Understanding how appraisers determine the value of a house can help guide pre-sale renovations or offer negotiation as a buyer or a seller.

FHA loans require special appraisals with stricter requirements

FHA appraisals are special appraisals required to get funding for an FHA loan, which is backed by the federal government.

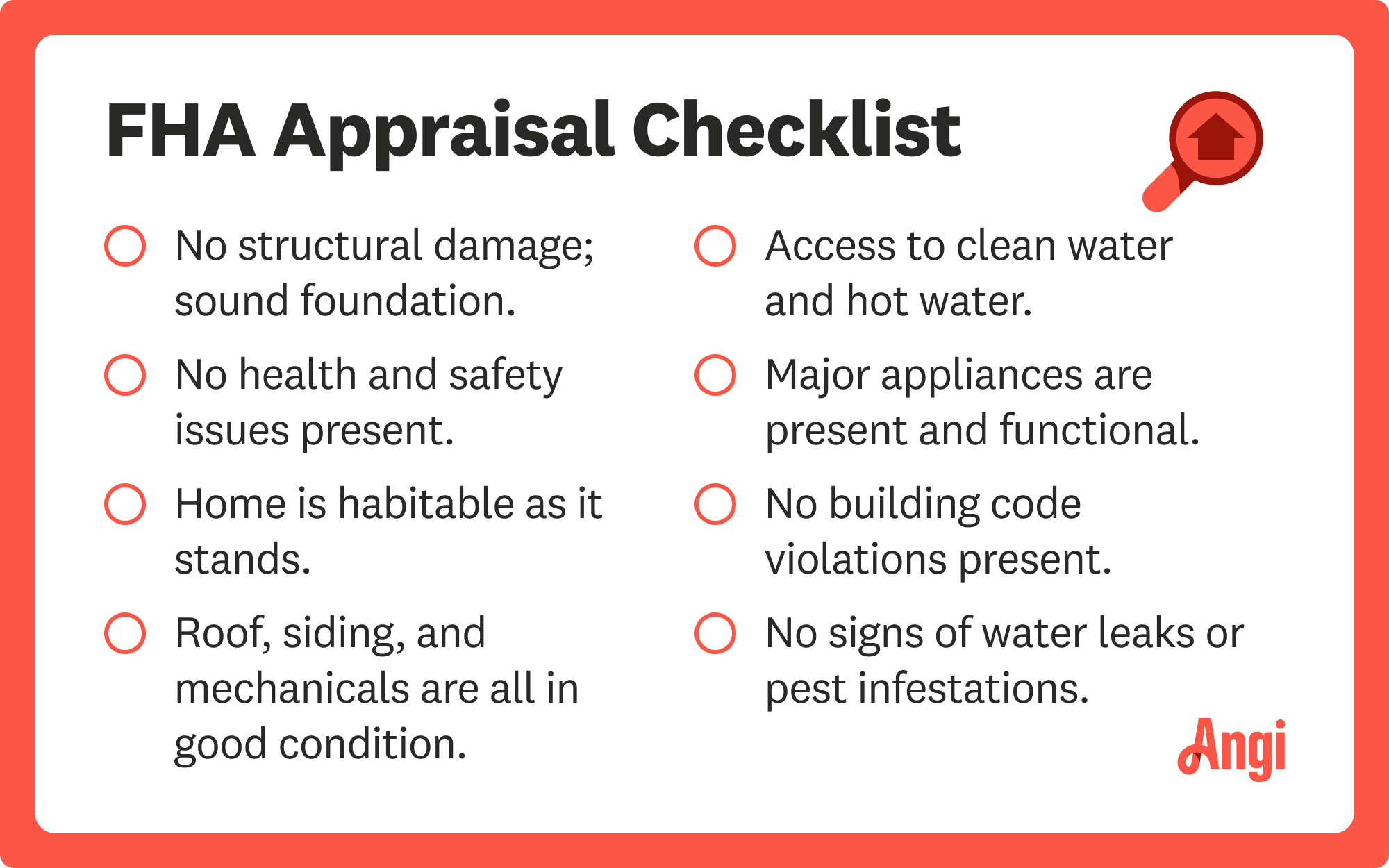

An FHA appraisal focuses on safety and habitability, and it also goes more in-depth than a standard appraisal to determine value.

An FHA appraisal may have strict requirements, but it’s not a replacement for a home inspection.

If you’re buying a home using a loan backed by the Federal Housing Administration (FHA), the property will need to meet stricter requirements set by the federal government to get approval. As such, the FHA appraisal guidelines are more intensive than those for standard appraisals. Whether you’re buying a home using an FHA loan or selling a home to a buyer using one, it’s a good idea to understand the process to be prepared for your home appraisal.

An FHA appraisal is similar to a traditional appraisal, but there are specific FHA appraisal guidelines to ensure a home meets the lending requirements set by the Federal Housing Association. The guidelines focus on the safety and habitability of the property, and they’re a bit more strict than those you’d find when hiring a local home appraiser for a traditional appraisal.

