduling the work during the off-season.

How to Figure Out If Homeowners Insurance Will Cover Your Tree Removal

Since every policy is different, the only way to know for certain if your insurance will cover tree removal is to check your individual policy. If it’s still unclear, give your insurance agent a call to find out for sure. It’s also a good idea to document the damage before taking any action, taking thorough photos and videos of any areas that need repair or might be affected by the tree falling. This preparation can help you make your case if your insurance company wants to see evidence of the damage. Then, hire a local tree removal professional to oversee and complete the process of removing the tree, with the approval of your insurance company.

The homeowners guide to tree services

From average costs to expert advice, get all the answers you need to get your job done.

- •

The cost to remove palm trees depends on several factors, including their size, location, and more. Our guide shows the average palm tree removal costs.

Tree inspections can ensure your trees stay healthy and safe, preventing costly damage. Learn how much tree inspections cost and what can affect the price.

Discover the answer to what is eating my tree trunk, why it's doing it, and what you can do to eliminate and prevent the insect problem.

Trees add natural beauty and shade to your yard, whether it’s a mighty oak or a fragrant olive tree. Learn how to protect trees during construction in this guide.

Discover tips and tricks for how to plant a tree on a slope in your yard. Check out these four easy-to-follow steps to add shade and enjoyment.