An FHA appraisal begins with a thorough property inspection to look for building safety issues, code violations, and property conditions that could affect the value of the home. An appraisal inspection can take anywhere from one to four hours. The appraiser will then use comparable properties that sold recently to estimate the value of the property, which can take one to three weeks, depending on demand.

FHA appraisal guidelines cover a wide array of safety issues in the home. Things like the presence of asbestos and lead paint, missing handrails, and uneven flooring can all hurt your appraised value.

Check for structural integrity, including roof trusses, joists, beams, support columns, and more.

Look for signs of foundation damage, including cracks, leaks, and efflorescence.

Confirm there is no mold or mildew growing in the home.

Check for asbestos insulation, floor tiles, and siding. If it’s present, it must be properly encapsulated.

Look for evidence of lead paint. All chipping or peeling paint in homes built prior to 1978 must include a lead paint test.

Confirm all stairs inside and outside have appropriate handrails.

Check to make sure there’s no uneven or spongy flooring that could be a trip hazard.

Ensure there are no trip hazards due to raised sidewalks or walkways.

Confirm there’s no exposed wiring or wires running on the outside of the drywall.

Look for signs of pest infestation, including rotted wood framing.

All bedrooms must have at least two points of egress.

Confirm that there are no tripping breakers.

Check for broken glass in windows, doors, and appliances.

An FHA appraiser will also look for building code violations, which can have a major negative impact on home value. Unlike with standard appraisals, code violations will often require a resolution before the mortgage can move forward to underwriting.

Confirm property setbacks are met.

Check to ensure that the electrical and plumbing systems are fully up to code.

Ensure there are functioning GFCI outlets in kitchens, bathrooms, and laundry rooms.

Make sure bathroom fans are vented to the exterior and not into the attic.

Ensure boilers and fireplaces are vented properly.

Confirm that smoke and carbon monoxide detectors have been installed.

Check to make sure there are functioning lightbulbs in all fixtures.

Confirm there are no overloaded circuits in the electric panel.

Ensure standards for property drainage meet Housing and Urban Development (HUD) standards, which may include the presence of gutters, downspouts, and downspout extenders.

Look for illegal home additions or renovations.

FHA appraisers will also confirm that the home is generally habitable. This portion of the home inspection will include a review of the general condition, but it focuses more on the aspects that are required for safe and comfortable living.

Check to ensure the property is sealed off from the elements, including a review of the roof, siding, windows, and doors.

Confirm that the property is equipped with a functioning heating system.

Check that there’s a supply of safe, clean water for drinking and domestic use.

Confirm that there’s adequate water pressure for bathing and cleaning.

Ensure that the home is either connected to municipal sewers or has a functioning septic system that’s sized appropriately for the number of bedrooms and bathrooms.

Confirm that the home has at least one functioning full bathroom, including a toilet, sink, tub, and shower.

Check to make sure the home has access to domestic hot water, which could include a hot water heater or a pass-through boiler.

Confirm proximity to flood zones, nuisances—like major roads, railroad tracks, and airports—and utility lines.

After the property inspection, the FHA appraiser will take all of the information they gathered about the subject property and use it to compare to property values in the area. They’ll make adjustments for condition, square footage, property age, and more to come up with their professional opinion of value. FHA appraisal guidelines require specific comparable property data or explanations as to why those guidelines aren’t met.

Comparable properties, called comps, should be recent sales within the same development.

Comps should be reasonably close to the subject, with the proximity depending on how developed the area is.

Comparable sales should have closed no more than 6 months before the valuation.

Comps should be as similar to the property in style, condition, lot size, and square footage as possible.

Once your appraiser is done with the valuation, you’ll get an appraisal report, which includes the professional opinion of value and an explanation of how they arrived at that number. They may also include a list of repairs or changes that the seller must make before the mortgage can move on to underwriting. Repairs won’t include cosmetic changes but can include health and safety repairs or fixes for structural damage or other substantial problems with roofing, siding, drainage, appliances, and more.

Note that an FHA appraisal is different than a home inspection. You should still hire a home inspector and have them inspect the home you’re considering, even if you get an FHA appraiser to sign off on their own inspection.

You should also note that appraised value can differ from market value. If the appraised value comes in too high, the seller may need to lower the sale price or offer a concession. If the appraised value is too low, the seller may try to negotiate a higher sales price.

From average costs to expert advice, get all the answers you need to get your job done.

Understanding how appraisers determine the value of a house can help guide pre-sale renovations or offer negotiation as a buyer or a seller.

A home appraisal determines your property’s value and is necessary for most real estate transactions. Learn more about home appraisals and why they matter.

Wondering how to improve the appraisal value of your home? Use these tips to maximize return on investment and boost your property value before you sell.

A home appraisal determines the value of your home when buying or selling. Learn more about common types of real estate appraisals.

Home appraisals typically expire in just a few months. Learn how long an appraisal is good for and what factors affect its longevity.

Waiting for an appraisal on a home you’re buying or selling? Learn how long an appraisal takes and factors that can affect your timeline.